Chrysler 2006 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Report on Operations Fiat Auto62

Operating Performance

In 2006, the Western European automobile market expanded

slightly (+0.7%) from 2005.

Demand rose 3.7% in Italy and 3.8% in Germany, while it

contracted in the other principal countries: France by -3.3%,

Great Britain by -3.9%, and Spain by -2%.

Outside Western Europe, demand expanded slightly in

Poland (+1.5%). In contrast, the Brazilian market expanded

significantly,at a rate of 13.1%.

The commercial vehicle market performed well in Western

Europe (+5.6%) as compared with the previous year. Demand

rose by about 8% in Italy, over 10% in Germany, 4.8% in France,

and 5.9% in Spain, while remaining stable in Great Britain.

In 2006, the Sector performed very well in terms of market

share. In Italy,its share of the automobile market rose to

30.7%, or 2.7 percentage points higher than in 2005. In

Western Europe, its share reached 7.6%, up 1.1 percentage

points from 2005.

Fiat Auto’s share of the commercial vehicle market in Italy

was 47.1%, with an improvement of 4.7 percentage points. In

Western Europe, its share rose by 0.7 percentage points to 11%.

In Brazil, the Sector’sshare of the automobile and commercial

vehicle markets in 2006 reached 25.3% (for an increase of 0.9

percentage points) and 26.1% (-2.7 percentage points),

respectively.

In 2006, Fiat Auto delivered a total of 1,980,300 units, for an

increase of 16.7% from 2005. In Western Europe, 1,289,600

units were delivered, for an increase of 17.2%.

The positive sales performance during the year stemmed from

the growing success of new models that had been introduced

previously,first and foremost the Grande Punto and Panda, as

well as the other models that were introduced during the year

to enrich the product line of the three brands.

Deliveries increased sharply in almost all of the principal

European countries, with growth rates far outpacing the

market, as in Italy (+17.5% from 2005 deliveries) and Germany

(+21.3%), or realised in contracting markets, such as Great

Britain, where deliveries rose by 42.8%, and France (+10.9%).

Spain represented an exception, where a marginal slip

in deliveries (-1.0%) reflected weak demand.

enter new segments and technologies, enhance its know-how,

and access new markets.

The primary objective of these agreements was to reinforce

the Sector’s presence on two high-growth markets, Russia

and India.

The collaboration between Fiat Auto and the Russian car maker

Severstal Auto has evolved in a series of steps. At the

beginning of 2006, agreements were reached for the assembly

in Russia, starting in 2007, of Albea, Palio, and Doblò models

based on CKD produced by Tofas, as well as for the import and

distribution in Russia of Fiat cars and light commercial vehicles.

In March 2006, a letter of intent was signed to further develop

of the strategic partnership between Fiat and Severstal in all

industrial areas of the Fiat Group. An agreement was signed

in July for production and distribution of the Ducato in Russia

by Severstal. Production is planned to start in the last quarter

of 2007.

Cooperation with India was also intense. After reaching an

agreement in January 2006 for the sale of Fiat cars in India

through joint use of the sales network, Fiat and Tata Motors

signed a memorandum of understanding in July for industrial

collaboration; within this context, in December they signed an

agreement for the creation of a joint venture in India for the

production of cars, engines and transmissions. Fiat Auto will

introduce the Grande Punto and Fiat Linea. On the basis of a

joint analysis undertaken in July 2006, Fiat and Tata Motors

continued studies for industrial and commercial cooperation

in Latin America: these studies resulted in an agreement,

signed in February 2007, which calls for a Tata license to build

a pick-up vehicle in the Fiat Group Automobiles plant in

Cordoba, Argentina.

These important partnership agreements are complemented

by the license to produce diesel engines granted to Suzuki

in March 2006, the May 2006 agreement with PSA Peugeot

Citroën for production at the Fiat plant in Cordoba of a

transmission for the French customer,and the signing in

October of a memorandum of understanding with the

Chinese company Chery Automobiles for the supply of

gasoline engines to Fiat Auto.

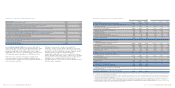

Report on Operations Fiat Auto 63

In Poland, volumes contracted by 2.3% from 2005.

