Chrysler 2006 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review of Fiat S.p.A. 235Financial Review of Fiat S.p.A.234234

Financial Review of Fiat S.p.A.

The financial statements illustrated and commented on in the following pages have been prepared on the basis of the company’s

statutory financial statements at December 31, 2006 to which reference should be made. In compliance with European Regulation

no. 1606 of July 19, 2002, starting from 2005 the Fiat Group has adopted International Financial Reporting Standards (“IFRS”)

issued by the International Accounting Standards Board (“IASB”) in the preparation of its consolidated financial statements. On the

basis of national laws implementing that Regulation, starting from 2006 the Parent Company Fiat S.p.A. is presenting its financial

statements in accordance with IFRS, which are reported together with comparative figures for the previous year.

Operating Performance

The Parent Company earned net income of 2,343 million euros in 2006, 1,226 million euros higher than in 2005 when the result

included net non-recurring income of 1,714 million euros.

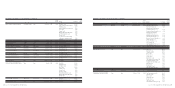

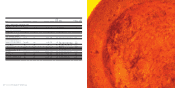

The company’s Income Statement is summarised in the following table:

(in millions of euros) 2006 2005

Investment income 2,461 (424)

-Dividends 362 8

-(Impairment losses) reversals 2,099 (431)

-Gains (losses) on disposals –(1)

Personnel and operating costs net of other revenues (120) (109)

Income (expenses) from significant non-recurring transactions –1,133

Financial income (expenses) (24) (62)

Financial income from significant non-recurring transactions – 858

Income taxes 26 (279)

Net income 2,343 1,117

Investment income totals 2,461 million euros compared with investment expense of 424 million euros in 2005 and consists

of dividends received during the period and reversal of impairment losses (net of write-downs) of investments. Specifically:

■Dividends total 362 million euros and were received from the subsidiaries IHF – Internazionale Holding Fiat S.A. (259 million

euros), Fiat Finance S.p.A. (75 million euros) and other companies. In 2005 dividends received from investments totalled 8 million

euros.

■Impairment loss reversals (net of write-downs) of 2,099 million euros resulted from the revaluation of the investments in the

subsidiaries Fiat Partecipazioni S.p.A. (1,388 million euros mainly connected to Fiat Auto), Iveco S.p.A. (946 million euros) and Fiat

Netherlands Holding N.V. (96 million euros connected to CNH), all written-down in previous years, net of the impairment loss

recognised on the investment in Comau S.p.A. (330 million euros).

In 2005, net impairment losses recognised on investments totalled 431 million euros, mainly due to losses from the investments

in Fiat Partecipazioni S.p.A. (811 million euros connected mainly to the losses of Fiat Auto), Teksid S.p.A., Comau S.p.A. and

Business Solutions S.p.A. (for a total of 147 million euros), net of the revaluation of the investments held in Fiat Netherlands

Holding N.V. (376 million euros due to the positive performance of the CNH and Iveco subsidiaries), Magneti Marelli Holding

S.p.A. (144 million euros) and minor companies.

Personnel and operating costs net of other revenues total 120 million euros, compared with 109 million euros in 2005.

Specifically:

■Personnel and operating costs,totalling 199 million euros, comprise 58 million euros in personnel costs (60 million euros

in 2005), and 141 million euros in other operating costs (121 million euros in 2005), which include the costs for services,

amortisation and depreciation and other operating costs. These costs increased as a whole by 18 million euros from 2005

as aresult of non-recurring charges. In 2006, the average headcount was 140 employees, compared with an average of 133

employees in 2005.

■Other revenues,totalling 79 million euros (72 million euros in 2005), principally refer to the change in contract work in progress

(agreements between Fiat S.p.A. and Treno Alta Velocità – T.A.V. S.p.A.), which is measured by applying the percentage of

completion to the total contractual value of the work, to royalties for the use of the Fiat trademark, calculated as a percentage

of the revenues generated by the Group companies that use it, and the services of executives at the principal companies of the

Group. The increase from 2005 is mainly attributable to higher charges for the use of the trademark.

No Income (expenses) from significant non-recurring transactions is reported in 2006. In 2005 a gain of 1,133 million euros

(net of related costs) was recorded on the transaction regarding the termination of the Master Agreement with General Motors.

In 2006, there were net financial expenses of 24 million euros, arising from the interest charges on the Company’s debt, which

was partially offset by the gain resulting from derivative financial instruments.

In 2005 there were net expenses of 62 million euros mainly arising from the interest expenses connected with the Mandatory

Convertible Facility.

No Financial income from significant non-recurring transactions is reported in 2006. In 2005 this item included income of 858

million euros resulting from the capital increase of September 20, 2005 with the simultaneous conversion of the Mandatory

Convertible Facility. The income represents the difference between the subscription price of the new shares issued and the stock

market price of the shares at the subscription date, net of issuance costs.

The income tax revenue of 26 million euros is the net result of the remuneration for the tax loss brought into the national tax

consolidation by Fiat S.p.A. in 2006 to offset the income reported by the Group’s Italian companies, and the IRAP charge

recognised for the period.

Income tax expenses of 279 million euros in 2005 consisted of the reversal of deferred tax assets of 277 million euros, recognised

in the financial statements at December 31, 2004 in relation to the settlement subsequently made with General Motors for the

termination of the Master Agreement.