Chrysler 2006 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

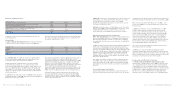

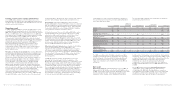

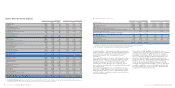

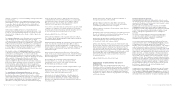

Financial Services

Revenues

(in millions of euros) 2006 2005 % change

Fiat Auto 991 619 60.1

Agricultural and Construction Equipment (CNH-Case New Holland) 1,061 879 20.7

Trucks and Commercial Vehicles (Iveco) 508 457 11.2

Holding companies and Other companies (1) 47 68 -30.9

Total 2,607 2,023 28.9

(1) These amounts refer to the banking activities performed by B.U.C. – Banca Unione di Credito until August 2006 when it was sold.

Report on Operations Financial Review of the Group 43Report on Operations Financial Review of the Group42

The trading profit of Financial Services in 2006 was 296 million

euros compared with 318 million euros in 2005:

■the decrease recorded at the Financial Services of Fiat Auto

(trading profit was 56 million euros in 2006 versus 60 million

euros in 2005) is mainly attributable to the contraction in

financing to suppliers and the results of the services

companies; in fact, in the renting business, the positive impact

of the consolidation of Leasys virtually offset lower results by

renting companies outside of Italy;

■the trading profit of CNH’s Financial Services grew from

235 million euros in 2005 to 249 million euros in 2006.

The improvement reflects growth in the managed portfolio,

In 2006 Financial Services reported net revenues of 2,607

million euros, up 28.9% from the 2,023 million euros of 2005

due to the increases reported at Fiat Auto, Iveco and CNH,

which were only partially offset by the impact of the sale of

B.U.C - Banca Unione di Credito, whose activities were

deconsolidated at the end of August 2006. In particular:

■the Financial Services of Fiat Auto had revenues of 991

million euros, versus 619 million euros in 2005. The increase

principally reflects the change in the scope of operations

following the consolidation of Leasys, full control of which was

acquired at the end of 2005. On a comparable basis, revenues

would have increased by 3.4% due to an increase in financing

activity to the dealer network which more than offset lower

financing activities to suppliers;

■CNH’s Financial Services reported revenues of 1,061 million

euros, up 20.7% from 2005. This improvement reflects the

increase of the financed portfolio and a higher level of the

reference interest rates;

■the Financial Services of Iveco had revenues of 508 million

euros. In 2005 revenues amounted to 457 million euros and

included activities whose sale started on June 1, 2005 as part

of the Barclays transaction. The 11.2% increase is attributable

to higher activity levels in Eastern Europe.

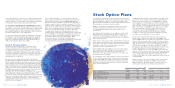

Trading profit

(in millions of euros) 2006 2005 Change

Fiat Auto 56 60 -4

Ferrari (1) –-1

Agricultural and Construction Equipment (CNH-Case New Holland) 249 235 14

Trucks and Commercial Vehicles (Iveco) (18) 10 -28

Holding companies and Other companies (1) 10 13 -3

Total 296 318 -22

(1) These amounts refer to the banking activities performed by B.U.C. – Banca Unione di Credito until August 2006 when it was sold.

partially offset by higher financial expenses and greater

provisions for doubtful accounts (especially relating to the

Brazilian portfolio, due to the credit renegotiation program

sponsored by the local government);

■Iveco’s Financial Services closed the year with a trading

loss of 18 million euros, compared with a trading profit of

10 million euros in 2005. The 2005 trading profit included the

profit (9 million euros) reported in the first 5 months of the

year by the activities subsequently sold within the framework

of the establishment of the joint venture with Barclays.

On a comparable basis, the decrease (19 million euros)

is mainly attributable to higher provisions connected

with renting activities in Western Europe.