Chrysler 2006 Annual Report Download - page 125

Download and view the complete annual report

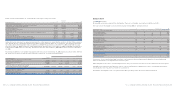

Please find page 125 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements 247Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements246

Other non-current assets, Trade receivables, Current financial

receivables and Other current receivables,excluding assets

deriving from derivative financial instruments and all financial

assets for which quotations on an active market are not available

and whose fair value cannot be reliably determined are measured

at amortised cost using the effective interest method if they have

apre-determined maturity. If financial assets do not have a pre-

determined maturity they are measured at cost. Receivables with

adue date beyond one year that are non-interest bearing or on

which interest accrues at below market rate are discounted to

present value using market rates.

Valuations are performed on a regular basis with the purpose of

verifying if there is objective evidence that a financial asset, taken

on its own or within a group of assets, may have been impaired.

If objective evidence exists, the impairment loss is recognised as

acost in the Income Statement for the period.

Non-current financial payables, Other non-current liabilities,

Trade payables, Current financial payables and Other payables

are measured on initial recognition at fair value (normally

represented by the cost of the transaction), including any

transaction costs.

Financial liabilities are subsequently measured at amortised cost

using the effective interest method, except for derivative financial

instruments and liabilities for financial guarantee contracts.

Financial liabilities hedged by derivative instruments are

measured according to the hedge accounting criteria applicable to

fair value hedges; gains and losses resulting from subsequent

measurement at fair value, caused by fluctuations in interest

rates, are recognised in the Income Statement and are set off by

the effective portion of the gain or loss resulting from the

respective valuation of the hedging instrument at fair value.

Liabilities for financial guarantee contracts are measured at the

higher of the estimate of the contingent liability (determined in

accordance with IAS 37 - Provisions, Contingent Liabilities and

Contingent Assets)and the amount initially recognised less any

amount released to income over time.

Derivative financial instruments

Derivative financial instruments are used solely for hedging

purposes, for the purpose of reducing foreign exchange rate

risk, interest rate risk and the risk of fluctuations in market

prices.

In accordance with the conditions of IAS 39, derivative

financial instruments qualify for hedge accounting only when,

at the inception of the hedge, there is formal designation

and documentation of the hedging relationship, the hedge

is expected to be highly effective, the effectiveness can be

reliably measured and the hedge is actually highly effective

throughout the financial reporting periods for which it was

designated.

All derivative financial instruments are measured at fair value,

in accordance with IAS 39.

When financial instruments have the characteristics to qualify

for hedge accounting the following accounting treatment is

adopted:

■Fair value hedge –If a derivative financial instrument

is designated as a hedge of the exposure to changes in fair

value of a recognised asset or liability that is attributable

to a particular risk that could affect the Income Statement,

the gain or loss resulting from remeasuring the hedging

instrument at fair value is recognised in the Income Statement.

The gain or loss on the hedged item attributable to the hedged

risk adjusts the carrying amount of the hedged item and is

recognised in the Income Statement.

■Cash flow hedge –If a derivative financial instrument is

designated as a hedge of the exposure to variability in the future

cash flows of a recognised asset or liability or a highly probable

forecast transaction that could affect the Income Statement, the

effective portion of the gain or loss on the derivative financial

instrument is recognised directly in equity. The cumulative gain

or loss is reversed from equity and reclassified into the Income

When an impairment loss on assets subsequently reverses or

decreases, the carrying amount of the asset or cash-generating

unit is increased up to the revised estimate of its recoverable

amount, but not in excess of the carrying amount that would

have been recognised had no impairment loss been recorded.

The reversal of an impairment loss is recognised immediately

in income.

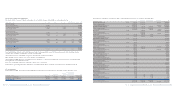

Financial instruments

Presentation

Financial instruments held by the company are presented in the

Balance Sheet as described in the following:

■Non-current assets: Investments, Other financial assets, Other

non-current assets.

■Current assets: Trade receivables, Current financial receivables,

Other current receivables, Cash and cash equivalents.

■Non-current liabilities: Non-current financial payables,

Other non-current liabilities.

■Current liabilities: Trade payables, Current financial payables

(including payables for advances on the sale of receivables),

Other payables.

The item “Cash and cash equivalents” consists of cash and

deposits with banks, units with liquidity funds and other highly

traded securities that are readily convertible to cash and which

are subject to an insignificant risk of changes in value.

The liability relating to financial guarantee contracts is included

in Non-current financial payables. The term financial guarantee

contracts refers to contracts under which the company guarantees

to make specific payments to reimburse the holder for a loss it

incurs because a specified debtor fails to make payment when

due in accordance with the terms of a debt instrument. The

present value of the related receivable for any outstanding

commissions is classified in Non-current financial assets.

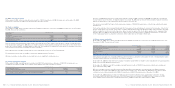

Measurement

Investments in subsidiaries and associates are stated at cost

adjusted for any impairment losses.

The excess on acquisition of the purchase cost and the share

acquired by the company of the investee company’s net assets

measured at fair value is, accordingly,included in the carrying

value of the investment.

Investments in subsidiaries and associates are tested for

impairment annually and if necessary more often. If there

is any evidence that these investments have been impaired,

the impairment loss is recognised directly in the Income

Statement. If the company’s share of losses of the investee

exceeds the carrying amount of the investment and if the

company has an obligation to respond for these losses, the

company’s interest is reduced to zero and a liability is

recognised for its share of the additional losses. If the

impairment loss subsequently no longer exists it is reversed

and the reversal is recognised in the income statement up

to the limit of the cost of the investment.

Investments in other companies,comprising non-current

financial assets that are not held for trading (available-for-

sale financial assets), are initially measured at fair value. Any

subsequent profits and losses resulting from changes in fair

value, arising from quoted prices, are recognised directly in

equity until the investment is sold or is impaired; the total

profits and losses recognised in equity up to that date are

recognised in the Income Statement for the period.

Minor investments in other companies for which a market

quotation is not available are measured at cost, adjusted

for any impairment losses.

Other financial assets for which the company has the intent

to hold to maturity are recognised on the trade date and are

measured at purchase price (being representative of fair value)

on initial recognition in the Balance Sheet, inclusive of

transaction costs other than in respect of assets held for

trading. These assets are subsequently measured at amortised

cost using the effective interest method.