Chrysler 2006 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

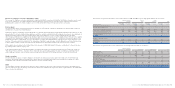

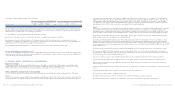

The above-mentioned bonds issued by CNH Inc. contain, moreover, financial covenants common to the high yield American bond

market which place restrictions, among other things, on the possibility of the issuer and certain companies of the CNH group to

secure new debt, pay dividends or buy back treasury stock, realise certain investments, conclude transactions with associated

companies, give collateral on its assets, conclude sale and leaseback transactions, sell certain fixed assets or merge with other

companies, and financial covenants which impose a maximum limit on further indebtedness by the CNH group companies which

cannot exceed a specific ratio of cash flows to dividend payments and financial expenses. Such covenants are subject to various

exceptions and limitations and, in particular, some of these would no longer be binding should the bonds be assigned an

investment grade rating by Standard & Poor’s Rating Services and/or Moody’s Investors Service.

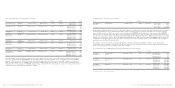

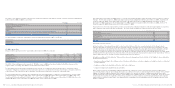

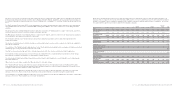

The major bond issues outstanding at December 31, 2006 are the following:

Face value of Outstanding

outstanding bonds amount

Currency (in millions) Coupon Maturity (in millions of euros)

Global Medium Term Notes:

Fiat Finance & Trade Ltd.(1) EUR 1,000 6.25% February 24, 2010 1,000

Fiat Finance & Trade Ltd.(1) EUR 1,300 6.75% May 25, 2011 1,300

Fiat Finance & Trade Ltd.(1) EUR 617 (2) (2) 617

Fiat Finance & Trade Ltd.(5) EUR 1,000 5.625% November 15, 2011 1,000

Others (3) 258

Total Global Medium Term Notes 4,175

Convertible bonds:

Fiat Fin. Luxembourg S.A. (4) USD 17 3.25% January 9, 2007 13

Total Convertible bonds 13

Other bonds:

CNH Capital America LLC USD 127 6.75% October 21, 2007 96

Case New Holland Inc. USD 500 6.00% June 1, 2009 380

Case New Holland Inc. USD 1,050 9.25% August 1, 2011 797

Fiat Finance & Trade Ltd. (5) EUR 1,000 6.625% February 15, 2013 1,000

Case New Holland Inc. USD 500 7.125% March 1, 2014 380

CNH America LLC USD 254 7.25% January 15, 2016 193

Total Other bonds 2,846

Hedging effect and amortised cost valuation 263

Total Bonds 7,297

(1) Bonds listed on the Mercato Obbligazionario Telematico of the Italian stock exchange (EuroMot). In addition, the majority of the bonds issued by the Fiat Group are also listed on the

Luxembourg stock exchange.

(2) “Fiat Step-Up Amortizing 2001-2011” bonds repayable at face value in five equal annual instalments each for 20% of the total issued (617 million euros) due beginning from the sixth year

(November 7, 2007) by reducing the face value of each bond outstanding by one-fifth. The last instalment will be repaid on November 7, 2011. The bonds pay coupon interest equal to: 4.40% in

the first year (November 7, 2002), 4.60% in the second year (November 7, 2003), 4.80% in the third year (November 7, 2004), 5.00% in the fourth year (November 7, 2005), 5.20% in the fifth year

(November 7, 2006), 5.40% in the sixth year (November 7, 2007), 5.90% in the seventh year (November 7, 2008), 6.40% in the eighth year (November 7, 2009), 6.90% in the ninth year (November

7, 2010), 7.40% in the tenth year (November 7, 2011).

(3) Bonds with amounts outstanding equal to or less than the equivalent of 50 million euros.

(4) Bonds convertible into General Motors Corporation common stock.

(5) Bonds listed on the Irish Stock Exchange

The Fiat Group intends to repay the issued bonds in cash at due date by utilising available liquid resources. At December 31, 2006,

the Fiat Group also had unused committed credit lines expiring after 2007 of approximately 2 billion euros.

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 169

In addition, the companies in the Fiat Group may from time to time buy back bonds on the market that have been issued by the

Group, also for purposes of their cancellation. Such buy backs, if made, depend upon market conditions, the financial situation

of the Group and other factors which could affect such decisions.

