Chrysler 2006 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Report on Operations Iveco 71

In Eastern Europe, Iveco’s market share (GVW > 2.8 tons) rose

to 11.8% in 2006 (+0.1 percentage points). Its market share

rose in the medium-vehicle segment, while remaining stable

in the light-vehicle segment and contracting slightly in the

heavy-vehicle segment.

The market share of Irisbus in Western Europe, 20.6% in 2006,

rose 0.3 percentage points from 2005. In particular,its market

share rose in France (+2.7 percentage points) and Germany

(+1.3 percentage points), while remaining largely stable in Italy

and falling in Spain (-1.2 percentage points) and Great Britain

(-0.9 percentage points).

In 2006, Iveco delivered a total of 181,500 vehicles, including

17,600 with a buy-back commitment, achieving growth of 5.2%

from the previous year. In Western Europe, 135,100 vehicles

were delivered, for an increase of 3.2% from 2005. At the

individual country level, Germany and Spain reported

significant increases (for the light and heavy vehicle segments

in Germany and for heavy vehicles in Spain), while Italy and

Great Britain, partly due to their soft markets, reported

decreases in all segments (the decline in sales was

concentrated in the light and heavy vehicle segments).

Outside Western Europe, sales volumes were up sharply

in Eastern Europe, rising in Africa and the Middle East, and

virtually stable in Latin America.

Iveco delivered a total of 9,300 buses, marking a 9.4%

improvement over 2005.

In China, Naveco, the 50-50 joint venture with the NAC Group

(Nanjing Automotive Corporation), sold approximately 20,000

light vehicles (+11% from 2005). In Turkey, the licensee Otoyol

sold 5,200 units (in line with 2005 results).

In August 2006, Iveco sold its entire shareholding in Machen-

Iveco Holding S.A., which controlled 51% of the Indian

company Ashok Leyland Ltd.

Iveco gave significant impetus to its growth strategy in 2006,

especially in China.

In September, Iveco signed an agreement with SAIC Motor

Corporation Ltd and Chongqing Heavy Vehicle Group Co. Ltd

to establish a joint venture in the field of heavy commercial

vehicles. On the basis of this agreement, Iveco and SAIC set

up a 50-50 joint venture named SAIC Iveco Commercial Vehicle

Investment Company Ltd, for the acquisition of a 67% share

of the capital of Chongqing Hongyan Automotive Co. Ltd,

controlled by the Chongqing Heavy Vehicle Group.

In September,Iveco signed a joint venture agreement with

NAC, according to which Naveco will acquire all of the

commercial vehicle activities of the Yuejin Motor Company,

a subsidiary of NAC. This acquisition falls within the scope

of Iveco’sstrategy to offer a complete range of commercial

vehicles in China.

Trucks and Commercial Vehicles

Iveco

Operating Performance

Since January 1, 2006, Iveco powertrain activities have been

included in the Fiat Powertrain Technologies Sector. As

envisaged in IAS 14 – Segment Reporting, the figures for

2005 have consequently been reclassified by excluding the

powertrain activities from Iveco and allocating them to FPT.

In 2006, demand for commercial vehicles in Western Europe

(GVW > 2.8 tons) totalled 1,132,300 units, up 2.3% from 2005.

On the principal markets, demand rose in France (+3.6%) and

Germany (+3.2%), while contracting slightly in Italy (-1.9%),

Great Britain (-1.1%), and Spain (-0.2%).

The light-vehicle segment (GVW of between 2.8 and 6 tons)

grew by 1.8% from 2005. Among the main countries, a market

increase was reported in France (+6.4%), while in Great Britain

the market remained stable with virtually the same volumes as

2005, and it contracted in Italy (-2.8%), Germany (-0.6%), and

Spain (-1.2%).

Demand for medium-vehicles (GVW of between 6.1 and 15.9

tons) was also up (+1.9%) from 2005. This improvement was

influenced principally by the German market (+7.4%) and

Spanish market (+2.3%). Demand fell on the British (-8.2%),

Italian (-3.4%), and French (-2.3%) markets.

Demand for heavy-vehicles (GVW >16 tons) rose by 3.7%

from the previous year. The greatest increase was reported

in Germany (+11.9%); modest growth was reported in Spain

(+1.9%) and Italy (+1.5%), while demand fell in France (-3.9%)

and Great Britain (-2.7%).

