Chrysler 2006 Annual Report Download - page 145

Download and view the complete annual report

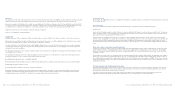

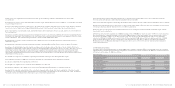

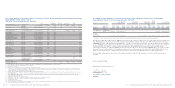

Please find page 145 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements 287Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements286

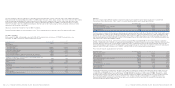

Teksid

Fiat S.p.A. is subject to a put contract with Renault (in reference to the original investment of 33.5% in Teksid, now 15.2%).

In particular, Renault would acquire the right to exercise a sale option to Fiat on its interest in Teksid, in the following cases:

■in the event of nonfulfilment in the application of the protocol of the agreement and admission to receivership or any other

redressment procedure;

■in the event Renault’s investment in Teksid falls below 15% or Teksid decides to invest in a structural manner outside the foundry

sector;

■should Fiat be the object of the acquisition of control by another car manufacturer.

The exercise price of the option is established as follows:

■for 6.5% of the capital stock of Teksid, the initial investment price increased by a given interest rate;

■for the remaining amount of capital stock of Teksid, the share of the accounting net equity at the exercise date.

Contingent liabilities

In connection with significant asset divestitures carried out in 2006 and in prior years, Fiat S.p.A. directly or indirectly through

its subsidiaries provided indemnities to purchasers with the maximum amount of potential liability under these contracts generally

capped at a percentage of the purchase price. These liabilities primarily relate to potential liabilities arising from contingent

liabilities in existence at the time of the sale, as well as breach of representations and warranties provided in the contracts and,

in certain instances, environmental or tax matters, generally for a limited period of time. At December 31, 2006, potential

obligations with respect to these indemnities are approximately 810 million euros (approximately 750 million euros at December

31, 2005), net of provisions set aside by the single companies. Certain other indemnifications have been provided that do not limit

potential payment; it is not possible to estimate a maximum amount of potential future payments that could result from claims

made under these indemnities.

Certain claims against Fiat S.p.A. for damages in relation to real estate properties sold in previous years are still pending. Given

this fact and the specific conditions of the related proceedings, the possible outcome of this situation cannot be reasonably

estimated and, therefore, the likelihood of any costs to be borne by the company cannot be determined.

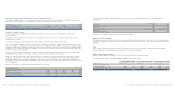

29. Information on financial risks

The manner in which Fiat S.p.A. measures and manages financial risks are consistent with Group policy.

In particular, the categories of the major risks to which the company is exposed are set out in the following.

These relate to:

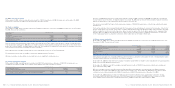

■guarantees of 6,748,140 thousand euros granted on behalf of Group companies, including:

– 790,193 thousand euros for loans (Banco CNH Capital S.A. 603,861 thousand euros, CNH America LLC 38,656 thousand euros,

Fiat Automoveis S.A. 112,203 thousand euros, Magneti Marelli Controle Motor Ltda. 2,753 thousand euros and Fiat Finance

Canada Ltd. 32,720 thousand euros);

– 5,188,361 thousand euros for bond issuances (Fiat Finance and Trade Ltd. 5,175,306 thousand euros and Fiat Finance

Luxembourg S.A. 13,055 thousand euros);

– 186,373 thousand euros for credit facilities (CNH Capital America LLC 113,895 thousand euros, Iveco France S.A. 30,000 thousand

euros, Fiat Finance North America Inc. 30,354 thousand euros, Fiat Automoveis S.A. 1,466 thousand euros, Fiat India Private

Limited 9,619 thousand euros, Comau India Private Limited 1,037 thousand euros);

– 469,627 thousand euros for VAT receivables as part of the tax consolidation procedure, as required by the Ministerial Decree

of December 13, 1979 as subsequently amended, and 113,586 thousand euros for other guarantees;

■guarantees of 152,404 thousand euros granted on behalf of third parties (former Group companies, mainly on VATreceivables).

In addition:

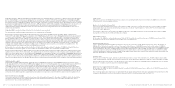

■as part of an agreement signed on June 22, 2005 with a pool of national and international banks headed by Citibank

International, Fiat S.p.A. has provided guarantees on the use of a new three-year credit facility of 1 billion euros granted to Fiat

Finance S.p.A. and other Group companies. At December 31, 2006 the facility had not yet been used. In addition, Fiat S.p.A. has

granted CNH Global N.V. and its subsidiaries a revolving credit facility of 1 billion dollars usable with the Group treasuries and

expiring at the end of January 2007. This facility was not renewed on expiry by Fiat S.p.A. but by the Group’s treasury companies

with whom it may be utilised until its expiry on 28 February 2008;

■in 2005, in relation to the early collection by Fiat Partecipazioni S.p.A. of the residual consideration for the sale of the aviation

business, Fiat S.p.A. is jointly and severally liable with Fiat Partecipazioni S.p.A. to the purchaser,Avio Holding S.p.A., should Fiat

Partecipazioni S.p.A. fail to pay the compensation (following either an arbitral award or an out-of-court settlement) provided for by

the sales agreement signed with the seller in 2003. Similarly, in connection with the sale of the controlling interest in the railway

business, Fiat S.p.A. is liable to the purchaser, Alstom N.V., for any failure of the company that sold the business (now Fiat

Partecipazioni S.p.A.) to comply with the contractual compensation obligations.

Commitments

Commitments total 4,648 thousand euros at year end, a decrease of 2,324 thousand euros over December 31, 2005. The balance

represents the residual amount of the commitment undertaken by Fiat S.p.A. on its centenary, in a resolution adopted by

stockholders in their meeting of June 22, 1998, to make a contribution to the costs of providing degree courses in Automotive

Engineering and of renovating the related university building over a ten-year period.