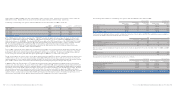

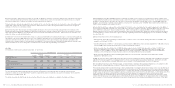

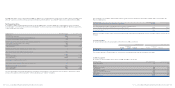

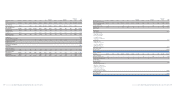

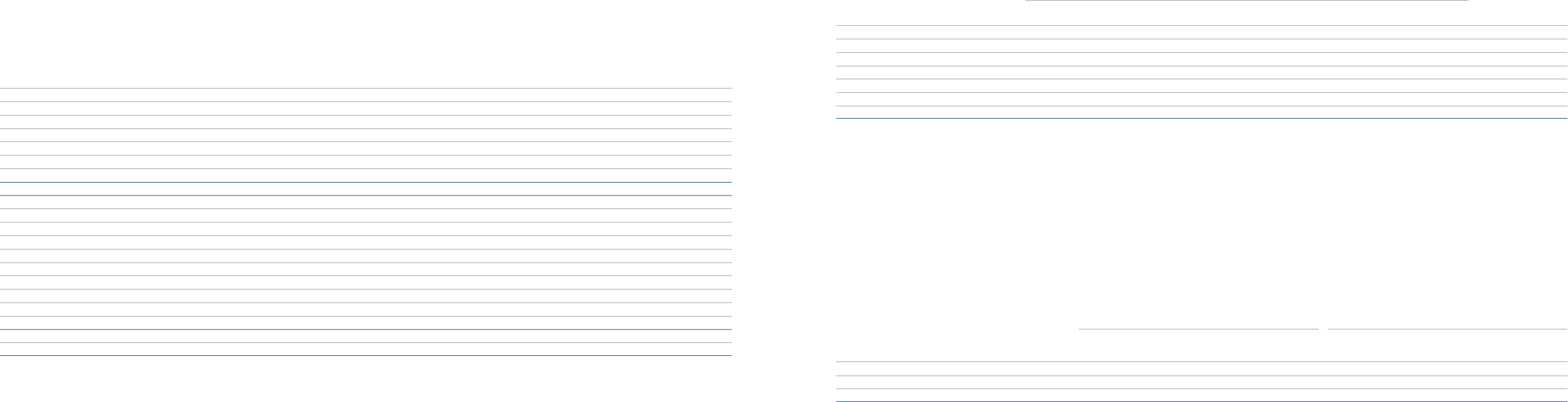

The annual interest rates and the nominal currencies of debt are as follows:

Interest rate

less from 5% from 7.5% from 10% greater

(in millions of euros) than 5% to 7.5% to 10% to 12.5% than 12.5% Total

Euro 2,714 5,628 271 – 1 8,614

U.S. dollar 85 6,886 812 15 1 7,799

Brazilian real 175 43 1,211 211 434 2,074

British pound 29 49 – – – 78

Canadian dollar 12 924 – – – 936

Other 76 512 76 14 9 687

Total Debt 3,091 14,042 2,370 240 445 20,188

Debt with annual nominal interest rates in excess of 12.5% relate principally to Group’s subsidiaries operating in Brazil.

For further information on the management of interest rate and exchange rate risk reference should be made to the previous

section Risk Management and to Note 34.

The fair value of Debt at December 31, 2006 amounts approximately to 20,484 million euros (approximately 25,624 million euros

at December 31, 2005), determined using the quoted market price of financial instruments, if available, or the related future cash

flows. The amount is calculated using the interest rates stated in Note 19, suitably adjusted to take account of the Group’s current

creditworthiness.

At December 31, 2006 the Group has outstanding financial lease agreements for certain property,plant and equipment whose net

carrying amount totalling 70 million euros (96 million euros at December 31, 2005) is included in the item Property, plant and

equipment (Note 14). Payables for finance leases included in the item Other debt amount to 57 million euros at December 31, 2006

(145 million euros at December 31, 2005) and are analysed as follows:

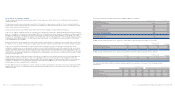

At December 31, 2006 At December 31, 2005

due between due between

due within one and due beyond due within one and due beyond

(in millions of euros) one year five years five years Total one year five years five years Total

Minimum future lease payments 16 39 6 61 79 59 17 155

Interest expense (1) (3) – (4) (4) (5) (1) (10)

Present value of minimum lease payments 15 36 6 57 75 54 16 145

The significant decrease in finance lease payables is mostly the result of paying the final instalments of 58 million euros in 2006

of an agreement for the lease of assets that were fully impaired in prior years.

Debt secured by mortgages on assets of the Group amounts to 190 million euros at December 31, 2006 (710 million euros

at December 31, 2005), of which 57 million euros (145 million euros at December 31, 2005) due to creditors for assets acquired

under finance leases. The total carrying amount of assets acting as security for loans amounts to 223 million euros at December

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 168