Chrysler 2006 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 151

The majority of options that had been granted to managers were exercised during the fourth quarter of the year. The average price

of Fiat S.p.A. ordinary shares during this period was 14.14 euros per share.

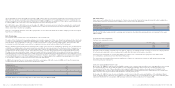

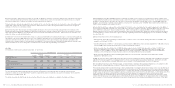

As discussed under Significant accounting policies, in the case of share-based payments the Group applies IFRS 2 to all stock

options granted after November 7, 2002, which had not yet vested at January 1, 2005, namely the July 2004 and November 2006

stock option plans. For these stock options plans, the fair value calculated at the grant date used to determine the compensation

expense to be accrued, based on a binomial pricing model is based on the following assumptions:

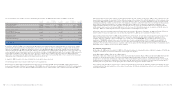

Plan July 2004 Plan November 2006

Fair value at the grant date (euros) 2.440 3.99

Price of Fiat S.p.A. ordinary shares (euros) 6.466 14.425

Historical volatility of Fiat S.p.A ordinary shares (%) 29.37 28,33

Risk free interest rate 4.021 –

In addition, it is recalled that the dividend payment rate used in the determination of the fair value at the plan grant date in July

2004 was assumed to be zero, based on the experience in the period from 2003 to 2005. In determining the fair value of the

November 2006 plan the recent statements made on future dividend prospects of approximately 25% of the consolidated Net result

have been considered instead. In addition, the interest rate yield used in the option-pricing model for the 2006 plan is in line with

that referred to in Note 19.

The total cost recognised in the income statement for share-based payments linked to Fiat S.p.A. ordinary shares amounts

to 11 million euros in 2006 (10 million euros in 2005).

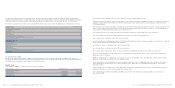

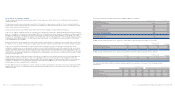

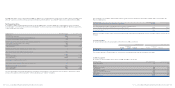

Stock Option plans linked to CNH Global N.V. ordinary shares

In the Agricultural and Construction Equipment Sector,CNH Global N.V.(“CNH”) has granted share-based compensation

to directors officers and employees which are linked to shares and which have the following terms:

■The CNH Global N.V.Outside Directors’ Compensation Plan (“CNH Directors’ Plan”), as amended on April 28, 2006, provides for

the payment of the following to independent outside members of the CNH Global N.V.Board in the form of cash, and/or common

shares of CNH, and/or options to purchase common shares of CNH.

–an annual retainer fee of 65,000 USD;

– a committee membership fee of 25,000 USD; and

– a committee chair fee of 10,000 USD (collectively, the “Fees”).

In addition, on April 7, 2006, outside directors received a one-time grant of 4,000 options to purchase common shares of CNH

Global N.V. that vest on the third anniversary of the grant date. Each quarter the outside directors elect the form of payment of

1/4 of their Fees. If the elected form is options, the outside director will receive as many options as the amount of Fees that the

director elects to forego, multiplied by four and divided by the fair market value of a common share, such fair market value being

equal to the average of the highest and lowest sale price of a CNH Global N.V. common share on the last trading day of the New

York Stock Exchange preceding the start of each quarter. Stock options granted as a result of such an election vest immediately

upon grant, but shares purchased under options cannot be sold for six months following the date of grant.

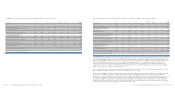

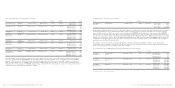

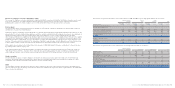

Asummary of outstanding stock options at December 31, 2006 is as follows:

Managers compensation Compensation as member of the Board

Average remaining Average remaining

Options Options contractual life Options Options contractual life

outstanding at outstanding at (in years) at outstanding at outstanding at (in years) at

Exercise price (in euros) December 31, 2006 December 31, 2005 December 31, 2006 December 31, 2006 December 31, 2005 December 31, 2006

6.583 ––– 10,670,000 10,670,000 4.0

10.397 2,117,000 3,046,500 3.7 – ––

12.699 ––– 1,000,000 1,000,000 3.0

13.37 (*) 10,000,000 –7.8 10,000,000 –7.8

16.526 1,943,500 2,299,000 2.8 – ––

23.708 ––– 1,000,000 1,000,000 1.8

24.853 80,000 300,000 2.2 –––

25.459 –––250.000 250.000 1.6

26.120 241,900 316,000 0.3 – ––

28.122 1,051,500 1,788,000 1.1 – ––

Total (*) 15,433,900 7,749,500 22,920,000 12,920,000

(*) The granting of 20,000,000 stock options (of which 10,000,000 to managers and 10,000,000 to the Chief Executive officer), approved by the Board of Directors on November 3, 2006, is subject to

the approval of shareholders in general meeting pursuant to law.

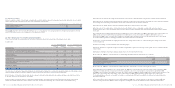

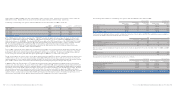

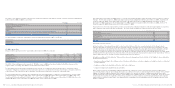

Changes during the year are as follows:

Managers compensation Compensation as member of the Board

Average Average

exercise price exercise price

Number of shares (in euros) Number of shares (in euros)

Outstanding at the beginning of the year 7,749,500 17.51 12,920,000 8.75

Granted (*) 10,000,000 13.37 10,000,000 13.37

Forfeited ––––

Exercised (558,250) 10.397 – –

Expired (1,757,350) 21.54 – –

Outstanding at December 31, 2006 (*) 15,433,900 14.62 22,920,000 10.76

Exercisable at December 31, 2006 5,433,900 16.93 2,250,000 19.01

Exercisable at December 31, 2005 6,987,875 18.28 2,250,000 19.01

(*) The granting of 20,000,000 stock options (of which 10,000,000 to managers and 10,000,000 to the Chief Executive officer), approved by the Board of Directors on November 3, 2006, is subject to

the approval of shareholders in general meeting pursuant to law.

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 150