Chrysler 2006 Annual Report Download - page 53

Download and view the complete annual report

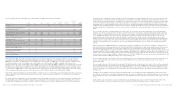

Please find page 53 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 103

recognised in the consolidated financial statements or that

have a significant risk of causing a material adjustment to

the carrying amounts of assets and liabilities within the next

financial year.

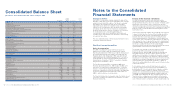

Allowance for doubtful accounts

The allowance for doubtful accounts reflects management

estimate of losses inherent in wholesale and retail credit

portfolio. The Group reserves for the expected credit losses

based on past experience with similar receivables, current and

historical past due amounts, dealer termination rates, write-offs

and collections, the careful monitoring of portfolio credit quality

and current and projected economic and market conditions.

Recoverability of non-current assets (including goodwill)

Non-current assets include property, plant and equipment,

investment property, intangible assets (including goodwill),

investments and other financial assets. Management reviews

the carrying value of non-current assets held and used and that

of assets to be disposed of when events and circumstances

warrant such a review. Management performs this review

using estimates of future cash flows from the use or disposal

of the asset and suitable discount rate in order to calculate

present value. If the carrying amount of a non-current asset is

considered impaired, the Group records an impairment charge

for the amount by which the carrying amount of the asset

exceeds its estimated recoverable amount from use or disposal

determined by reference to its most recent corporate plans.

Residual values of assets leased out under operating

lease arrangements or sold with a buy-back

commitment

The Group reports assets rented or leased to customers under

operating leases as tangible assets. Furthermore, new vehicle

“sales” with a buy-back commitment are not recognised as

sales at the time of delivery but are accounted for as operating

leases if it is probable that the vehicle will be bought back. The

Group recognises income from such operating leases over the

term of the lease. Depreciation expense for assets subject to

operating leases is recognised on a straight-line basis over the

term of the lease in amounts necessary to reduce the cost of

the assets to its estimated residual value at the end of the

lease term. The estimated residual value of the leased assets is

charges for risk provisions and write-downs, are reported

in cost of sales.

Research and development costs

This item includes research costs, development costs not

eligible for capitalisation and the amortisation of development

costs recognised as assets in accordance with IAS 38 (see

Notes 4 and 13).

Government grants

Government grants are recognised in the financial statements

when there is reasonable assurance that the Group company

concerned will comply with the conditions for receiving

such grants and that the grants themselves will be received.

Government grants are recognised as income over the periods

necessary to match them with the related costs which they are

intended to compensate.

Taxes

Income taxes include all taxes based upon the taxable profits

of the Group. Taxes on income are recognised in the income

statement except to the extent that they relate to items directly

charged or credited to equity, in which case the related income

tax effect is recognised in equity. Provisions for income taxes

that could arise on the distribution of a subsidiary’s

undistributed profits are only made where there is a current

intention to distribute such profits. Other taxes not based on

income, such as property taxes and capital taxes, are included

in operating expenses. Deferred taxes are provided using the

full liability method. They are calculated on all temporary

differences between the tax base of an asset or liability and the

carrying values in the consolidated financial statements, except

for those arising from non tax-deductible goodwill and for

those related to investments in subsidiaries where their

reversal will not take place in the foreseeable future. Deferred

tax assets relating to the carry-forward of unused tax losses

and tax credits, as well as those arising from temporary

differences, are recognised to the extent that it is probable

that future profits will be available against which they can be

utilised. Current and deferred income tax assets and liabilities

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 102

are offset when the income taxes are levied by the same

taxation authority and where there is a legally enforceable

right of offset. Deferred tax assets and liabilities are measured

at the substantively enacted tax rates in the respective

jurisdictions in which the Group operates that are expected

to apply to taxable income in the periods in which temporary

differences will be reversed.

Dividends

Dividends payable are reported as a movement in equity

in the period in which they are approved by stockholders.

Earnings per share

Basic earnings per share are calculated by dividing the Group’s

net profit attributable to the various classes of shares by the

weighted average number of shares outstanding during the

year.For diluted earnings per share, the weighted average

number of shares outstanding is adjusted assuming conversion

of all dilutive potential shares. Group net result is also

adjusted to reflect the net after-tax impact of conversion.

Use of estimates

The preparation of financial statements and related disclosures

that conform to IFRS requires management to make

judgements, estimates and assumptions that affect the

reported amounts of assets and liabilities and the disclosure

of contingent assets and liabilities at the date of the financial

statements. The estimates and associated assumptions are

based on historical experience and other factors that are

considered to be relevant. Actual results could differ from

those estimates. Estimates and assumptions are reviewed

periodically and the effects of any changes are recognised

in the period in which the estimate is revised if the revision

affects only that period, or in the period of the revision and

future periods if the revision affects both current and future

periods.

The following are the critical judgements and the key

assumptions concerning the future, that management has

made in the process of applying the Group accounting policies

and that have the most significant effect on the amounts

calculated at the lease inception date on the basis of published

industry information and historical experience.

Realisation of the residual values is dependent on the Group’s

future ability to market the assets under the then-prevailing

market conditions. The Group continually evaluates whether

events and circumstances have occurred which impact the

estimated residual values of the assets on operating leases.

Sales allowance

At the later time of sale or the time an incentive is announced

to dealers, the Fiat Group records the estimated impact of

sales allowances in the form of dealer and customer incentives

as a reduction of revenue. There may be numerous types of

incentives available at any particular time. The determination

of sales allowances requires management estimates based on

different factors.

Product warranties

The Group makes provisions for estimated expenses related to

product warranties at the time products are sold. Management

establishes these estimates based on historical information on

the nature, frequency and average cost of warranty claims. The

Group seeks to improve vehicle quality and minimise warranty

claims, but it has also extended contractual warranty periods

for certain classes of vehicles.

Pension and other post-retirement benefits

Group companies sponsor pension and other post-retirement

benefits in various countries. In the US, the United Kingdom,

Germany and Italy, the Group has major defined benefit plans.

Management uses several statistical and judgmental factors

that attempt to anticipate future events in calculating the

expense, the liability and the assets related to these plans.

These factors include assumptions about the discount rate,

expected return on plan assets, rate of future compensation

increases and health care cost trend rates. In addition, the

Group’sactuarial consultants also use subjective factors such

as withdrawal and mortality rates in making relevant

estimates.

Realisation of deferred tax assets arising from tax

loss carryforwards

As of December 31, 2006, the Group had gross deferred tax

assets arising from tax loss carryforwards of 5,701 million