Chrysler 2006 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

IFIL

Investments S.p.A. 30.40%

Unicredito

Italiano 5.71%

FMR Corp. 5.05%

Generali

Group 2.21%

Institutional

Investors EU 21.97%

Institutional Investors

outside EU 7.76%

Other

stockholders 26.90%

6

16

14

12

10

8

5

15

13

11

9

7

6

16

14

12

10

8

1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7 8 9 10 11 12

600

500

400

300

200

100

0

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Fiat Ordinary Fiat Preference Fiat Savings

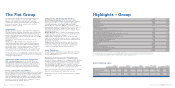

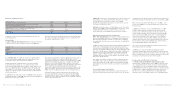

Official price per share:

(in euros) 12.29.06 12.30.05 12.30.04 12.30.03 12.30.02 12.28.01

Ordinary shares 14.468 7.333 5.897 6.142 7.704 17.921

Preference shares 12.119 5.935 3.976 3.704 4.348 12.267

Savings shares 13.880 6.558 4.243 3.957 4.183 11.459

Minimum and maximum monthly price in 2006

(in euros)

Fiat Ordinary Fiat Preference Fiat Savings

Report on Operations Stockholders 15

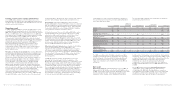

Major Stockholders

Atotal of 1,092,247,485 ordinary shares are outstanding. As of

today, the following individual and institutional investors have

holdings exceeding 2% of total outstanding ordinary stock.

Ordinary shares: 1,092,247,485

IFIL Investments S.p.A. (*) 30.40%

Unicredito Italiano 5.71%

FMR Corp. 5.05%

Generali Group 2.21%

Institutional Investors European Union 21.97%

Institutional Investors outside European Union 7.76%

Other stockholders 26.90%

(*) Including 0.34% of treasury stock held by Fiat S.p.A.

Highlights per share

(in euros) 2006 2005

Basic earnings per share (ordinary and preference) 0.789 1.250

Basic earnings per savings share 1.564 1.250

Diluted earnings per share (ordinary and preference) 0.788 1.250

Diluted earnings per savings share 1.563 1.250

Report on Operations Stockholders14

Financial communication

Fiat maintains a constant dialogue with its Stockholders

and Institutional Investors, pursuing a policy of open

communication with them through its Investor Relations

function. Over the course of the year, the Investor Relations

function organises presentations, live or through conference

calls, after the regular publication of Group results or other

events requiring direct communications with the market.

Moreover, the programme includes several seminars that

provide a more in-depth understanding of the operating

performance and strategies of the principal Group Sectors,

as well as meetings and roadshows that permit a direct

relationship between the financial community and the Group’s

top management. The most important meeting of 2006 was

the Fiat Investor and Analyst Meeting held on November 8

and 9 in Turin at the Lingotto. At the meeting, Fiat’s Chief

Executive Officer and the top management of all Sectors

illustrated the Group’s2007-2010 plan to an audience

of analysts and investors.

More information is available at the Group’s institutional

website www.fiatgroup.com. The Investor Relations section

provides historical financial data, institutional presentations,

periodic publications, and real time updates on Fiat stock.

Fiat stockholders may also contact:

For holders of Fiat shares:

Toll-free telephone number in Italy:

800-804027

E-mails:

investor[email protected]

Average monthly trading volume

(in millions of shares)

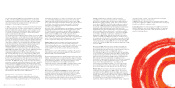

Performance of Fiat stock with respect to MIBTEL

and Eurostoxx Auto indexes since January 1, 2006

(1/1/06=100)

Stockholders

Fiat Milan DJ Eurostoxx Automotive Mibtel

210

190

170

150

130

90

110

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Stock markets worldwide posted strong gains in 2006. At the international market level, growth was posted in the Asian stock markets, with the Hong Kong stock exchange rising by 121%,

and Wall Street recorded an increase of 16%. At the European level, the Madrid (+32%), Frankfurt (+22%), Paris (+18%) and London (+13%) stock exchanges recorded excellent performances.

2006 was a record year for the Milan stock exchange which posted an increase for the fourth consecutive year: MIB index +19%, S&P/Mib +16%.

In 2006, the European automotive market confirmed the positive growth trend recorded in 2005: the automotive sector index (Dow Jones Eurostoxx Auto) posted an increase of 26%. Against

this background, Fiat stock almost doubled in value posting an increase of 97%. The market has therefore once again rewarded the successful achievement of the Group financial targets for 2006.

For holders of ADRs:

Toll-free telephone number

in the USA and Canada:

800 749 18 73

Outside the USA and Canada:

+1 201 680 66 26

Website: www.adr.db.com

Major stockholders whose holding exceeds 2%

(as of February 15, 2007)