Chrysler 2006 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

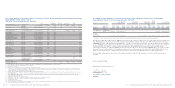

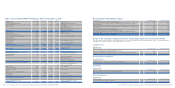

Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements 293Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements292

Financial flows from relations with related parties are not presented in a specific table as these also regard almost entirely

the transactions with directly or indirectly held subsidiaries discussed earlier.

Transactions with related parties as defined by IAS 24 which did not involve directly or indirectly held subsidiaries were as follows:

■professional and advisory services and services as the secretary of the Board of Directors and of the Committees were provided

to Fiat S.p.A. by Franzo Grande Stevens for fees of 1,136 thousand euros;

■directors’ fees of 77 thousand euros and 48 thousand euros were recharged to Istituto Finanziario Industriale S.p.A. and IFIL

Investments S.p.A. respectively;

■Ferrari S.p.A. increased its capital stock in 2006 by issuing a total of 104,000 new shares at a price of 175 euros each, following

the exercising by the company’s chairman, Luca Cordero di Montezemolo, of the same number of stock options. Notice of this

decision was provided in advance to the Board of Fiat S.p.A. at its meeting on 28 February and the options were effectively

exercised on 12 May for 88,400 options and on 8 June for the remaining 15,600 options. Fiat S.p.A. purchased a total of 93,600

shares from Mr.Montezemolo at a price of 285 euros each, which was the same price as that the one agreed upon between

Mediobanca S.p.A. and Mubadala Development Company on the occasion of the recent sale. The total investment amounted

to 26,713 thousand euros.

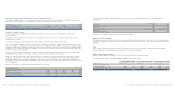

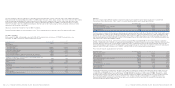

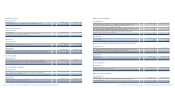

31. Net financial position

Pursuant to the Consob Communication of July 28, 2006 and in compliance with the CESR’srecommendations for the consistent

implementation of the European Commission’s Regulation on Prospectuses issued on February 10, 2005, the net financial position

of Fiat S.p.A. at December 31, 2006 is as follows:

(in thousands of euros) At 31 December 2006 At 31 December 2005 Change

Cash and cash equivalents 608 495 113

Current financial receivables: 84,173 3,075,894 (2,991,721)

- from Group companies 84,173 3,075,894 (2,991,721)

- from Third parties –––

Non-current financial payables: (2,810,029) (5,262) (2,804,767)

- due to Group companies (2,810,029) (5,262) (2,804,767)

- due to Third parties –––

Current financial payables: (1,627,430) (557,383) (1,070,047)

- due to Group companies (1,405,554) (434) (1,405,120)

- due to Third parties (221,876) (556,949) 335,073

Net financial position (4,352,678) 2,513,744 (6,866,422)

- due to Group companies (4,131,410) 3,070,198 (7,201,608)

- due to Third parties (221,268) (556,454) 335,186

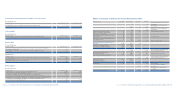

Details of the more significant transactions between Fiat S.p.A. and Group companies summarised in the above table

are as follows:

■granting of a licence to use the Fiat trademark to Fiat Auto S.p.A. and Fiat Automoveis S.A.– FIASA for a consideration calculated

as a percentage of turnover;

■services provided by executives of Fiat S.p.A. to the main Group companies (Fiat Auto S.p.A., Comau S.p.A., Business Solutions

S.p.A., Iveco S.p.A., Teksid S.p.A., Magneti Marelli Holding S.p.A., Fiat Powertrain Technologies S.p.A. and other minor);

■lease of property to Ingest Facility S.p.A. and Fiat Information & Communication Services S.c.p.A. and the recovery of directors’

fees and expenses;

■provision of sureties and personal guarantees (see Note 28) on the issues of bonds and Billets de Trésorerie (mainly Fiat Finance

and Trade Ltd.), bank loans (Fiat Automoveis S.A., Fiat Finance S.p.A. and other minor), property rental payments (Fiat Auto S.p.A.

and its subsidiaries) and credit facilities guaranteed or made available (CNH Global N.V.);

■management of current accounts, granting of loans, obtaining of short- and medium-term loans and financial assistance

(Fiat Finance S.p.A.);

■management of derivative financial instruments (Intermap - Nederland B.V.and Fiat Finance S.p.A., see Notes 17 and 26);

■purchases of administrative, tax and corporate assistance and consultancy services (Fiat Gesco S.p.A., Servizio Titoli S.p.A.

and KeyG Consulting S.p.A.), public relations services (Fiat Information & Communications Services S.c.p.A.), office space services,

maintenance and real estate services (Ingest Facility S.p.A. and Fiat Partecipazioni S.p.A.), personnel and other management

services (Fiat Servizi per l’Industria S.c.p.A.), ICT services (eSPIN S.p.A.), security services (Orione S.c.p.A and Sirio S.c.p.A.),

sponsorship, advertising and promotional activities (Ferrari S.p.A. and Fiat France S.A.) and supervisory and internal audit services

(Fiat Revisione Interna S.c.r.l.);

■contributions to expenses for activities supporting the trademark and image of the Group (Fiat Auto S.p.A.).

Intercompany transactions in 2006 also include the management of investments which entailed the following:

■collection of dividends from subsidiaries (see Note 1);

■subscription of capital increases of directly held subsidiaries (see Note 13);

■acquisition of 60.56% of the capital of Iveco S.p.A. from Fiat Netherlands Holding N.V., as reported in Note 13;

■as part of the corporate restructuring of the consortium companies of the Group, Fiat S.p.A., acquisition of the direct control

of Fiat Revi S.c.p.A. by purchasing the investments previously held by Fiat Partecipazioni S.p.A. and Fiat Auto S.p.A. In addition,

Fiat S.p.A. sold its minority interest in Fiat Sepin S.c.p.A. to Fiat Partecipazioni S.p.A.