Chrysler 2006 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

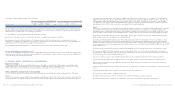

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 165

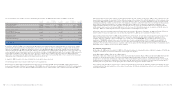

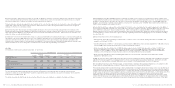

The total balance at December 31, 2006 relates to corporate restructuring programs of the following Sectors (in millions of euros):

Fiat Auto 137 (175 at December 31, 2005); Agricultural and Construction Equipment 148 (72 at December 31, 2005); Powertrain 61

(15 at December 31, 2005), Trucks and Commercial Vehicles 49 (102 at December 31, 2005); Metallurgical Products 18 (19 at

December 31, 2005); Components 25 (28 at December 31, 2005); Production Systems 83 (48 at December 31, 2004); Services 18

(16 at December 31, 2005); Other sectors 22 (13 at December 31, 2005).

The provision for other risks represents the amounts set aside by the individual companies of the Group principally in connection

with contractual and commercial risks and disputes. The more significant balances of these provisions are as follows.

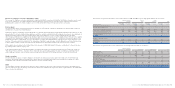

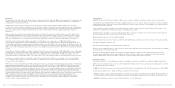

(in millions of euros) At December 31, 2006 At December 31, 2005

Sales Incentives 851 856

Legal proceedings and other disputes 630 598

Commercial risks 808 877

Environmental risks 95 149

Indemnities 49 87

Other reserves for risk and charges 535 576

Other risks 2,968 3,143

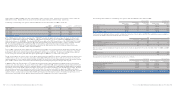

Adescription of these follows:

■Sales Incentives -These provisions relate to sales incentives that are offered on a contractual basis to the Group’s dealer

networks, primarily on the basis of the dealers achieving a specific cumulative level of revenue transactions during the calendar

year. This provision is estimated based on the information available regarding the sales made by the dealers during the calendar

year. The provision also includes sales incentives such as cash rebates announced by the Group and provided by dealers to

customers, for which the dealers are reimbursed. The Group records these provisions when it is probable that the incentive will be

provided and the Group’s inventory is sold to its dealers. The Group estimates these provisions based on the expected use of these

rebates with respect to the volume of vehicles that has been sold to the dealers.

■Legal proceedings and other disputes -This provision represents management’s best estimate of the liability to be recognised by

the Group with regard to:

–Legal proceedings arising in the ordinary course of business with dealers, customers, suppliers or regulators (such as contractual

or patent disputes).

–Legal proceedings involving claims with active and former employees.

–Legal proceedings involving different tax authorities.

None of these provisions is individually significant. Each Group company recognises a provision for legal proceedings when

it is deemed probable that the proceedings will result in an outflow of resources. In determining their best estimate of the probable

liability, each Group company evaluates their legal proceedings on a case-by-case basis to estimate the probable losses that

typically arise from events of the type giving rise to the liability. Their estimate takes into account, as applicable, the views of legal

counsel and other experts, the experience of the Group and others in similar situations and the Group’sintentions with regard to

further action in each proceeding. Fiat’s consolidated provision aggregates these individual provisions established by each of the

Group’s companies.

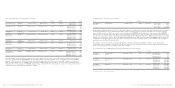

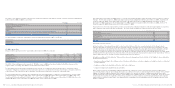

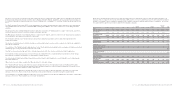

The effects of the differences between the previous actuarial assumptions and what has actually occurred (experience adjustments)

at December 31, 2006 and 2005, is as follows:

At December At December

(in millions of euros) 31, 2006 31, 2005

Experience adjustments actuarial (gains) losses:

-Employee severance indemnity (3) 48

- Pension plans 57 (7)

- Healthcare plans 618

- Others 61 (25)

Total Experience adjustments actuarial (gains) losses on the present value of defined benefit obligation 121 34

Plan assets 10 15

Total Experience adjustments actuarial (gains) losses on the fair value of the plan assets 10 15

The best estimate of expected contribution to pension and healthcare plan for 2007 is as follows:

(in millions of euros) 2007

Pension plans 151

Healthcare plans 69

Total expected contribution 220

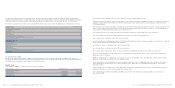

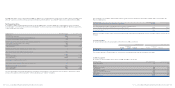

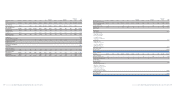

27. Other provisions

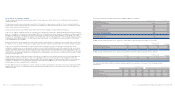

Changes in Other provisions for the year ended at December 31, 2006 are as follows:

At December Release to Other At December

(in millions of euros) 31, 2005 Charge Utilisation income changes 31, 2006

Warranty provision 1,046 1,157 (981) (28) 60 1,254

Restructuring provision 488 331 (224) (9) (25) 561

Investment provision 71 – – – (4) 67

Other risks 3,143 2,046 (1,886) (178) (157) 2,968

Total Other provisions 4,748 3,534 (3,091) (215) (126) 4,850

The effect of discounting provisions amounts to 10 million euros in 2006 and has been included in the Other changes as the

negative effect of exchange rate differences amounting to 87 million euros.

The warranty provision represents management’s best estimate of commitments given by the Group for contractual, legal or

constructive obligations arising from product warranties given for a specified period of time which begins at the date of delivery

to the customer. This estimate has been calculated considering, past experience and specific contractual terms.

The restructuring provision comprises the estimated amount of benefits payable to employees on termination in connection with

restructuring plans amounting to 456 million euros at December 31, 2006 (391 million euros at December 31, 2005), other costs

for exiting activities amounting to 25 million euros at December 31, 2006 (10 million euros at December 31, 2005) and other costs

totalling 80 million euros at December 31, 2006 (87 million euros at December 31, 2005).

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 164