Chrysler 2006 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

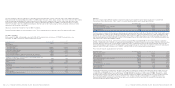

Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements 265Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements264

The increase in the investments in Mediobanca S.p.A. and Assicurazioni Generali S.p.A. shown in the column Acquisitions/Capital

increases is the result of the winding up of Consortium S.r.l. and the consequent transfer to its shareholders of the shares that the

company held in Mediobanca S.p.A. and Assicurazioni Generali S.p.A. on the basis of their investments. The transfer prices were

determined on the basis of the market price of the shares.

Fiat S.p.A has measured its investments in Mediobanca S.p.A. and Assicurazioni Generali S.p.A. on the basis of the market price

of the shares at year end. This led to an increase in the carrying amount of the investments, recognised directly in equity at year end.

There are no entities in Investments in other companies for whose obligations Fiat S.p.A. has unlimited responsibility (article 2361,

paragraph 2 of the Italian civil code).

At December 31, 2005 and 2006 there were no investments given as security for financial or contingent liabilities.

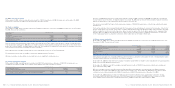

14. Other financial assets

Other financial assets may be analysed as follows:

At At

(in thousands of euros) December 31, 2006 December 31, 2005 Change

Call option on Ferrari S.p.A. shares 10,032 –10,032

Fees receivables for guarantees given 10,029 5,262 4,767

Debt securities 73 73 –

Total Other financial assets 20,134 5,335 14,799

The call option on Ferrari S.p.A. shares has been measured at the amount of the premium paid in October 2006 and relates to 5%

of the capital stock of Ferrari S.p.A. held by the Arab Mubadala Development Company PJSC fund. The option may be exercised

at a price of 303 euros per share from January 1, 2008 to July 31, 2008. It has been recognised at cost since its fair value cannot

be reliably measured.

Fees receivables for guarantees given are measured at the present value of the fees to be received in future years for guarantees

provided by the company (mainly for guaranteeing loans obtained by Group companies).

Debt securities consist of listed Italian State securities pledged to fund scholarship grants.

Abreakdown of other financial assets by maturity date is as follows:

At At

(in thousands of euros) December 31, 2006 December 31, 2005

Other financial assets

due within one year 2,512 1,331

due after one year but within five years 17,578 3,044

due after five years 44 960

total 20,134 5,335

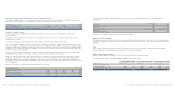

Changes that occurred in 2006 may be summarised as follows:

■In May 2006, in order to re-balance the equity structure inside the Group, the capital stock of the subsidiaries Fiat Partecipazioni

S.p.A and Fiat Netherlands Holding N.V. was increased by 6,000,000 thousand euros and 121,126 thousand euros respectively.

■In May 2006, Ferrari S.p.A. increased its capital stock through the issuance of 104,000 new shares servicing its stock option plans.

Fiat S.p.A. subsequently acquired 93,600 newly-issued shares of Ferrari S.p.A. for 26,713 thousand euros and sold 5,200 shares for

1,484 thousand euros, the latter as part of its agreements with Mubadala Development Company PJSC, bringing its interest therein

to 56.4%.

■At the end of September 2006, Fiat S.p.A. exercised its call option and repurchased 28.6% of the capital stock of Ferrari S.p.A. from

Mediobanca S.p.A. (and the other members of the syndicate), increasing its interest therein from 56.4% to 85%. The call option was

part of the agreements signed with Mediobanca S.p.A. in connection with the sale in 2002 aimed at listing the Ferrari S.p.A. shares.

The above transaction led to an increase in the carrying amount of the investment equal to the purchase price of 892,555 thousand

euros, including related charges, net of the release of the provision of 23,256 thousand euros accrued in previous years against the

company’s obligation to Mediobanca S.p.A. which was subject to the latter’s execution of the listing of Ferrari S.p.A. shares (see

Note 24). The remaining rights agreed with Mediobanca S.p.A. have now ceased. Fiat has a call option exercisable from January 1,

2008 to July 31, 2008 on a further 5% of the Ferrari shares held by Mubadala Development Company at a pre-determined price of

303 euros per share (for a total of 122,776 thousand euros) less any dividend that may be distributed.

■In December 2006, Fiat Netherlands Holding N.V. decreased its capital stock and transferred its 100% investment in Iveco S.p.A.

to its stockholders (Fiat S.p.A. and Fiat Partecipazioni S.p.A.) on the basis of their ownership percentage. Fiat S.p.A. thus obtained

519,871,290 Iveco S.p.A. shares, equal to 60.56% of the capital stock, at the same value as the previous carrying amount in the

financial statements of Fiat Netherlands Holding N.V.(approximately 1.245 euros per share). At the same time it decreased its

investment in Fiat Netherlands Holding N.V.by the same amount (647,476 thousand euros). Since the transaction involved directly

and indirectly wholly owned subsidiaries of Fiat S.p.A., carrying amounts were left unchanged throughout the operation. As a

result, the accumulated impairment losses recognised by Fiat S.p.A. in previous years due to the impairment losses related to

Iveco S.p.A. have not been adjusted.

Impairment losses and the reversals of impairment losses arise from the application of the cost method (see Note 2).

Afull list of investments with the additional disclosures required by Consob in its communication no. DEM/6064293 of July 28,

2006 is attached.

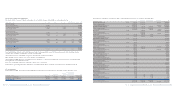

Investments in other companies and the changes that occurred are set out below:

Disposals/

At Acquisitions/ Capital Fair value At

(in thousands of euros) %interest December 31, 2005 Capital increases reimbursements adjustments December 31, 2006

Mediobanca S.p.A. 1.84 227,107 13,544 27,605 268,256

Fin.Priv. S.r.l. 14.28 14,355 14,355

Consortium S.r.l. 2.76 19,530 (19,243) 287

Assicurazioni Generali S.p.A. 0.01 4,567 892 5,459

Total investments in other companies 260,992 18,111 (19,243) 28,497 288,357