Chrysler 2006 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

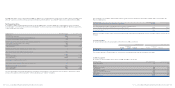

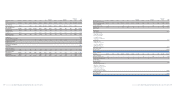

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 191

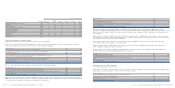

Purchased Cash outflows Goodwill recognised

(in millions of euros) minority interest on acquisition at the acquisition date

Conversion of CNH Global N.V. privileged “Series A” shares 6% – –

Acquisition of Ferrari newly-issued shares and exercise of the

call option on 28.6% of the Ferrari shares 29% 919 776

Total 919 776

In addition, the immaterial subsidiary Ferrari Financial Services AG was acquired in 2006, for a price paid by the Group which

included goodwill amounting to 1 million euros. The acquiree’s assets and liabilities at the acquisition date and immediately after

the acquisition were as follows:

IFRS book value at the IFRS book value immediately

(in millions of euros) acquisition date after the acquisition

Non current assets 11

Current assets 30 30

Total assets 31 31

Liabilities 31 31

Contingent liabilities ––

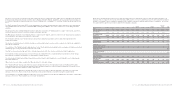

At the beginning of 2005, Magneti Marelli increased its equity investment in the capital stock of the automotive light manufacturer

Mako Elektrik Sanayi Ve Ticaret A.S. from 43% to 95%, thus acquiring control from the Turkish group Koç. As a result, the company,

previously accounted for using the equity method, has been consolidated on a line-by-line basis from January 1, 2005.

This transaction led to the acquisition of already recognised goodwill of 4 million euros from the acquired entity, which was left

unaltered in the consolidated financial statements at December 31, 2005 given the acquiree’s ability to earn a higher rate of return

and the fact that the value of this also stemmed from synergies to be realised after the acquisition as well as from other benefits

expected to arise from the operation.

The acquiree’s assets and liabilities at the acquisition date and immediately after the acquisition were as follows:

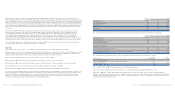

IFRS book value at the IFRS book value immediately

(in millions of euros) acquisition date after the acquisition

Non current assets 13 13

Current assets 35 35

Total assets 48 48

Liabilities 25 25

Contingent liabilities ––

In 2005 the Group acquired the control of the following previously jointly controlled entities as described below:

■As of May 2005, the operations that had previously been transferred to the Fiat-GM Powertrain joint-venture were consolidated

in Fiat Powertrain Technologies. Fiat re-acquired full control of these operations upon termination of the Master Agreement with

General Motors, with the sole exception of the Polish operations that continue to be jointly managed with General Motors. Fiat and

GM had formed the JV through the contribution of certain businesses. As part of the agreement to liquidate the JV, Fiat and GM

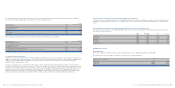

■Current trade receivables of 78 million euros (87 million euros at December 31, 2005): these relate to receivables resulting from

the revenues discussed above.

Transactions with other related parties

The principal transaction in this category relates to an amount of 14 million euros (13 million euros in 2005) classified in cost

of sales; included in this balance is the purchase of goods of 12 million euros for the high range and de-luxe upholstery

of the Group’s automobiles (12 million euros in 2005) from Poltrona Frau S.p.A., a company listed on the Milan Stock Exchange

in which the chairman of the Board of Directors of Fiat S.p.A., Luca Cordero di Montezemolo, has an indirect investment.

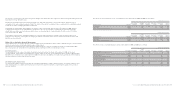

Emoluments to Directors, Statutory Auditors and Key Management

The fees of the Director and Statutory Auditors of Fiat S.p.A. for carrying out their respective functions, including those in other

consolidated companies, are as follows:

(in thousands of euros) 2006 2005

Directors 16,006 16,273

Statutory auditors 190 177

Total Emoluments 16,196 16,450

The aggregate expense incurred in 2006 and accrued at year end for the compensation of executives with strategic responsibilities

of the Group amounts to approximately 23 million euros. This amount is inclusive of the following:

■the provision charged by the Group in respect of mandatory severance indemnity, amounting to 1 million euros;

■the amount contributed by the Fiat Group to State and employer defined contribution pension funds amounting to approximately

4million euros;

■the amount contributed by the Fiat Group to a special defined benefit plan for certain senior Executives amounting to 0.7 million

euros.

These costs consist of compensation of 15 million euros for Executives with strategic responsibilities who were already working

for the Group in 2005 and continue with the Group at present, and 8 million euros for management personnel who took on key

responsibilities in 2006 and managers who left the Group in the year, including the severance pay of the latter.

36. Acquisitions and Disposals of subsidiaries

Acquisitions

The Group did not acquire any significant subsidiary in 2006. It acquired instead minority interests in companies in which it already

held control, leading to the recognition of the following cash outflows and goodwill:

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 190