Chrysler 2006 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements 273Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements272

On July 26, 2004, the Board of Directors granted to Sergio Marchionne as a part of his compensation as Chief Executive Officer

options for the purchase of 10,670,000 Fiat S.p.A. ordinary shares at the price of 6.583 euros, exercisable from June 1, 2008 to

January 1, 2011. In each of the first three years following the grant date, the Officer accrues the right to purchase, starting from

June 1, 2008, an annual maximum of 2,370,000 shares. From June 1, 2008, he will have the right to exercise, effective at that date,

the residual portion of the options on 3,560,000 shares. This right is subject to achieving certain pre-determined profitability

targets (Non-Market Conditions or “NMC”).

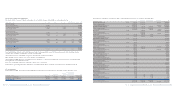

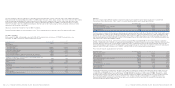

The contractual terms of the plan are as follows:

Strike price Number of

Plan Grant date Expiry date (euros) options granted Vesting date Vesting portion

Stock Option July 26, 2004 January 1, 2011 6.583 10,670,000 June 1, 2005 22.2%

July 2004 June 1, 2006 22.2%

June 1, 2007 22.2%

June 1, 2008 33.4%*NMC

On November 3, 2006 the Fiat S.p.A. Board of Directors approved an eight year stock option plan, which provides certain managers

of the Group and the Chief Executive Officer with the right to purchase a determined number of Fiat S.p.A. ordinary shares at the

fixed price of 13.37 euros per share. In particular, the 10,000,000 options granted to employees and the 5,000,000 options granted

to the Chief Executive Officer have a vesting period of four years, with a quarter of the number vesting each year, are subject to

achieving certain pre-determined profitability targets (Non-Market Conditions or “NMC”)in the reference period and may be

exercised from the date on which the 2010 financial statements are approved. The remaining 5,000,000 options granted to the

Chief Executive Officer of Fiat S.p.A. also have a vesting period of four years with a quarter of the number vesting each year

and may be exercised from November 2010.

The ability to exercise the options is additionally subject to specific restrictions regarding the duration of the employment

relationship or the mandate given. The stock option plan will become effective after approval by the Stockholders Meeting

and once all its conditions have been satisfied.

The contractual terms of 2006 plans proposed by Board of Directors are as follows:

Strike price Number of

Plan Recipient Expiry date (euros) options granted Vesting date Vesting portion

Stock Option Chief Executive Officer November 3, 2014 13.37 5,000,000 November 2007 25%

November 2006 November 2008 25%

November 2009 25%

November 2010 25%

Stock Option Chief Executive Officer November 3, 2014 13.37 5,000,000 Spring 2008 (*) 25%*NMC

November 2006 Spring 2009 (*) 25%*NMC

Spring 2010 (*) 25%*NMC

Spring 2011 (*) 25%*NMC

Stock Option Executives November 3, 2014 13.37 10,000,000 Spring 2008 (*) 25%*NMC

November 2006 Spring 2009 (*) 25%*NMC

Spring 2010 (*) 25%*NMC

Spring 2011 (*) 25%*NMC

(*) On the approval of the Financial Statements of the previous year.

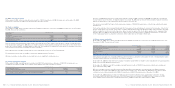

Stock option reserve

As discussed in Note 5, the overall expense recognised in 2006 for share-based payments linked to Fiat S.p.A. shares is 11,297 thousand

euros (10,041 thousand euros in 2005).

The accumulated stock option reserve totals 27,400 thousand euros at December 31, 2006 (16,103 thousand euros at December 31, 2005).

Share-based payments

At December 31, 2006, Fiat S.p.A. has various share-based payment plans for the executives of Group companies and members

of the Board of Directors of Fiat S.p.A.

Stock Option plans linked to Fiat S.p.A. ordinary shares

The Board of Directors of Fiat S.p.A. approved certain stock option plans between March 1999 and September 2002 which provide

executives of the Group with the title of “direttore” and high management potential included in “management development

programmes” and members of the Board of Directors of Fiat S.p.A. with the right to purchase a determined number of Fiat S.p.A.

ordinary shares at a fixed price (strike price). These rights may be exercised over a fixed period of time from the vesting date to

the expiry date of the plan. These stock option plans do not depend on any specific market conditions.

In accordance with applicable tax regulations, options are generally exercisable after three years from the grant date and for

the following six years. Nevertheless the full amount granted as options is not exercisable until the end of the fourth year.

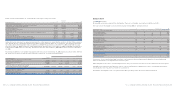

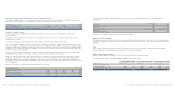

The contractual terms of these plans are as follows:

Strike price Number of

Plan Recipient Grant date Expiry date (euros) options granted Vesting date Vesting portion

Stock Option 1999 Executives March 30, 1999 March 31, 2007 26.120 1,248,000 April 1, 2001 50%

April 1, 2002 50%

Stock Option 2000 Executives February 18, 2000 February 18, 2008 28.122 5,158,000 February 18, 2001 25%

February 18, 2002 25%

February 18, 2003 25%

February 18, 2004 25%

Stock Option Chairman of B.o.D. July 25, 2000 July 25, 2008 25.459 250,000 July 25, 2001 50%

July 2000 May 14, 2002 50%

Stock Option Executives February 27, 2001 February 27, 2009 24.853 785,000 February 27, 2002 25%

February 2001 February 27, 2003 25%

February 27, 2004 25%

February 27, 2005 25%

Stock Option

March 2001 Chairman of B.o.D. March 29, 2001 October 30, 2008 23.708 1,000,000 July 1, 2002 100%

Stock Option Executives October 31, 2001 October 31, 2009 16.526 5,417,500 October 31, 2002 25%

October 2001 October 31, 2003 25%

October 31, 2004 25%

October 31, 2005 25%

Stock Option

May 2002 Chairman of B.o.D. May 14, 2002 January 1, 2010 12.699 1,000,000 January 1, 2005 100%

Stock Option Executives September 12, 2002 September 12, 2010 10.397 6,100,000 September 12, 2003 25%

September 2002 September 12, 2004 25%

September 12, 2005 25%

September 12, 2006 25%