Chrysler 2006 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

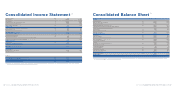

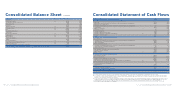

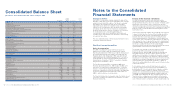

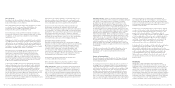

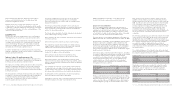

(in millions of euros) 2006 2005

Gains (losses) recognised directly in the cash flow hedge reserve 109 (16)

Gains (losses) recognised directly in reserve for fair value measurement of available-for-sale financial assets 46 61

Exchange gains (losses) on the translation of foreign operations (551) 921

Gains (losses) recognised directly in equity (396) 966

Transfers from cash flow hedge reserve (6) (44)

Transfers from reserve for fair value measurement of available-for-sale financial assets (12) –

Transfers from reserve for the translation of foreign operations (1) –

Net result 1,151 1,420

Recognised income (expense) 736 2,342

Attributable to:

Equity holders of the parent 680 2,215

Minority interests 56 127

Fiat Group Consolidated Financial Statements at December 31, 2006 91

Consolidated Statement

of Recognised Income and Expense

Income (expenses)

recognised

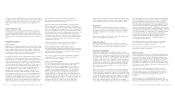

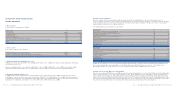

Capital Treasury Capital Earning directly Minority

(in millions of euros) stock stock reserves reserves in equity interest Total

Balances at January 1, 2005 4,918 (26) – (615) 27 624 4,928

Capital increase from extinguishment of Mandatory Convertible Facility 1,459 – 682 – – – 2,141

Dividends –––––(29)(29)

Changes in reserve for share based payments – – – 12 – – 12

Net changes in Income (expenses) recognised directly in equity – – – – 884 38 922

Other changes – (2) – 11 – 10 19

Net result – – – 1,331 – 89 1,420

Balances at December 31, 2005 6,377 (28) 682 739 911 732 9,413

Capital increase –––––1616

Dividends –– – – – (23) (23)

Changes in reserve for share based payments –––11––11

Net changes in Income (expenses) recognised directly in equity –– – – (385) (30) (415)

Other changes –4 – (14) – (107) (117)

Net result –– – 1,065 – 86 1,151

Balances at December 31, 2006 6,377 (24) 682 1,801 526 674 10,036

Fiat Group Consolidated Financial Statements at December 31, 200690

Statement of Changes

in Stockholders’ Equity

of which of which

Related Related

parties parties

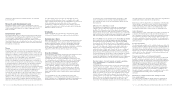

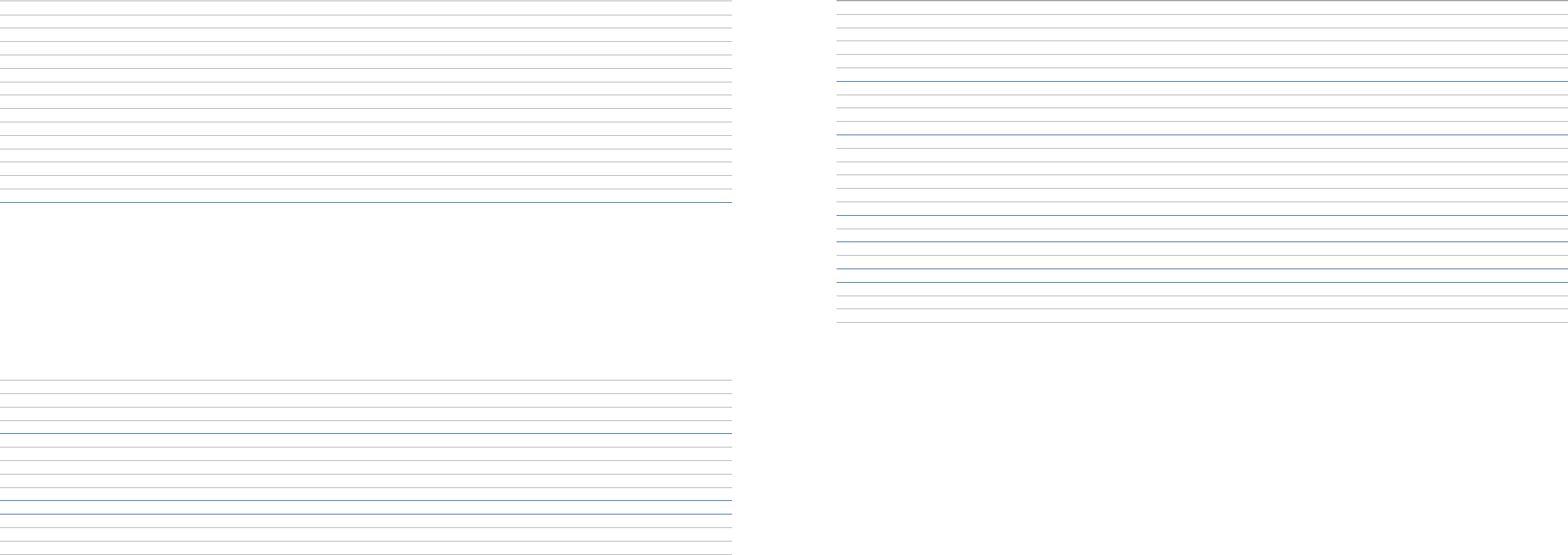

(in millions of euros) Note 2006 (Note 35) 2005 (Note 35)

Net revenues (1) 51,832 2,189 46,544 1,870

Cost of sales (2) 43,888 3,051 39,624 2,201

Selling, general and administrative costs (3) 4,697 3 4,513 4

Research and development costs (4) 1,401 – 1,364 –

Other income (expenses) (5) 105 – (43) –

Trading profit 1,951 1,000

Gains (losses) on the disposal of investments (6) 607 – 905 –

Restructuring costs (7) 450 – 502 –

Other unusual income (expenses) (8) (47) – 812 –

Operating result 2,061 2,215

Financial income (expenses) (9) (576) –(843) –

Unusual financial income (9) ––858 –

Result from investments: (10) 156 –34 –

-Net result of investees accounted for using the equity method 125 –115 –

-Other income (expenses) from investments 31 – (81) –

Result before taxes 1,641 2,264

Income taxes (11) 490 – 844 –

Result from continuing operations 1,151 1,420

Result from discontinued operations – – – –

Net result 1,151 1,420

Attributable to:

Equity holder of the parent 1,065 1,331

Minority interests 86 89

Consolidated Income Statement

pursuant to Consob Resolution No. 15519 of July 27, 2006