Chrysler 2006 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

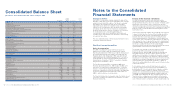

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 97

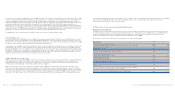

Depreciation rates

Buildings 2% - 10%

Plant and machinery 8% - 30%

Industrial and commercial equipment 15% - 25%

Other assets 10% - 33%

Land is not depreciated.

Leased assets

Leased assets include vehicles leased to retail customers

by the Group’s leasing companies under operating lease

agreements. They are stated at cost and depreciated at annual

rates of between 15% and 25%.

Investment property

Real estate and buildings held in order to obtain rental income

are carried at cost less accumulated depreciation (charged at

annual rates of between 2.5% to 5%) and impairment losses.

Impairment of assets

The Group reviews, at least annually, the recoverability of the

carrying amount of intangible assets (including capitalised

development costs) and tangible assets, in order to determine

whether there is any indication that those assets have suffered

an impairment loss. If indications of impairment are present,

the carrying amount of the asset is reduced to its recoverable

amount. An intangible asset with an indefinite useful life is

tested for impairment annually or more frequently,whenever

there is an indication that the asset may be impaired.

Where it is not possible to estimate the recoverable amount

of an individual asset, the Group estimates the recoverable

amount of the cash-generating unit to which the asset belongs.

The recoverable amount of an asset is the higher of fair value

less disposal costs and its value in use. In assessing its value in

use, the pre-tax estimated future cash flows are discounted to

their present value using a pre-tax discount rate that reflects

current market assessments of the time value of money and the

risks specific to the asset. An impairment loss is recognised

components, engines, and production systems) are recognised

as an asset if and only if all of the following conditions are

met: the development costs can be measured reliably and the

technical feasibility of the product, volumes and pricing

support the view that the development expenditure will

generate future economic benefits. Capitalised development

costs comprise only expenditures that can be attributed

directly to the development process.

Capitalised development costs are amortised on a systematic

basis from the start of production of the related product over

the product‘s estimated life, as follows:

N° of years

Cars 4 - 5

Trucks and buses 8

Agricultural and construction equipment 5

Engines 8 - 10

Components and Production Systems 3 - 5

All other development costs are expensed as incurred.

Intangible assets with indefinite useful lives

Intangible assets with indefinite useful lives consist principally

of acquired trademarks which have no legal, regulatory,

contractual, competitive, economic, or other factors that limits

their useful lives. Intangible assets with indefinite useful lives

are not amortised, but are tested for impairment annually or

more frequently whenever there is an indication that the asset

may be impaired.

Other intangible assets

Other purchased and internally-generated intangible assets

are recognised as assets in accordance with IAS 38 – Intangible

Assets,where it is probable that the use of the asset will

generate future economic benefits and where the costs of

the asset can be determined reliably.

Such assets are measured at purchase or manufacturing cost

and amortised on a straight-line basis over their estimated

useful lives, if these assets have finite useful lives.

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 96

Other intangible assets acquired as part of an acquisition

of a business are capitalised separately from goodwill if their

fair value can be measured reliably.

Property, plant and equipment

Cost

Property, plant and equipment are stated at acquisition

or production cost and are not revalued.

Subsequent expenditures and the cost of replacing parts of an

asset are capitalised only if they increase the future economic

benefits embodied in that asset. All other expenditures are

expensed as incurred. When such replacement costs are

capitalised, the carrying amount of the parts that are replaced

is recognised in the income statement.

Property, plant and equipment also include vehicles sold with

abuy-back commitment, which are recognised according to the

method described in the paragraph Revenue recognition if the

buy-back agreement originates from the Trucks and

Commercial Vehicles Sutor.

Assets held under finance leases, which provide the Group

with substantially all the risks and rewards of ownership, are

recognised as assets of the Group at their fair value or,if

lower, at the present value of the minimum lease payments.

The corresponding liability to the lessor is included in the

financial statement as a debt. The assets are depreciated by

the method and at the rates indicated below.

Leases where the lessor retains substantially all the risks and

rewards of ownership of the assets are classified as operating

leases. Operating lease expenditures are expensed on a

straight-line basis over the lease terms.

Depreciation

Depreciation is calculated on a straight-line basis over the

estimated useful life of the assets as follows:

when the recoverable amount is lower than the carrying amount.

Where an impairment loss on assets other than goodwill

subsequently no longer exists or has decreased the carrying

amount of the asset or cash-generating unit is increased to the

revised estimate of its recoverable amount, but not in excess

of the carrying amount that would have been recorded had no

impairment loss been recognised. A reversal of an impairment

loss is recognised in the income statement immediately.

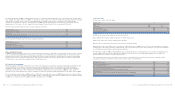

Financial instruments

Presentation

Financial instruments held by the Group are presented in the

financial statements as described in the following paragraphs.

Investments and other non-current financial assets comprise

investments in non-consolidated companies and other non-

current financial assets (held-to-maturity securities, non-

current loans and receivables and other non-current available-

for-sale financial assets).

Current financial assets include trade receivables, receivables

from financing activities (retail financing, dealer financing,

lease financing and other current loans to third parties),

current securities, and other current financial assets (which

include derivative financial instruments stated at fair value

as assets), as well as cash and cash equivalents.

In particular, Cash and cash equivalents include cash at banks,

units in liquidity funds and other money market securities that

are readily convertible into cash and are subject to an

insignificant risk of changes in value. Current securities include

short-term or marketable securities which represent temporary

investments of available funds and do not satisfy the

requirements for being classified as cash equivalents; current

securities include both available-for-sale and held for trading

securities.

Financial liabilities refer to debt, which includes asset-backed

financing, and other financial liabilities (which include

derivative financial instruments stated at fair value as

liabilities), trade payables and other payables.