Chrysler 2006 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements 289Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements288

Exchange rate risk

At December 31, 2006 Fiat S.p.A. has no significant receivables or payables balances or derivative financial instruments exposed

to exchange rate risk.

Interest rate risk

Fiat S.p.A. satisfies its financial requirements through the Group’s centralised treasury management system.

In particular:

■non-current financial payables consist of fixed rate loans granted by Fiat Finance S.p.A. (as discussed in Note 22). The change

in the fair value of these loans resulting from a hypothetical, instantaneous and unfavourable change of 10% in market interest

rates would have been approximately 51 million euros;

■current financial payables consist mostly of current account overdrafts with Fiat Finance S.p.A., a fixed rate loan from Fiat

Finance S.p.A. and payables for advances received from counterparty banks on the sale of receivables (as discussed in Note 26).

In regard to those financial payables and their refinancing, a hypothetical, instantaneous and unfavourable change of 10% in

short-term interest rate levels would have led to an increase in pre-tax expenses on an annual basis of approximately 5 million

euros.

Other risks relating to derivative financial instruments

As discussed in Note 8, Fiat S.p.A. holds certain derivative financial instruments whose value is linked to the trends in the price

of listed shares (they are essentially equity swaps on Fiat shares). Although these transactions were entered into for hedging

purposes, they do not always qualify for hedge accounting under IFRS. As a result, fluctuations in their value could affect the

company’s results.

The potential loss in fair value of derivative financial instruments held by the company at December 31, 2006, linked to changes

in the price of listed shares, which would arise in the case of a hypothetical, instantaneous and unfavourable change of 10% in

the underlying values, amounts to approximately 40 million euros (8 million euros at December 31, 2005). The increase over the

figure at December 31, 2005 is the result of new transactions entered during the year and the increase in the market price of the

underlying Fiat share.

30. Intercompany and related party transactions

Related party transactions for Fiat S.p.A. consist for the most part of transactions carried out with the company’s directly and

indirectly held subsidiaries, carried out at market conditions that are normal in the respective markets taking into account the

characteristics of the goods and the services involved.

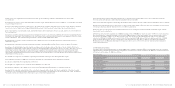

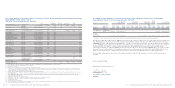

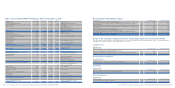

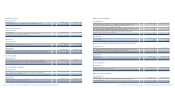

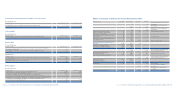

The effects of these transactions on the single items of the 2006 financial statements, which may also be found in the

supplementary financial statements and in the explanatory notes, is summarised in the following tables:

Credit risk

The maximum credit risk to which Fiat S.p.A. is theoretically exposed at December 31, 2006 is represented by the carrying amounts

stated for financial assets in the Balance Sheet and the nominal value of the guarantees provided as discussed in Note 28.

Amounts receivable at the Balance Sheet date are essentially due from Group companies, from the tax authorities and from T.A.V.

S.p.A. The risk on receivables from this latter company is limited to the margin earned by Fiat S.p.A. (of approximately 3.6%), since

acondition for the settlement of payables to consortium companies is the receipt of the amounts due from TAV S.p.A.

Guarantees given are for the most part on behalf of Group companies.

There are no significant overdue balances.

Liquidity risk

Liquidity risk arises if the company is unable to obtain under economic conditions the funds needed to carry out its operations.

Fiat S.p.A. takes part in the Group’scentralised treasury management and as a result the liquidity risks to which it is exposed are

strictly connected with those to which the Fiat Group is exposed as a whole.

The two main factors that determine the Group’sliquidity situation are on one side the funds generated by or used in operating

and investing activities and on the other the debt lending period and its renewal features or the liquidity of the funds employed

and market terms and conditions.

The Group has adopted a series of policies and procedures whose purpose is to optimise the management of funds and to reduce

the liquidity risk, as follows:

■centralising the management of receipts and payments, where it may be economical in the context of the local civil, currency

and fiscal regulations of the countries in which the Group is present;

■maintaining an adequate level of available liquidity;

■diversifying the means by which funds are obtained and maintaining a continuous and active presence on the capital markets;

■obtaining adequate credit lines; and

■monitoring future liquidity on the basis of business planning.

Management believes that the funds and credit lines currently available, in addition to those funds that will be generated from

operating and funding activities, will enable the Group to satisfy its requirements resulting from its investing activities and its

working capital needs and to fulfil its obligations to repay its debts at their natural due date.