Chrysler 2006 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements 249Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements248

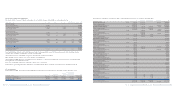

Employee benefits

Post-employment plans

The company provides pension plans and other post-

employment plans to its employees. The pension plans for which

the company has an obligation under Italian law are defined

contribution plans, while the other post-employment plans, for

which the company generally has an obligation under national

collective bargaining agreements, are defined benefit plans. The

payments made by the company for defined contribution plans

are recognised in the Income Statement as a cost when incurred.

Defined benefit plans are based on the employees’ working lives

and on the salary or wage received by the employee over a pre-

determined period of service.

The employees’ severance indemnity (trattamento di fine

rapporto or TFR)is considered to be a defined benefit plan and is

accounted for in the same way as other defined benefit plans.

The company’s obligation to fund defined benefit plans

and the annual cost recognised in the Income Statement are

determined by independent actuaries using the projected unit

credit method. The portion of net actuarial gains and losses

at the end of the previous reporting period that exceeds the

greater of 10% of the present value of the defined benefit

obligation and 10% of the fair value of the plan assets at that

date is deferred and recognised over the remaining working lives

of the employees (the “corridor method”); the portion

of actuarial gains and losses that does not exceed this threshold

is deferred.

In the context of IFRS first-time adoption, the company elected to

recognise all cumulative actuarial gains and losses at January 1,

2004 (date of first-time adoption of IFRS by the Fiat Group),

although it has adopted the corridor method for those arising

subsequently.

The expense related to the reversal of discounting pension

obligations for defined benefit plans are reported separately

as part of the Group’s financial expense.

The liability for obligations arising under defined benefit plans

and due on termination of the employment contract represents

the present value of the obligation adjusted by actuarial gains

and loses deferred as the result of applying the corridor approach

and by past service costs for employee service in prior periods

that will be recognised in future years.

Other long-term benefits

The accounting treatment of other long-term benefits is the same

as that for post-employment benefit plans except for the fact that

actuarial gains and losses and past service costs are fully

recognised in the Income Statement in the year in which they

arise and the corridor method is not applied.

Equity compensation plans

The company provides additional benefits to certain members

of top management and to certain employees through equity

compensation plans. Under IFRS 2 - Share-based Payment,these

plans are a component of employee remuneration whose cost is

measured by the fair value of the stock options at the grant date

recognised in the Income Statement on a straight-line basis from

the grant date to the vesting date, with a counter entry to equity.

Changes in fair value after the grant date do not have any effect

on the initial measurement.

The company has applied the transitional provisions of IFRS 2

and as a result the Standard is applicable to all stock option plans

granted after November 7, 2002 but which had not yet vested by

January 1, 2005, the effective date of the Standard. Detailed

disclosures are also provided for plans granted before that date.

Statement in the period in which the hedged transaction is

recognised. Gains or losses associated with a hedge (or part of

a hedge) which is no longer effective are immediately recognised

in the Income Statement. If a hedging instrument or a hedging

relationship is terminated, but the transaction being hedged has

not yet occurred, the cumulative gains and losses recognised in

equity until that time are recognised in the Income Statement at

the time the transaction occurs. If a hedged transaction is no

longer considered probable, the unrealised gains and losses that

remain in equity are immediately recognised in the Income

Statement.

If hedge accounting cannot be used, the gains and losses

resulting from changes in the measurement of the derivative

financial instrument at fair value are immediately recognised

in the Income Statement.

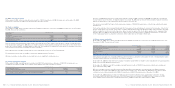

Inventory

Inventory consists of work in progress on specific contracts and in

particular relates to long-term construction contracts signed by

Fiat S.p.A. with Treno Alta Velocità – T.A.V. S.p.A. under which

Fiat S.p.A. as general contractor performs the coordination,

organisation and management of the work.

Work in progress refers to activities carried out directly and

is measured by applying the percentage of completion to the

contract fee, thereby recognising the margins deriving from the

work performed to date. The cost to cost method is used

to determine the percentage of completion of a contract (by

dividing the costs incurred by the total costs forecast for the

whole construction).

Any losses expected to be incurred on contracts are fully

recognised in the Income Statement and as a reduction

in contract work in progress when they become known.

Any advances received from customers for services performed

are presented as a reduction in inventory. If the amount of

advances exceeds inventory, the excess is recognised as

Advances in the item Other payables.

Sales of receivables

Receivables sold in factoring operations are derecognised

from assets if and only if the risks and rewards relating to

their ownership have been substantially transferred to the

buyer. Receivables sold with recourse and without recourse

that do not satisfy this condition remain in the company’s

Balance Sheet even if they have been sold from a legal point

of view; in this case, an obligation of the same amount is

recognised as a liability for the advances received.

Assets held for sale

Any amounts in this item will consist of non-current assets

(or assets and liabilities included in disposal groups) whose

carrying amount will be recovered principally through a sale

transaction rather than through continuing use. Assets held

for sale (or disposal groups) are measured at the lower of

their carrying amount and fair value less disposal costs.