Chrysler 2006 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

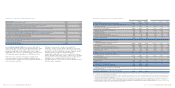

Financial Services with Crédit Agricole resulted in receipts of

approximately 3 billion euros, including Other changes, which

totalled 3,078 million euros.

Proceeds from the sale of non-current assets totalled 1,591

million euros and referred for approximately 940 million euros

to the proceeds (net of liquidity held by the financial services

companies that were transferred to the joint venture) realised

upon the sales of the investments transferred to the joint

venture with Crédit Agricole, to which proceeds deriving from

the sale of vehicles as part of long-term renting activities (290

million euros) must be added; the remainder referred to the

sale of B.U.C. – Banca Unione di Credito (net of the liquidity it

held), Atlanet S.p.A. and Sestrieres S.p.A., and of the interests

held in Machen Iveco Holding SA (which held a shareholding

of about 51% in Ashok Leyland Ltd), Immobiliare Novoli S.p.A.,

IPI S.p.A., and other minor sales.

Cash flows used in financing activities totalled 1,731 million

euros. Cash collection from bonds issuances made during the

first six months of the year (2 billion euros in notes issued by

Fiat Finance and Trade S.A. and USD 500 million in notes

issued by Case New Holland Inc.) was more than offset by the

repayment of bonds (for approximately 2.4 billion euros), the

reduction of approximately 1.8 billion euros in bank loans and

other financial payables.

Report on Operations Financial Review of the Group 37Report on Operations Financial Review of the Group36

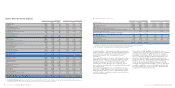

Balance Sheet of the Group

at December 31, 2006

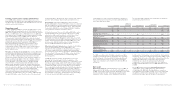

At December 31, 2006, total assets amounted to 58,303 million

euros, a 4,151 million euro decrease with respect to 62,454

million euros at December 31, 2005.

At December 31, 2006, Total Assets included assets reclassified

under “Assets held for sale” for 332 million euros mainly

related to the Metallurgical Products Sector (sale of Meridian

Technologies), the Services Sector (sale of Ingest Facility) and

Fiat Auto, for activities destined to be conveyed to the joint

venture with Tata Motors in India.

In 2006, non-current assets decreased by 1,288 million euros.

Net of the negative impact of changes in the translation rates

for dollar denominated items (approximately 570 million

euros), the decrease is mainly due to:

■the decrease in Leased assets, due to the deconsolidation

of the financial services companies controlled by Fiat Auto

and sold within the framework of the establishment of FAFS;

■the decrease in Property, plant, and equipment. This was

caused principally by the negative balance of investments,

depreciation, disposals (mainly vehicles sold by Iveco with

buy-back commitments), to which must be added the

deconsolidation of the activities of B.U.C. – Banca Unione

di Credito (sold at the end of August 2006) and the

reclassification under Assets held for sale of assets held

by the Companies/Sectors mentioned above.

These changes were partially offset by the increase in

intangible assets due to goodwill (776 million euros) recognised

upon the acquisition by Fiat S.p.A. of part of the recently issued

shares of Ferrari S.p.A. in the second quarter of 2006,

representing 0.44% of the capital stock of the company, as

well as exercise in the third quarter of 2006 of the call option

on 28.6% of Ferrari shares. Following these two transactions,

Fiat’s stake in Ferrari S.p.A. rose from 56% to 85%.

At December 31, 2006, receivables from financing activities

totalled 11,743 million euros, reflecting a decrease of 4.2 billion

euros from December 31, 2005. Net of the negative foreign

exchange impact of approximately 0.9 billion euros, the sale

of Fiat Auto’s financial services companies that are part of the

above-mentioned transaction with Crédit Agricole (3.4 billion

euros) and the sale of B.U.C. (0.9 billion euros), receivables

from financing activities showed an increase of 0.9 billion

euros.

The increase in financing extended to the dealer network and

to the end customers of CNH which occurred in particular in

the first six months of 2006, was only partially offset by the

collection of financial receivables from associated companies,

sold companies (Atlanet S.p.A.), and financial receivables from

others.

Working capital,net of the items connected with the sale

of vehicles with buy-back commitments, is negative by 838

million euros, 589 million euros less than at December 31,

2005, when working capital was negative by 249 million euros.

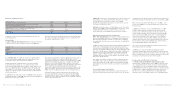

(in millions of euros) At 12.31.2006 At 12.31.2005 Change

Inventories (1) 7,553 7,133 420

Trade receivables 4,944 4,969 -25

Trade payables (12,603) (11,777) -826

Other receivables/ (payables), accruals and deferrals (2) (732) (574) -158

Working capital (838) (249) -589

(1) Inventories are shown net of the value of vehicles sold with buy-back commitments by Fiat Auto.

(2) Other payables included in the balance of Other receivables/ (payables), accruals and deferrals exclude amounts due to customers corresponding to the buy-back price due upon expiration

of the related contracts and the amount of the fees paid in advance by customers for vehicles sold with buy-back commitments, which is equal to the difference at the date of signing the

contract between the sales price and the buy-back price and which is allocated over the term of the entire agreement.