Chrysler 2006 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review of Fiat S.p.A.236 Financial Review of Fiat S.p.A. 237236

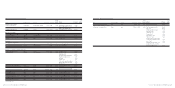

Balance Sheet

Highlights of the Parent Company’s Balance Sheet are illustrated in the following table:

At At

(in millions of euros) December 31, 2006 December 31, 2005

Non-current assets 14,559 5,168

- of which: Investments 14,500 5,118

Working capital 167 303

Total net invested capital 14,726 5,471

Stockholders’ equity 10,374 7,985

Net debt (liquid funds) 4,352 (2,514)

Non-current assets mainly include investments in the relevant subsidiaries of the Group.

The net increase of 9,382 million euros in investments as compared to December 31, 2005 stems from net write-ups arising from

the reversal of previously recognised impairment losses and recapitalisations of 6,361 million euros carried out during the year in

the subsidiaries Fiat Partecipazioni S.p.A. (6,000 million euros), Fiat Netherlands Holding N.V. (121 million euros) and Comau S.p.A.

(240 million euros), in order to re-balance the equity structure inside the Group and cover losses, as well as the re-purchase from

Mediobanca S.p.A. of 28.6% of the shares of Ferrari S.p.A. (893 million euros) upon exercise of the call option provided for in the

2002 agreements, which brought the investment to an 85% stake.

Working capital,which totalled 167 million euros, consists of inventories net of advances received, trade, tax and employee

receivables/payables, other receivables/payables and provisions. The 136 million euro decrease over December 31, 2005 is mainly

attributable to the refund of VAT receivables by the Tax Authorities.

Stockholders’ equity at December 31, 2006 totalled 10,374 million euros, reflecting an increase of 2,389 million euros as compared

to December 31, 2005 due to the positive result of the year (2,343 million euros) and other minor changes (including 28 million

euros resulting from marking to market the fair value carrying amount of the Mediobanca shareholding).

For a more complete analysis of the changes in stockholders’ equity,reference should be made to the relevant table set out in the

following pages as part of the statutory financial statements of the Parent Company Fiat S.p.A.

Net debt totalled 4,352 million euros at December 31, 2006 compared with net liquid funds of 2,514 million euros at December 31,

2005. The use of the liquid funds balance at the beginning of the year and the subsequent accumulation of debt are the

consequence of the previously mentioned recapitalisations of subsidiaries and purchase of Ferrari S.p.A. shares. A breakdown of

net debt is illustrated in the following table:

At At

(in millions of euros) December 31, 2006 December 31, 2005

Financial receivables, cash and cash equivalents (85) (3,076)

Current financial payables 1,627 557

Non-current financial payables 2,810 5

Net debt (net liquid funds) 4,352 (2,514)

Current financial payables consist of the overdraft with the subsidiary Fiat Finance S.p.A. and short-term financing received from

that company, as well as payables to factoring companies for advances on receivables. Non-current financial payables consist

almost entirely of loans repayable in the 2010-2013 period granted by the subsidiary Fiat Finance S.p.A. at market rates as part

of the recapitalisation of subsidiaries discussed above.

At December 31, 2005 financial receivables related to short-term financing of 2,700 million euros granted to the subsidiary Fiat

Finance S.p.A. and due in 2006, and to cash deposited on the current account held with that company.

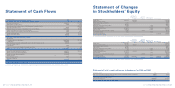

For a more complete analysis of cash flows, reference should be made to the Statement of Cash Flows set out on the following

pages as part of the statutory financial statements of the Parent Company Fiat S.p.A.

Reconciliation between the Parent Company’s equity and its result for the year

with those of the Group

Pursuant to the Consob Communication of July 28, 2006, set out below is a reconciliation between the Parent Company’s equity

at December 31, 2006 and its result for the year then ended with those of the Group (Group interest).

Stockholders’ equity at

(in millions of euros) December 31, 2006 2006 Net result

Financial Statements of Fiat S.p.A. 10,374 2,343

Elimination of the carrying amounts of consolidated investments and the respective dividends

from the financial statements of Fiat S.p.A. (14,211) (346)

Elimination of the reversal of impairment losses (net of recognised impairment losses) of consolidated investments – (2,099)

Equity and results of consolidated subsidiaries 13,404 1,229

Consolidation adjustments:

Elimination of intercompany profits and losses on the sale of investments – (41)

Elimination of intercompany profits and losses in inventories and fixed assets and other adjustments (205) (21)

Consolidated financial statements (Group interest) 9,362 1,065