Chrysler 2006 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

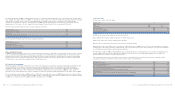

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 107

Additional qualitative information on the financial risks

to which the Group is exposed is provided in Note 34.

Scope of consolidation

The consolidated financial statements of the Group as of

December 31, 2006 include Fiat S.p.A. and 419 consolidated

subsidiaries in which Fiat S.p.A., directly or indirectly, has a

majority of the voting rights, over which it exercises control,

or from which it is able to derive benefit by virtue of its power

to govern corporate financial and operating policies.

The total number of consolidated subsidiaries at December 31,

2006 decreased by 38 compared with that at December 31, 2005.

Excluded from consolidation are 81 subsidiaries that are either

dormant or generate a negligible volume of business: their

proportion of the Group’s assets, liabilities, financial position

and earnings is immaterial. In particular,44 such subsidiaries

are accounted for using the cost method; and represent 0.1

percent of Group revenues, 0.0 percent of stockholders’ equity

and 0.1 percent of total assets.

Interests in jointly controlled entities (64 companies, including

37 entities of Fiat Auto Financial Services group) are accounted

for using the equity method, except for one investment

accounted for using proportionate consolidation, although

the amounts involved in this case are not significant. The

combined balances of the Group’sshare in the principal

balance sheet items of joint ventures accounted for using

the equity method are as follows:

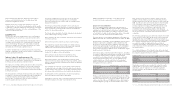

(in millions of euros) At December 31, 2006 At December 31, 2005

Non-current assets 1,992 1,064

Current assets 8,777 1,413

Total assets 10,769 2,477

Debt 7,781 710

Other liabilities 1,687 1,062

There is a significant increase in these balances at December

31, 2006 due to the inclusion at that date of the balances of the

Fiat Auto Financial Services group (the “FAFS” group), a joint

venture created at the end of 2006 with Sofinco (belonging to

the Crédit Agricole group), as described further in the notes.

Union market for the Fiat Auto and Commercial Vehicles

Sectors, and in North America for the Agricultural and

Construction Equipment Sector.

Financial assets are recognised in the balance sheet net

of write-downs for the risk that counterparties will be unable

to fulfil their contractual obligations, determined on the basis

of the available information as to the creditworthiness of the

customer and historical data.

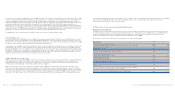

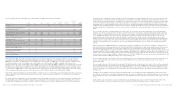

Liquidity risk

The Group is exposed to funding risk if there is difficulty in

obtaining finance for operations at any given point in time.

The cash flows, funding requirements and liquidity of Group

companies are monitored on a centralised basis, under the

control of the Group Treasury. The aim of this centralised

system is to optimise the efficiency and effectiveness of the

management of the Group’s capital resources

In order to minimise the cost of financing and to ensure that

funding is obtainable, Group Treasury has the committed credit

facilities described in Note 28.

Interest rate risk and currency risk

As a multinational group that has operations throughout the

world, the Group is exposed to market risks from fluctuations

in foreign currency exchange and interest rates.

The exposure to foreign currency risk arises both in connection

with the geographical distribution of the Group’sindustrial

activities compared to the markets in which it sell products,

and in relation to the use of external borrowing denominated

in foreign currencies.

The Group utilises external borrowing and the sale of financial

receivables as asset-backed securities through securitisations

to fund its industrial and financial activities. Changes in

interest rates could have the effect of either increasing

or decreasing the Group’s net result.

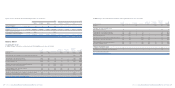

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 106

The Group regularly assesses its exposure to interest rate

and foreign currency risk through the use of derivative

financial instruments in accordance with its established risk

management policies.

The Group’s policy permits derivatives to be used only for

managing the exposure to fluctuation in exchange and interest

rates connected to monetary flows and assets and liabilities,

and not for speculative purposes.

The Group utilises derivative financial instruments designated

as fair value hedges, mainly to hedge:

■the exchange rate risk on financial instruments denominated

in foreign currency;

■the interest rate risk on fixed rate loans and borrowings.

The instruments used for these hedges are mainly currency

swaps, forward contracts, interest rate swaps and combined

interest rate and currency financial instruments.

The Group uses derivative financial instruments as cash flow

hedges for the purpose of pre-determining:

■the exchange rate at which forecasted transactions

denominated in foreign currencies will be accounted for;

■the interest paid on borrowings, both to match the fixed

interest received on loans (customer financing activity), and to

achieve a pre-defined mix of floating versus fixed rate funding

structured loans.

The exchange rate exposure on forecasted commercial flows

is hedged by currency swaps, forward contracts and currency

options. Interest rate exposures are usually hedged by interest

rate swaps and, in limited cases, by forward rate agreements.

Counterparties to these agreements are major international

financial institutions with high credit ratings.

Information on the fair value of derivative financial instruments

held at the balance sheet date is provided in Note 22.

This operation led to the derecognition of the assets and

liabilities held by entities previously controlled by the Fiat

Group and transferred to the joint venture as of December 28,

2006. In particular, Non-current assets have increased mainly

as a consequence of the inclusion of the leased assets of

renting companies belonging to FAFS, while Current assets

have increased as a consequence of the inclusion of the

receivables from the financing activities of the financial

services companies; the item Debt has increased significantly

due to the inclusion of the debt of those financial services

companies.

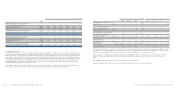

The following summary income statement excludes the results

of the operations of the FAFS group, as the joint venture was

established at the end of 2006. Prior to the joint venture, on

this date, the entities were consolidated on a line-by-line basis

for companies still belonging to the Fiat Group, and where

accounted for using the equity method for associated

companies belonging to the Fidis Retail Italia group. After the

joint venture was formed, all entities are accounted for using

the equity method.

The combined balances of the Group’s share in the principal

income statement items of jointly controlled entities accounted

for using the equity method are as follows:

(in millions of euros) 2006 2005

Net revenues 4,000 3,464

Trading profit 110 59

Operating result 93 59

Result before taxes 87 56

Net result 50 34

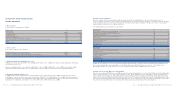

Twenty-nine associates are accounted for using the equity

method, while 31 associates, that in aggregate are of minor

importance, and are stated at cost. The main aggregate

amounts related to the Fiat Group interests in associates

are as follows:

(in millions of euros) At December 31, 2006 At December 31, 2005

Total assets 2,680 7,482

Liabilities 2,167 6,432

(in millions of euros) 2006 2005

Net revenues 1,145 1,280

Net result 78 71