Chrysler 2006 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

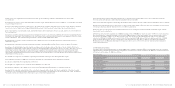

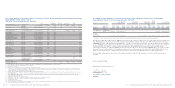

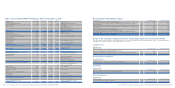

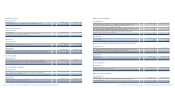

Adjustments

(in millions of euros) 2005

Write-off of deferred costs (excluding the financial expenses costs regarding the “Mandatory Convertible Facility”) C(15)

Recognition and measurement of financial liabilities (the “Mandatory Convertible Facility”) G(8)

Other adjustments (1)

(24)

Income (expenses) from significant non-recurring transactions

Reclassifications

(in millions of euros) 2005

from “Extraordinary income” for changes in the format of the Income Statement 1,135

from “Extraordinary expenses” for changes in the format of the Income Statement (2)

1,133

Financial income (expenses)

Reclassifications

(in millions of euros) 2005

from “Interest and other financial expenses” for changes in the format of the Income Statement (169)

(169)

Adjustments

(in millions of euros) 2005

Measurement of derivative financial instruments E8

Employee benefits B(1)

Recognition and measurement of financial liabilities (the “Mandatory Convertible Facility”) G(13)

Other adjustments (1)

(7)

Financial income from significant non-recurring transactions

Adjustments

(in millions of euros) 2005

Recognition of unusual income from the conversion of the “Mandatory Convertible Facility” H858

858

equivalents, whereas previously it also included current

financial receivables. There are no substantial changes in the

presentation of the various cash flows other than the effect on

cash flows from (used in) financing activities as a result of the

matter just described.

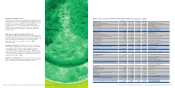

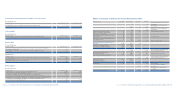

A. Measurement of work in progress using

the percentage of completion method

As permitted by Italian accounting principles Fiat S.p.A.

previously measured work in progress on long-term

construction-type contracts (being the contracts entered into

by Fiat S.p.A. as general contractor with Treno Alta Velocità –

T.A.V.S.p.A.)at cost of production. Contract revenue,

therefore, was recognised when the work was delivered to

the customer and finally accepted, in this way deferring the

recognition of the margin to the completion of the contract.

Amounts received from the customer during contract activity

were considered as financial advances and recognised as a

liability under the item “Advances”, while amounts paid to

subcontractors as advances were recognised in assets as

inventory.

IAS 11 – Construction Contracts requires construction contracts

to be measured by reference to the stage of completion of the

contract, applied as a percentage to the sales price, in this way

recognising margins in relation to contract activity carried out

over the periods concerned. In addition, the legal aspects of

the means and timing by which the transfer of title is passed

are not relevant and accordingly progress payments received

for work performed on a contract are deducted from the

carrying amount of inventory for presentational purposes.

If the amount of progress payments received is greater than

that of inventory,the difference is presented as a liability

(item “Other payables) for “advances”.

The adoption of IAS 11 has therefore led to an increase in

stockholders’ equity at January 1, 2005, arising from the

cumulative margins on contracts in progress at the transition

date, and to an increase in the net result for 2005 deriving

from margins earned and recognised on contracts in progress

during the year.

Appendix Transition of the Parent Company Fiat S.p.A. to International Financial Reporting Standards (IFRS) 313Appendix Transition of the Parent Company Fiat S.p.A. to International Financial Reporting Standards (IFRS)312

Description of the principal reconciling items

between Italian accounting principles and IFRS

The following paragraphs provide a description of the main

differences between Italian accounting principles and IFRS that

have had an effect on the financial statements of Fiat S.p.A.

In this respect the following clarifications are provided:

■the differences are presented before any tax effect;

■net deferred tax liabilities emerge from these differences;

the effect of these is set off by reducing the deferred tax assets

previously recognised in the Balance Sheet prepared in

accordance with Italian accounting principles.

Given the activities carried out by Fiat S.p.A. it is important

to note that IAS 27 – Consolidated and Separate Financial

Statements requires investments in subsidiaries to be measured

at cost or, alternatively, at fair value in accordance with IAS 39.

Fiat S.p.A. has adopted the cost method and as a result if there

are indications that the recoverability of cost, wholly or partially,

is in doubt, the carrying amount is reduced to the recoverable

amount in accordance with IAS 36 – Impairment of Assets.If,

subsequently, an impairment loss no longer exists or is

decreased, the carrying amount, which in any event cannot

exceed original cost, is increased to the new estimate of the

recoverable amount. This reversal of an impairment loss is

recognised immediately in the Income Statement.

In accordance with Italian accounting principles Fiat S.p.A.

formerly measured its investments in subsidiaries at cost

adjusted for permanent losses in value. Taking into account

the means by which investments were either established or

acquired and their subsequent performance, any write-downs

and reinstatements of value recognised in the financial

statements prepared in accordance with Italian accounting

principles are considered to be in line with the recognition

and measurement requirements of IFRS.

The principal difference with the previous set of accounting

principles arising on the adoption of IFRS and regarding the

presentation of the statement of cash flows is the different

composition of the item whose changes are being discussed.

Under IAS 7, this item consists only of cash and cash