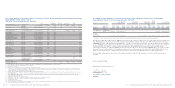

Chrysler 2006 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the Balance Sheet date. The adoption of IAS 39, therefore, led

to an increase in stockholders’ equity at both January 1, 2005

and December 31, 2005.

G. Recognition and measurement of financial liabilities

(the “Mandatory Convertible Facility”)

Financial liabilities at January 1, 2005 relate principally to the

“Mandatory Convertible Facility” which was measured in the

financial statements of Fiat S.p.A. prepared in accordance with

Italian accounting principles at the amounts received from the

lending banks. The various commissions due to the banks (for

financial arrangement, underwriting commitments, etc.) and paid

at agreed contractual dates (on inception, over the term and on

repayment) were recognised in the Income Statement on a

straight-line basis over the term of the loan (pro-rata temporis).

Under IAS 39 – Financial Instruments: Recognition and

Measurement,financial liabilities must initially be recognised at

fair value (being the amounts received from the banks), net of the

related transaction costs, and must subsequently be measured at

amortised cost using the effective interest method. The adoption

of IAS 39, therefore, led to the requirement to recompute expense

over the various years with a resulting net increase in

stockholders’ equity at January 1, 2005. This effect reversed on

the extinguishment of the Mandatory Convertible Facility in 2005

leading to a decrease in the 2005 net result.

H. Recognition of financial income from the conversion

of the “Mandatory Convertible Facility”

The Mandatory Convertible Facility Agreement provided for

either reimbursement by cash (which was possible only under

certain conditions, which were not actually satisfied at the date

Appendix Transition of the Parent Company Fiat S.p.A. to International Financial Reporting Standards (IFRS)316

that the agreement was terminated) or the mandatory

conversion of the facility into shares (at a contractually agreed

variable price, depending on the performance of the Fiat share

on the stock exchange), underwritten by the lending banks and

subsequently offered in option to stockholders. In the financial

statements of Fiat S.p.A. prepared in accordance with Italian

accounting principles, the conversion of the facility led to a

decrease of the debt and an increase in capital stock and

additional paid-in capital by an amount of 10.28 euros per

share, being the subscription price of the new shares, with

no effect on the Income Statement.

In the financial statements of Fiat S.p.A. prepared in

accordance with IFRS, the Mandatory Convertible Facility

should have been considered a financial liability with a

conversion feature that is considered to be an embedded

derivative and that should be separated from the debt

instrument at inception, with any subsequent changes in

fair value recognised in the Income Statement. Due to the

significant uncertainty as to whether gains on the

remeasurement to fair value of the embedded derivative would

actually have been realised, however,the fair value adjustment

has not been recognised over the life of the instrument.

Financial income from significant non-recurring transactions of

858 million euros was then recognised for IFRS purposes when

the uncertainty surrounding the ability to convert and realise

the gains was resolved, and namely at the time that the actual

conversion took place. This gain corresponds to the difference

between the subscription price of 10.28 euros per share and

the market value of 7.337 euros per share at the subscription

date, net of issuance costs.

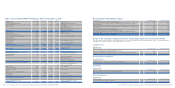

This different accounting treatment has no effect on

stockholders’ equity.

Under IAS 39 – Financial Instruments: Recognition and

Measurement,the derecognition of financial assets is

permitted if and only if the risks and rewards of ownership

of the assets have been substantially transferred: as a result,

all receivables sold with recourse and a part of receivables

sold without recourse (in particular receivables from the tax

authorities) have been reinstated in the Balance Sheet.

M. Recognition of financial guarantee contracts

Under Italian accounting principles guarantees granted were

recognised in the memorandum accounts and only the

commissions received and any risk provisions were

recognised in the financial statements; risk provisions were

measured on the basis of the best estimate of the cost

required to fulfill the obligation existing at the Balance Sheet

date in the event of risks regarding the solvency of the

guaranteed entity.

Under IFRS (and with particular regard to IAS 39 as amended),

guarantees given are initially measured at fair value, adjusted

for any directly attributable transaction costs.

On first-time adoption of IFRS, Fiat S.p.A. accordingly

recognised the present value of the commissions receivable

for guarantees granted in non-current financial assets and

recognised the fair value of the contractual liabilities in non-

current debt, as there were no specific risk situations requiring

provisions to be recognised in accordance with IAS 37 –

Provisions, Contingent Liabilities and Contingent Assets.In

particular, since the guarantees given by Fiat S.p.A. (regarding

financial liabilities of other Fiat Group companies) are granted

at market conditions and generate commissions, it has been

concluded that the current value of the commissions which

were to be received represented the best estimate of the fair

value of the guarantees granted. As these amounts were the

same there was no effect on stockholders’ equity nor on the

result for the year ended December 31, 2005.

Appendix Transition of the Parent Company Fiat S.p.A. to International Financial Reporting Standards (IFRS) 317

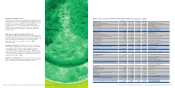

I. Stock options

No obligation or cost was recognised for stock-based

compensation under Italian accounting principles.

IFRS 2 – Share-based Payment requires the total fair value

of stock options at the grant date to be recognised in the

Income Statement on a straight-line basis from the grant

date to the vesting date, with the offsetting credit recognised

directly in equity. Changes in fair value after the grant date

do not have any effect on the initial measurement.

In accordance with the transitional provisions of IFRS 2, Fiat

S.p.A. has applied the Standard to all stock options granted

after November 7, 2002 which had not yet vested by January 1,

2005, the effective date of the Standard; as a consequence

no cost has been recognised for stock-based compensation

granted prior to that date.

There was no effect on stockholders’ equity at January 1, 2005

from the application of IFRS 2, while there was a decrease in

the net result for 2005.

L. Sales of receivables

Fiat S.p.A. sells a significant part of its receivables through

factoring transactions.

Factoring transactions may be either with or without recourse

to the seller; certain factoring agreements without recourse

contain deferred price clauses (payment of a minority portion

of the purchase price is conditional upon the full collection of

the receivable), require a first loss guarantee of the seller up

to a limited amount or imply a continuing significant exposure

to the receivables cash flows.

Under Italian accounting principles all the receivables sold

under factoring transactions (both with or without recourse)

were derecognised.