Report on Operations Iveco70

In 2006, the demand for commercial vehicles in Eastern Europe

(GVW >2.8 tons) rose to 114,000 units (+23.7% from 2005).

The most significant increase was reported for the heavy-

vehicle segment (+36.3% from 2005).

The Western European bus market remained at substantially

the same level as in 2005 (34,600 units), due to offsetting

between the increases in France (+7.5%) and Germany (+6.9%)

and the decreases in Spain (-7.4%), Italy (-3.9%), and Great

Britain (-2.6%).

The market share of Iveco in Western Europe (GVW > 2.8 tons)

was 10.7% (-0.2 percentage points from 2005). Its share of the

light-vehicle segment was 9.1% (-0.2 percentage points). The

Daily confirmed its position as the absolute leader in the 3.5

ton segment, with 17% of the market. In the medium-vehicle

segment (Eurocargo), Iveco’s share, while contracting by 0.9

percentage points, was still 25.4%, confirming the Sector’s

position as co-leader on the European market. In the heavy-

vehicle segment, Iveco’s market share was 10.9% (11.1% in 2005).

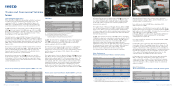

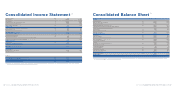

Highlights

(in millions of euros) 2006 2005

Net revenues 9,136 8,483

Trading profit 546 332

Operating result (*) 565 212

Investments in tangible and intangible assets (**) 342 321

-of which capitalised R&D costs 88 115

Total R&D expenses (***) 174 211

Employees at year-end (number) (****) 24,533 24,323

(*) Including restructuring costs and unusual income (expenses).

(**) Net of vehicles sold with buy-back commitments.

(***) Including R&D capitalised and charged to operations.

(****) Excluding employees of the powertrain activities conveyed in FPT

(8,256 at December 31, 2006 and 8,050 at December 31, 2005).

Sales Performance

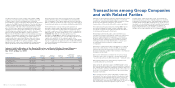

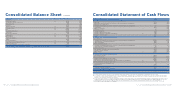

Trucks and Commercial Vehicles sold by Country

(in thousands of units) 2006 2005 (*) % change

-France 25.9 25.6 1.1

-Germany 20.3 16.8 21.0

-Great Britain 15.0 16.6 -9.9

-Italy 36.0 37.9 -5.1

-Spain 20.6 19.3 7.1

-Other Western European Countries 17.3 14.8 17.5

Western Europe 135.1 131.0 3.2

Eastern Europe 19.7 15.8 25.0

Rest of the World 26.7 25.7 3.5

Total units sold 181.5 172.5 5.2

Naveco 20.0 18.0 11.1

Other associated companies (**) 5.2 64.8 n.s.

Grand total 206.7 255.3 n.s.

(*) Figures for 2005 present a break-down by country different from the one published in the

2005 Annual Report as a result of an allocation of deliveries modified according to the

criterion adopted for 2006.

(**) Units sold by the Indian company Ashok Leyland are no longer included as it was sold in

August 2006. The 2005 figure included 59,600 units sold by said company.

Sales Performance

Trucks and Commercial Vehicles sold by Product Segment

(in thousands of units) 2006 2005 %change

Heavy 45.2 42.8 5.6

Medium 21.8 21.3 2.3

Light 100.6 95.7 5.1

Buses 9.3 8.5 9.4

Special purpose vehicles (*) 4.6 4.2 9.5

Total units sold 181.5 172.5 5.2

(*) Astra, Defence and Fire-fighting vehicles.

Trucks and Commercial Vehicles Market (GVW ≥2.8 tons)

(in thousands of units) 2006 2005 % change

France 200.7 193.8 3.6

Germany 246.0 238.3 3.2

Great Britain 194.4 196.6 -1.1

Italy 120.2 122.6 -1.9

Spain 118.3 118.4 -0.2

Other Western European Countries 252.7 237.6 6.4

Western Europe 1,132.3 1,107.3 2.3

Trucks and Commercial Vehicles Market (GVW ≥2.8 tons)

(in thousands of units) 2006 2005 % change

Heavy 260.2 250.8 3.7

Medium 80.6 79.1 1.9

Light 791.5 777.4 1.8

Western Europe 1,132.3 1,107.3 2.3