Chrysler 2006 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements 245Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements244

Group’s financial statements. The investment portfolios of

financial services companies are included in current assets

in the Consolidated Balance Sheet, as the investments will

be realised in their normal operating cycle. Financial services

companies, though, obtain funds only partially from the

market: the remaining are obtained through the Group’s

treasury companies (included in industrial companies), which

lend funds both to industrial Group companies and to financial

services companies as the need arises. This financial service

structure within the Group means that any attempt to separate

current and non-current debt in the Consolidated Balance

Sheet cannot be meaningful. This has no effect on the

presentation of the liabilities of Fiat S.p.A.

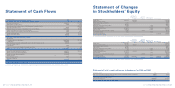

The statement of cash flows has been prepared using the

indirect method.

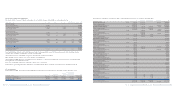

In connection with the requirements of the Consob Resolution

No. 15519 of July 27, 2006 as to the format of the financial

statements, specific supplementary Income Statement and

Balance Sheet formats have been added for related party

transactions, so as not to compromise the overall reading

of the statements.

Intangible assets

Purchased and internally-generated intangible assets are

recognised as assets in accordance with IAS 38 - Intangible

Assets,where it is probable that the use of the asset will

generate future economic benefits and where the cost of the

asset can be determined reliably.

Intangible assets with finite useful lives are measured at

purchase or manufacturing cost, net of amortisation charged

on a straight-line basis over their estimated useful lives and

net of any impairment losses.

Property,plant and equipment

Cost

Property, plant and equipment is measured at purchase or

manufacturing cost, net of accumulated depreciation and any

impairment losses, and is not revalued.

Subsequent expenditures are capitalised only if they increase

the future economic benefits embodied in the asset to which

they relate. All other expenditures are expensed as incurred.

Assets are depreciated using the policies and rates described

below.

Lease arrangements in which the lessor maintains substantially

all the risks and rewards incidental to the ownership of an

asset are classified as operating leases. Lease payments under

an operating lease are recognised as an expense on a straight-

line basis over the lease term.

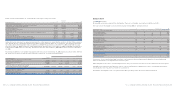

Depreciation

Depreciation is charged on a straight-line basis over the

estimated useful lives of assets as follows:

Annual depreciation rate

Buildings 3%

Plant 10%

Furniture 12%

Fixtures 20%

Vehicles 25%

Land is not depreciated.

Impairment of assets

The company reviews at least annually the recoverability of

the carrying amount of intangible assets, property, plant and

equipment and investments in subsidiaries and associates, in

order to determine whether there is any indication that those

assets have suffered an impairment loss. If any such indication

exists, the carrying amount of an asset is written down to its

recoverable amount.

The recoverable amount of an asset is the higher of fair value

less costs to sell and its value in use.

In particular,in assessing whether investments in subsidiaries

and associated companies have been impaired, their

recoverable amount has been taken as their value in use, as

the investments are not listed and a market value (fair value

less costs to sell) cannot be reliably measured. The value in

use of an investment is determined by estimating the present

value of the estimated cash flows expected to arise from the

results of the investment and from the estimated value of its

ultimate disposal, in line with the requirements of paragraph

33 of IAS 28.

Principal activities

Fiat S.p.A. (the “Company”) is a corporation organised under

the laws of the Republic of Italy and is the Parent Company

of the Fiat Group, holding investments, either directly or

indirectly through subholdings, in the capital of the parent

companies of business Sectors in which the Fiat Group

operates.

The head office of the company is in Turin, Italy.

The financial statements of Fiat S.p.A. are prepared in euros

which is the currency of the economic environment in which

the company operates.

The Balance Sheet and Income Statement are presented

in euros, while the Statement of Cash Flows, the Statement

of Changes in Stockholders’ Equity, the Statement of Total

Recognised Income and Expenses and the amounts stated

in the Notes are presented in thousands of euros, unless

otherwise stated.

As the Parent Company,Fiat S.p.A. has additionally prepared

the consolidated financial statements of the Fiat Group at

December 31, 2006.

Significant accounting policies

Basis of preparation

The 2006 financial statements are the separate financial

statements of the Parent Company,Fiat S.p.A., and have

been prepared in accordance with the International Financial

Reporting Standards (“IFRS”) issued by the International

Accounting Standards Board (“IASB”) and adopted by the

European Union. The designation “IFRS” also includes all

the revised International Accounting Standards (“IAS”) and

all the interpretations of the International Financial Reporting

Interpretations Committee (“IFRIC”), previously known as

the Standing Interpretations Committee (“SIC”).

In compliance with European Regulation no. 1606 of July 19,

2002, starting from 2005 the Fiat Group has adopted the

International Financial Reporting Standards (“IFRS”) issued by

the International Accounting Standards Board (“IASB”) for the

preparation of its consolidated financial statements. On the

basis of national legislation implementing that Regulation,

the annual statutory accounts of the Parent Company Fiat

S.p.A. as of December 31, 2006 have been prepared for the first

time also using those accounting standards. As a consequence

the Parent Company Fiat S.p.A. is presenting its financial

statements for 2006 and its comparative figures for the prior

year in accordance with IFRS. The accounting principles

applied are the same as those used in the preparation of the

Company’s Balance Sheets at January 1, 2005 and

December 31, 2005 and its 2005 Income Statement in

accordance with IFRS; these statements are provided in the

Appendix attached to these Notes, to which reference should

be made. The Appendix provides reconciliations of the

Company’s equity and Income Statement reported under its

previous accounting principles (Italian accounting principles)

and IFRS, together with Notes, as required by IFRS 1 – First-

time adoption of IFRS.

Certain reclassifications have been made with respect to the

figures published in the Appendix to the 2006 First-half Report.

The comparative figures for the previous period were

consequently reclassified. These reclassifications have no

effect on the net result or stockholders’ equity.

The financial statements have been prepared on a historical

cost basis, modified as required for measuring certain financial

instruments.

Format of the financial statements

Fiat S.p.A. presents an Income Statement using a classification

based on the nature of its revenues and expenses given the

type of business it performs. The Fiat Group presents a

Consolidated Income Statement using a classification based

on function, as this is believed to be more representative of

the format selected for managing the business sectors and

for internal reporting purposes and is coherent with

international practice in the automotive sector.

Fiat S.p.A. has elected to present current and non-current

assets and liabilities as separate classifications on the face

of the Balance Sheet. A mixed format has been selected by

the Fiat Group for the Consolidated Balance Sheet, as

permitted by IAS 1, presenting only current and non-current

assets separately. This decision has been taken in view of the

fact that both companies carrying out industrial activities and

those carrying out financial activities are consolidated in the

Notes to the Financial Statements