Chrysler 2006 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 113

of the platforms and the reallocation of production; costs of 71 million euros for an indemnity to Global Value S.p.A. for unwinding

the joint venture with IBM; 30 million euros from indemnities paid to settle contractual guarantees granted on the sale

of businesses in previous years and other minor items.

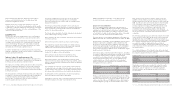

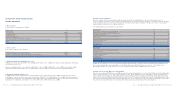

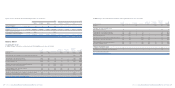

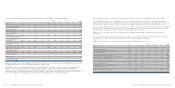

9. Financial income (expenses) and unusual financial income

Financial income (expenses)

In addition to the items included in the specific lines of the income statement, Net financial income (expenses) also includes the

income from financial services companies included in Net revenues for 1,077 million euros (1,088 million euros in 2005) and the

costs incurred by financial services companies included in Interest cost and other financial charges from financial services

companies included in Cost of sales for 897 million euros (726 million euros in 2005).

Reconciliation to the income statement is provided at the foot of the following table.

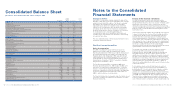

(in millions of euros) 2006 2005

Financial income

-Interest earned and other financial income 295 258

-Interest income from customers and other financial income of financial services companies 1,077 1,088

- Gains on disposal of securities 710

Total Financial income (a) 1,379 1,356

of which:

-Financial income, excluding financial services companies 302 268

Interest and other financial expenses

- Interest expense and other financial expenses 1,616 1,695

- Write-downs of financial assets 115 126

- Losses on disposal of securities 22

- Interest costs on employee benefits 166 146

Total Interest and other financial expenses (b) 1,899 1,969

Net income (expenses) from derivative financial instruments and exchange differences (c) 124 132

of which of (b+c):

Interest and other financial expenses, effects resulting from derivative financial instruments

and exchange differences, excluding financial services companies 878 1,111

Net financial income (expenses) excluding financial services companies (a-b-c) (576) (843)

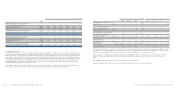

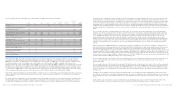

The majority of the balance of 905 million euros in 2005 consisted of the net gain of 878 million euros arising from the sale to EDF

of the investment held by Fiat in Italenergia Bis S.p.A. In particular, as a consequence of the notification received from EDF of its

intention to withdraw its arbitration claim, Fiat sold its holding of 24.6% of the capital stock of Italenergia Bis S.p.A. to EDF on

September 9, 2005 at a price of 1,147 million euros. On the same date, the Citigroup loan granted in September 2002 for the same

amount was reimbursed, and the banks that had acquired 14% of Italenergia Bis from Fiat in 2002, signing simultaneous

agreements for a series of put and call options, sold their stake to EDF, with the result that any possibility for Fiat to be required to

repurchase the 14% holding was eliminated (a possibility that led to the derecognition in the IFRS financial statements of the sale

of the 14% carried out in 2002 and the recognition of a liability of approximately 600 million euros to the banks who acquired that

holding). As a result of these transactions, Group net debt decreased by approximately 1.8 billion euros.

The 2005 balance also included a gain of 23 million euros on the disposal of Palazzo Grassi S.p.A.

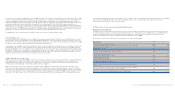

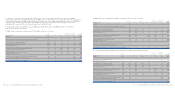

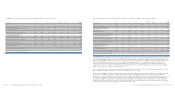

7. Restructuring costs

The restructuring costs of 450 million euros in 2006 were incurred mainly by Comau (179 million euros), CNH (145 million euros),

Fiat Powertrain Technologies (60 million euros), Magneti Marelli (16 million euros), and Business Solutions (12 million euros). In

this respect it is recalled that an intense reshaping and restructuring process was started in Comau during the third quarter of 2006

in response to the Sector’snegative performance and declining order backlog.

Restructuring costs in 2005 amounted to 502 million and were incurred by Fiat Auto for 162 million euros, mostly in relation to the

restructuring of the Sector’s central organisations and certain foreign operations, as well as the activities of Fiat-GM Powertrain;

by Iveco for 99 million euros, essentially due to a reorganisation process of the entire Sector and in particular of its staff structure;

by CNH for 87 million euros, regarding the reorganisation in progress of its activities and the restructuring of certain of its foreign

operations; and by Comau for 46 million euros, Magneti Marelli for 33 million euros Business Solutions for 22 million euros; in

addition to this there were minor amounts pertaining to other Group Sectors.

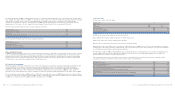

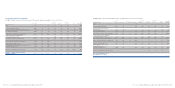

8. Other unusual income (expenses)

Other unusual income (expenses) in 2006 consists of net expenses of 47 million euros. Included in this item, amongst other things,

is the impairment of goodwill of 26 million euros relating to certain of Comau’s European operations, which results from the

redefinition and restructuring of the perimeters of that Sector’soperations, and expenses of 17 million euros arising from the

reorganisation and streamlining of relationships with the Group’ssuppliers.

Other unusual income (expenses) amounted to 812 million euros in 2005 and comprised the following items: the gain for the

settlement of the Master Agreement with General Motors for 1,134 million euros (net of related expenses); a gain of 117 million

euros realised on the final disposal of the real estate properties that had been securitised in 1998; additional costs connected with

the process of reorganisation and streamlining of relationships with Group suppliers, initiated in 2004, and with Fiat Auto dealers,

for a total of 187 million euros; costs of 141 million euros incurred by Fiat Auto, as a consequence of the rationalisation process

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 112