Outside the European Union, in 2006 Fiat Auto intensified its

activities on those markets where its position is consolidated,

such as Brazil, Argentina, and Turkey. At the same time, it

pursued growth opportunities on other emerging markets

together with strong local partners.

In Brazil, the Sector delivered 464,800 cars and light

commercial vehicles. It increased its sales by 15% from 2005

and confirmed its leadership position on the market. This

excellent result is mainly attributable to the success of flex

versions (which run on both alcohol and gasoline) of the Palio

and Mille models, as well as the Fiat Idea, voted Carro Do Año

(Car of the Year) in Brazil.

Economic recovery continued in Argentina. The automobile

market expanded by 16.2% from 2005, and Fiat Auto reported a

market share of 10.8%, down slightly from 2005 (-1.6 percentage

points). Deliveries of automobiles and light commercial

vehicles decreased by 0.7%, to a total of 43,800 units.

In Turkey,the automotive industry slowed down in 2006,

together with the rest of the economy.The automobile and

light commercial vehicle market totalled approximately 621,000

units, down 13.6% from 2005. Tofas (a local joint venture in

which Fiat Auto has a 37.9% interest) reported a 9.1% decrease

in deliveries. However,its aggregate market share was 11.8%,

up 0.6 percentage points from the previous year. This

improvement was driven by the New Doblò, New Palio,

and Albea.

In regard to light commercial vehicles only, a total of 323,500

units were delivered in 2006, for an increase of 13.4% from

2005. This was largely attributable to the New Ducato, which

enjoyed great success following its introduction at the end of

May 2006, and the New Doblò. In Western Europe, deliveries

totalled 211,900 units (+16.5%). With the exception of

Germany, where deliveries fell by 1.9%, the other European

countries reported an increase in the number of units

delivered: France +40.1%, Italy +24.4%, Great Britain +10.7%,

Spain +2.9%.

During 2006, the Sector continued its strategy of targeted

alliances to reinforce its position on international markets,

Fiat Auto –Fiat, Alfa Romeo, Lancia

and Fiat Light Commercial Vehicles

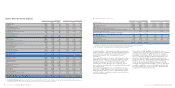

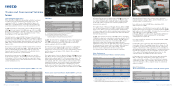

Highlights

(in millions of euros) 2006 2005

Net revenues 23,702 19,533

Trading profit 291 (281)

Operating result (*) 727 (818)

Investments in tangible and intangible assets 2,163 1,582

-of which capitalised R&D costs 434 310

Total R&D expenses (**) 675 665

Automobiles and light commercial

vehicles delivered (number) 1,980,300 1,697,300

Employees at year-end (number) 44,691 46,099

(*) Including restructuring costs and unusual income (expenses).

(**) Including R&D capitalised and charged to operations.

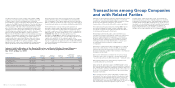

Automobile Market

(in thousands of units) 2006 2005 % change

-France 2,000.5 2,067.8 -3.3

-Germany 3,468.0 3,342.1 3.8

-Great Britain 2,344.9 2,439.7 -3.9

-Italy 2,321.1 2,237.4 3.7

-Spain 1,499.0 1,528.9 -2.0

Western Europe 14,624.2 14,529.8 0.7

Poland 239.0 235.5 1.5

Brazil 1,599.9 1,414.8 13.1

Sales Performance

Automobiles and Light Commercial Vehicles

(in thousands of units) 2006 2005 % change

-France 88.0 79.3 10.9

-Germany 110.1 90.8 21.3

-Great Britain 76.1 53.3 42.8

-Italy 808.2 687.7 17.5

-Spain 69.6 70.3 -1.0

-Rest of Western Europe 137.6 118.5 16.0

Western Europe 1,289.6 1,099.9 17.2

Poland 33.0 33.8 -2.3

Brazil 464.8 404.3 15.0

Rest of the World 192.9 159.3 21.2

Total sales 1,980.3 1,697.3 16.7

Associated companies 89.9 107.3 -16.2

Grand total 2,070.2 1,804.6 14.7