Chrysler 2006 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements 271Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements270

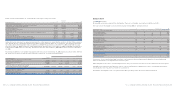

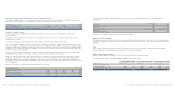

Legal reserve

This reserve amounts to 446,562 thousand euros at year end, unchanged with respect to December 31, 2005 since net income

is firstly used to cover accumulated losses.

Reserve for treasury stock in portfolio

This reserve totals 24,139 thousand euros at December 31, 2006, a decrease of 3,571 thousand euros over December 31, 2005,

following the disposal of treasury stock during the year; as a result, the legal obligation of article 2357-ter of the Italian Civil

Code is no longer applicable.

The amount of this reserve at December 31, 2006 corresponds to that approved by the Stockholders Meeting of May 11, 2004

in proportion to treasury stock still owned by the company.

Extraordinary reserve

At December 31, 2006, the extraordinary reserve totals 6,135 thousand euros, with an increase of 5,800 thousand euros from

the previous year due to the amounts received upon sale of treasury stock.

Retained earnings (losses)

Losses carried forward total 553,412 thousand euros at year end, a decrease of 258,325 thousand euros, due to the portion of

2005 profit not allocated to specific reserves. There were retained losses of 949,100 thousand euros at December 31, 2005 in

the financial statements prepared in accordance with Italian accounting principles; these losses were reduced to 726,081 thousand

euros following the allocation of 2005 profits by Stockholders Meeting held on May 3, 2006. The difference of 172,669 thousand

euros with respect to the balance of 553,412 thousand euros stated above is due to the adjustments made on transition to IFRS

(on both stockholders’ equity at January 1, 2005 and the 2005 results) which were classified as retained earnings under IFRS and

therefore attributable to retained earnings (losses).

Treasury stock

Treasury stock held by Fiat S.p.A. amounts to 24,139 thousand euros at year end and relates to 3,773,458 ordinary shares with

a unit carrying amount of 6.397 euros generally servicing the stock option plans granted to employees up to September 12, 2002.

The 3,571 thousand euros decrease over the previous year is due to the disposal of 558,250 shares following the exercise during

the year of a number of options granted in September 2002.

Gains (losses) recognised directly in equity

At December 31, 2006, net gains recognised directly in equity total 162,764 thousand euros, with a rise of 28,497 thousand euros

over the previous year.

The reserve includes gains and losses recognised directly in equity arising from the fair value adjustment of investments in other

companies (Mediobanca S.p.A. and Assicurazioni Generali S.p.A.) as described previously (see Note 13).

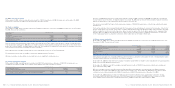

Regarding changes in 2005, the Mandatory Convertible Facility was extinguished by its conversion to capital stock through subscription

by the Lending Banks to an increase in capital stock for consideration, as approved by the Board of Directors on September 15, 2005;

the operation took place on September 20, 2005. Capital stock increased in this manner from 4,918,113,540 euros to 6,377,257,130 euros,

through the issuance of 291,828,718 ordinary shares, each with a par value of 5 euros, having the same characteristics as those currently

in circulation, including dividend rights from January 1, 2005, pursuant to article 2441, paragraph 7 of the Italian civil code, at a price of

10.28 euros, of which 5.28 euros represents share premium. The operation increased capital stock by 1,459,144 thousand euros,

additional paid-in capital by 681,856 thousand euros, and generated non-recurring financial income of 857,636 million euros, net of

related costs (see Note 9).

Regarding 2006, treasury stock was sold when the stock options were exercised.

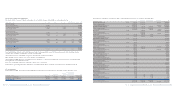

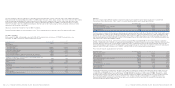

The following are significant matters with respect to the capital stock of Fiat S.p.A.:

■Pursuant to resolutions approved by the Board of Directors on December 10, 2001 and June 26, 2003, capital could have been

increased through rights offerings up to a maximum of 81,886,460 euros by the issue of up to 16,377,292 ordinary shares at a par value

of 5 euros each on February 1, 2007, following the exercise of the “FIATordinary share warrants 2007”. Fiat had reserved the right to

pay the warrant holders in cash, starting on January 2, 2007, in lieu of the shares to be issued (shares in exchange for warrants), for

the difference between the average of the official market price of Fiat ordinary shares in December 2006 and the warrant exercise price,

unless this difference exceeds the maximum amount set and previously communicated by Fiat S.p.A., in which case the holder of the

warrants could nevertheless have opted to subscribe to the shares in exchange for the warrants. Following exercise of 4,676 “FIAT

ordinary share warrants 2007”, on February 1, 2007 a total of 1,169 shares were issued for a consideration of 34,326.51 euros. The

remaining warrants have expired and have accordingly been cancelled.

■Pursuant to the resolution approved by stockholders in their extraordinary meeting of September 12, 2002, the Board of Directors

has the right to increase the capital one or more times by September 11, 2007, up to a maximum of 8 billion euros.

■At its meeting of November 3, 2006, the Board exercised its delegated powers pursuant to Article 2443 of the Italian Civil Code for the

capital increase to service the incentive plan. The capital increase is reserved to employees of the company and/or subsidiaries within a

limit of 1% of the capital stock, i.e. for a maximum of 50,000,000 euros through the issuance of a maximum of 10,000,000 ordinary shares

with a par value of 5 euros each, corresponding to 0.78% of the capital stock and 0.92% of the ordinary capital, at a price of 13.37 euros

per share, to service the new stock option plan for employees, described in the following paragraph. Execution of this capital increase is

subject to the approval by the Stockholders Meeting of the incentive plan and is dependant on the conditions of the plan being satisfied.

Additional paid-in capital

At December 31, 2006, additional paid-in capital amounts to 1,540,856 thousand euros. The 859,000 thousand euros increase is due

to the allocation thereto of the portion of 2005 profit relating to the non-recurring financial income recognised in the Income Statement

under IFRS. Such income arose in connection with the 2005 capital increase as a result of the extinguishment of the Mandatory

Convertible Facility and its conversion to capital stock. As described in Note 9, the amount is the difference between the subscription

price of 10.28 euros per share and the market value of 7.337 euros per share at the subscription date. However, the recognition of such

amount as income does not affect its substantial nature of share premium and it should be treated as such pursuant to article 2431 of the

Italian Civil Code. Therefore, the portion of 2005 profit recognised under IFRS and relating to such share premium has been recorded as

an increase in the additional paid-in capital that had already been recognised in connection with the above-mentioned capital increase.

Reserve under Law no. 413/1991

This reserve amounts to 22,591 thousand euros at year end, unchanged with respect to December 31, 2005. It reflects the mandatory

revaluation of property (net of the related substitute reserve) made pursuant to Law no. 413 of December 30, 1991, taken to this

specific reserve in accordance with that law.