Chrysler 2006 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial statement format

Fiat S.p.A. has adopted the current/non-current distinction for

the presentation of assets and liabilities in its Balance Sheet,

leading to the need to reclassify the previous Balance Sheets

presented in accordance with the formats required by

Legislative Decree no. 127 of April 9, 1991 and subsequent

modifications; the presentation of the Income Statement

remains unchanged, with expenses classified on the basis

of their nature.

Optional exemptions elected by Fiat S.p.A

In accordance with the optional exemption granted by IFRS 1,

Fiat S.p.A. has elected to measure its assets and liabilities at

January 1, 2005, the transition date, at the same amounts used

in the preparation of the Group’s consolidated financial

statements for the year ended December 31, 2004.

In further detail:

■Employee benefits:the Fiat Group elected to recognise

all cumulative actuarial gains and losses at January 1, 2004

on transition to IFRS, even though it decided to use the

“corridor approach” for later actuarial gains and losses.

This exemption was applied from January 1, 2004, the date

of first-time adoption of IFRS by the Fiat Group. There would

not have been material differences if this had instead been

applied from January 1, 2005.

■Business combinations:Fiat S.p.A. has elected not to apply

IFRS 3 – Business Combinations to business combinations

that occurred before the date of transition to IFRS.

Appendix Transition of the Parent Company Fiat S.p.A. to International Financial Reporting Standards (IFRS) 303302

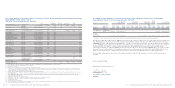

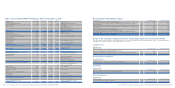

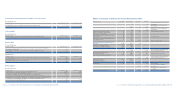

Effects of transition to IFRS on the Balance Sheet at January 1, 2005

(in millions of euros) Italian GAAP Reclassifications Adjustments IAS/IFRS

Intangible assets 50 – (50) – Intangible assets

Property, plant and equipment 43 (1) – 42 Property, plant and equipment

Equity investments 5,249 – 75 5,324 Investments

Other securities – – 7 7 Other financial assets

277 – 277 Deferred tax assets

2 – 2 Other non-current assets

Total fixed assets 5,342 278 32 5,652 Total Non-current assets

Inventories 7,145 (7,321) 176 – Inventories

Trade receivables 351 6 – 357 Trade receivables

Receivables from subsidiaries 25 (25) –

Financial receivables from subsidiaries 2,321 2 – 2,323 Current financial receivables

Taxes receivable 289 (289) –

Deferred tax assets 277 (277) –

Other receivables 33 312 359 704 Other current receivables

Treasury stock 26 – (26)

Cash on hand – – – – Cash and cash equivalents

Total current assets 10,467 (7,592) 509 3,384 Total Current Assets

Accrued income and prepaid expenses 7 (7) –

–––Assets held for sale

TOTAL ASSETS 15,816 (7,321) 541 9,036 TOTAL ASSETS

Total stockholders’ equity 4,466 – 190 4,656 Total stockholders’ equity

Provisions for termination indemnities Provisions for employee

and similar obligations 19 36 (3) 52 benefits and other non-current provisions

Other provisions 30 (30) –

– – – Deferred tax liabilities

–7 7 Non-current debt

13 –13 Other non-current liabilities

Total provisions for risks and charges 49 19 4 72 Total Non-current liabilities

Provision for employee severance indemnities 12 (12) –

Provisions for employees and

6–6 other current provisions

Trade payables 502 11 – 513 Trade payables

Payable to subsidiaries 223 (223) –

Borrowings from banks 3,060 137 347 3,544 Current debt

Advances 7,336 (7,336) –

Payables to social security authorities 3(3) –

Other payables 26 219 –245 Other payables

Taxes payable 9 (9) –

Total payables 11,159 (7,198) 347 4,308 Total Current Liabilities

Accrued expenses and deferred income 130 (130) –

––– Liabilities held for sale

TOTAL STOCKHOLDERS’ EQUITY AND LIABILITIES 15,816 (7,321) 541 9,036 TOTAL STOCKHOLDERS’

EQUITY AND LIABILITIES

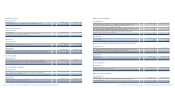

Appendix Transition of the Parent Company Fiat S.p.A. to International Financial Reporting Standards (IFRS)