Chrysler 2006 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

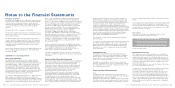

Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements 253Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements252

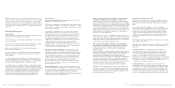

In particular as the investments are not listed and a market value (fair value less costs to sell) cannot be reliably measured, their

recoverable amount in measuring impairment losses and the reversal of impairment losses has been taken as their value in use.

The value in use of an investment is determined by estimating the present value of the estimated cash flows expected to arise

from the results of the investment and from the estimated value of a hypothetical ultimate disposal, in line with the requirements

of paragraph 33 of IAS 28. In calculating this value in use, the forecast included in the business plans of the individual Group

Sectors are taken into consideration, as attributed to the investments, increased by their terminal value, adjusted to take account

of the risks and uncertainties inherent in the assumptions on which these plans are based. These results and the terminal value

are then discounted to present value by applying a rate that is representative of the cost of equity, which varies between 11%

and 16% depending on the characteristics of the Sector under consideration.

The investment in Fiat Partecipazioni S.p.A. was impaired in previous years by a total of 5,403,000 thousand euros, which reflects

for the most part losses incurred in the Fiat Auto Sector, held as an investment by Fiat Partecipazioni S.p.A. through the

subholding Fiat Auto Holdings B.V. As a result of the fact that the Fiat Auto Sector has returned to profitability in 2006 and due to

positive future forecasts, the value in use of the investment in that company has been estimated to be approximately 3.3 billion

euros, taking into consideration the above-mentioned adjustments, which was then compared with its carrying amount in Fiat

Partecipazioni S.p.A. of approximately 2.1 billion euros. The difference of approximately 1.2 billion euros, taken together with the

cash flows generated at Fiat Partecipazioni S.p.A. (earned moreover from the gains realised on the sale of investments considered

by the Group to be non-strategic), has given rise to a reversal of 1,388,000 thousand euros of the previous impairment loss. The

residual part of the accumulated impairment loss recognised in prior years which is available for reversal in future years amounts

to 4,015,000 thousand euros, as reported in Note 13.

The investment in 60.56% of the capital of Iveco S.p.A. (the remaining 39.44% is held by Fiat Partecipazioni S.p.A.) was transferred

to Fiat S.p.A. during the year from Fiat Netherlands Holding N.V. under a regime whereby the carrying amounts were left

unchanged throughout the operation, as described further in Note 13. On the basis of grounds similar to those used for Fiat Auto

S.p.A., impairment losses of 945,814 thousand euros recognised in prior years and implicitly reflected in the book value transferred

were reversed. The value in use of the investment held is actually greater than the carrying value that has been reinstated, and

amounting to 1,593,290 thousand euros.

In a similar manner the part of the write-down of the investment in Fiat Netherlands Holding N.V. attributable to its holding

in CNH Global N.V. and amounting to 95,536 thousand euros has been fully reversed.

The write-down of the investment in Comau S.p.A., carried out using the same approach, was affected by the losses incurred

by the Sector in 2006 as the result of the steps taken to restructure the company and reshape its operations.

3. Gains (losses) on the disposal of investments

Net gains amount to 425 thousand euros in 2006, representing an improvement of 1,725 thousand euros compared to 2005.

The 2006 figure mainly includes the gains on the sale of minor investments within the Group.

Net losses of 1,300 thousand euros were realised from the disposal of investments in 2005, arising from price settlements

on the sale of minor investments.

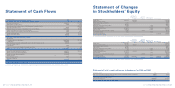

Composition and principal changes

Income Statement

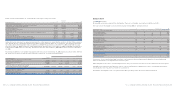

1. Dividends and other income from investments

Dividends and other income from investments can be analysed as follows:

(in thousands of euros) 2006 2005

Dividends distributed by subsidiaries:

- IHF - Internazionale Holding Fiat S.A. 258,967 –

- Fiat Finance S.p.A. 75,000 –

-Itedi S.p.A. 12,000 –

Total dividends distributed by subsidiaries 345,967 –

Dividends distributed by other companies 16,452 7,714

Total Dividends and other income from investments 362,419 7,714

Dividends distributed by other companies in 2006 consist of dividends paid by Mediobanca S.p.A. (8,702 thousand euros),

Consortium S.r.l. (6,618 thousand euros) and Fin. Priv.S.r.l. (1,132 thousand euros).

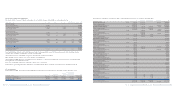

2. (Impairment losses) reversals of impairment losses of investments

Impairment losses and reversals of impairment losses of investments can be analysed as follows:

(in thousands of euros) 2006 2005

Reversals of impairment losses:

- Fiat Partecipazioni S.p.A. 1,388,000 –

-Iveco S.p.A. 945,814 –

- Fiat Netherlands Holding N.V. 95,536 376,100

- Magneti Marelli Holding S.p.A. –144,221

-Fiat USA Inc. –4,017

-Fiat Finance North America Inc. –2,415

Total Reversals of impairment losses 2,429,350 526,753

Impairment losses:

- Business Solutions S.p.A. –(52,056)

- Teksid S.p.A. –(52,986)

- Comau S.p.A. (330,000) (41,800)

- Fiat Partecipazioni S.p.A. –(810,700)

Total Impairment losses (330,000) (957,542)

Total (Impairment losses) reversals of impairment losses 2,099,350 (430,789)

This item consists of the impairment losses or reversals of impairment losses arising from the application of the cost method

in accordance with IAS 27 and IAS 36.