Chrysler 2006 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 161

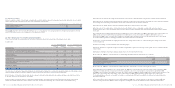

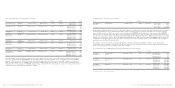

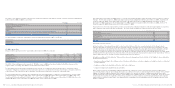

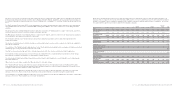

The amounts recognised in the balance sheet at December 31, 2006 and 2005 for post-employment benefits are as follows:

Employee severance Pension Health

indemnity Plans care plans Other

At December At December At December At December At December At December At December At December

(in millions of euros) 31, 2006 31, 2005 31, 2006 31, 2005 31, 2006 31, 2005 31, 2006 31, 2005

Present value of funded obligations ––2,296 2,647 ––––

Less: Fair Value of plan assets ––(2,176) (2,115) ––––

––120 532 ––––

Present value of unfunded obligations 1,362 1,417 811 539 1,109 1,417 278 323

Unrecognised actuarial gains (losses) (92) (134) (151) (164) (161) (370) (18) (28)

Less: Unrecognised past service cost ––(1) (4) 38 55 (1) (1)

Unrecognised assets ––5–––––

Net liability 1,270 1,283 784 903 986 1,102 259 294

Amounts in the balance sheet:

-Liabilities 1,270 1,283 795 903 986 1,102 259 294

-Less: Assets ––(11) –––––

Net liability 1,270 1,283 784 903 986 1,102 259 294

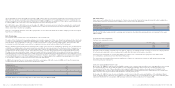

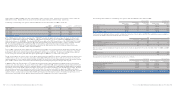

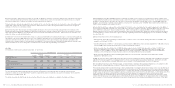

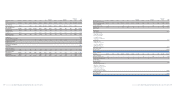

The amounts recognised in the income statement for Post-employment benefits are as follows:

Employee severance

indemnity Pension Plans Health care plans Other

(in millions of euros) 2006 2005 2006 2005 2006 2005 2006 2005

Current service cost 91 86 37 48 12 12 13 16

Interest costs 49 33 149 146 67 60 11 9

Less: Expected return on plan assets ––(152) (133) ––––

Net actuarial losses (gains) recognised in the year 31(4) –22 14 (2) 4

Past service costs ––11(11) (11) –1

Paragraph 58 adjustment ––3–––––

Losses (gains) on curtailments and settlements ––––––(1) (1)

Plan amendments ––15 (8) (31) (98) ––

Other 11–(7) –1–(3)

Total Costs (gains) for post-employment benefits 144 121 49 47 59 (22) 21 26

Actual return on plan assets n/a n/a 198 213 n/a n/a n/a n/a

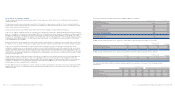

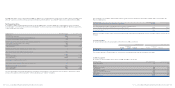

Reserve for employee severance indemnity (“TFR”)

The reserve for employee severance indemnities comprises liability for severance indemnities that Italian companies accrue each

year end for employees, as required by Italian labour legislation. This provision is settled to retiree employees and, shall be

partially paid in advance if certain conditions are met. This defined benefit post-employment plan is unfunded.

Pension plans

The item Pension plans consists principally of the obligations of Fiat Group companies operating in the United States (mainly to

the CNH Sector) and in the United Kingdom.

Under these plans a contribution is generally made to a separate fund (trust) which independently administers the plan assets. The

plan provides for a fixed contribution by employees and for a variable contribution by the employer necessary to, at a minimum, to

satisfy the funding requirements as prescribed by the laws and regulations of each country. Prudently the Group makes

discretionary contributions in addition to the funding requirements. If these funds are overfounded, that is if they present a surplus

compared to the requirements of law, the Group companies concerned are not required to contribute to the plan in respect of the

minimum performance requirement as long as the fund is in surplus. The administration strategy for these assets depends on the

features of the plan and on the maturity of the obligations. Typically, longer term plan benefit obligations are funded by investing

in more equity securities; shorter term plan benefit obligations are funded by investing in more fixed income securities.

With regard to pension plans in the United States from January 1, 2003 CNH Global N.V. makes contributions to these plans also

by ordinary shares and not only by cash.

In the United Kingdom the Fiat Group participates in a plan financed by various entities belonging to the Fiat Group, called the

“Fiat Group Pension Scheme”, amongst others. Under this plan, participating employers make contributions on behalf of their

active employees (active), retirees (pensioners) and employees who have left the Group but have not yet retired (deferred).

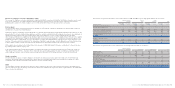

Health care plans

The item Health care plans comprise obligations for health care and insurance plans granted to employees of the Fiat Group

working in the United States and Canada. These plans, which are unfunded, generally cover all employees retiring on or after

reaching the age of 55 who have had at least 10 years of service with the Group.

Other

The item Other includes loyalty bonuses, which are due to employees who reach a specified seniority and are generally settled

when an employee leaves the Group; and for French entities, the Indemnité de depart à la retraite, a plan similar to the Italian TFR.

These schemes are unfunded.

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 160