Chrysler 2006 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

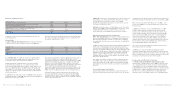

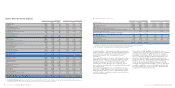

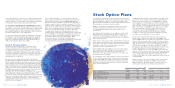

Balance Sheet by Activity Segment

At 12.31.2006 At 12.31.2005

Industrial Financial Industrial Financial

(in millions of euros) Consolidated Activities Services Consolidated Activities Services

Intangible assets 6,421 6,325 96 5,943 5,762 181

-Goodwill 2,850 2,756 94 2,418 2,259 159

-Other intangible assets 3,571 3,569 2 3,525 3,503 22

Property,plant and equipment 10,540 10,528 12 11,006 10,961 45

Investment property 19 19 – 26 26 –

Investments and other financial assets 2,280 3,886 867 2,333 4,184 796

Leased assets 247 7 240 1,254 4 1,250

Defined benefit plan assets 11 11 – –––

Deferred tax assets 1,860 1,710 150 2,104 1,930 174

Total Non-current Assets 21,378 22,486 1,365 22,666 22,867 2,446

Inventories 8,447 8,390 57 7,881 7,809 76

Trade receivables 4,944 5,068 178 4,969 4,856 341

Receivables from financing activities 11,743 2,891 11,977 15,973 4,881 15,856

Other receivables 2,839 2,806 58 3,084 2,922 243

Accrued income and prepaid expenses 247 226 21 272 253 21

Current financial assets 637 531 106 1,041 663 378

-Current investments 31 31 –31 31 –

-Current securities 224 134 90 556 204 352

-Other financial assets 382 366 16 454 428 26

Cash and cash equivalents 7,736 6,706 1,030 6,417 5,517 900

Total Current Assets 36,593 26,618 13,427 39,637 26,901 17,815

Assets held for sale 332 332 – 151 151 –

TOTAL ASSETS 58,303 49,436 14,792 62,454 49,919 20,261

Total assets adjusted for asset-backed financing transactions 49,959 48,504 7,313 51,725 48,388 10,797

Stockholders’ equity 10,036 10,036 2,395 9,413 9,409 2,479

Provisions 8,611 8,471 140 8,698 8,499 199

-Employee benefits (a) 3,761 3,750 11 3,950 3,925 25

-Other provisions (a) 4,850 4,721 129 4,748 4,574 174

Debt 20,188 11,555 11,836 25,761 13,782 16,915

-Asset-backed financing (b) 8,344 932 7,479 10,729 1,531 9,464

-Other debt (b) 11,844 10,623 4,357 15,032 12,251 7,451

Other financial liabilities 105 98 7189 180 9

Trade payables 12,603 12,637 260 11,777 11,700 297

Other payables 5,019 4,963 89 4,821 4,698 205

Deferred tax liabilities 263 262 1 405 375 29

Accrued expenses and deferred income 1,169 1,105 64 1,280 1,166 128

Liabilities held for sale 309 309 – 110 110 –

TOTAL STOCKHOLDERS’ EQUITY AND LIABILITIES 58,303 49,436 14,792 62,454 49,919 20,261

Total liabilities adjusted for asset-backed financing transactions 49,959 48,504 7,313 51,725 48,388 10,797

(a) The amounts at December 31, 2005 differ from those published in the Consolidated Financial Statements at December 31, 2005 due to the reclassification described in the Notes to the

Consolidated Financial Statements.

(b) The amounts of “Other debt” and “Asset-backed financing” of the Group and the Financial Services Companies at December 31, 2005 differ from those published in the Consolidated Financial

Statements at December 31, 2005 due to the reclassification described in the Notes to the Consolidated Financial Statements.

Report on Operations Financial Review of the Group 45Report on Operations Financial Review of the Group44

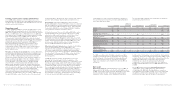

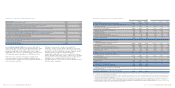

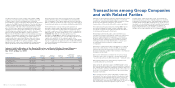

Net Debt by Activity Segment

At 12.31.2006 At 12.31.2005

Industrial Financial Industrial Financial

(in millions of euros) Consolidated Activities Services Consolidated Activities Services

Debt (20,188) (11,555) (11,836) (25,761) (13,782) (16,915)

-Asset-backed financing (a) (8,344) (932) (7,479) (10,729) (1,531) (9,464)

-Other debt (a) (11,844) (10,623) (4,357) (15,032) (12,251) (7,451)

Debt included among liabilities held for sale (33) (33) – –––

Current financial receivables from jointly controlled financial entities (b) 143 143 – –––

Intersegment financial receivables – 2,559 644 – 4,594 342

Financial payables net of intersegment balances and current

financial receivables from jointly controlled financial entities (20,078) (8,886) (11,192) (25,761) (9,188) (16,573)

Other financial assets (c) 382 366 16 454 428 26

Other financial liabilities (c) (105) (98) (7) (189) (180) (9)

Current securities 224 134 90 556 204 352

Cash and cash equivalents 7,736 6,706 1,030 6,417 5,517 900

Cash and cash equivalents included among assets held for sale 55– –––

Net debt (11,836) (1,773) (10,063) (18,523) (3,219) (15,304)

(a) The amounts of “Other debt” and “Asset-backed financing” of the Group and the financial services companies at December 31, 2005 differ from those published in the Consolidated Financial

Statements at December 31, 2005 due to the reclassification described in the Notes to the Consolidated Financial Statements.

(b) This item includes current financial receivables due to Fiat Group companies by the FAFS Group.

(c) This item includes the asset and liability fair values of derivative financial instruments.

“Financial payables” under Industrial Activities partly include

funds raised by the central cash management and transferred

to financial services companies in support of their activity

(represented under the item “Intersegment financial

receivables”).

“Intersegment financial receivables” under Financial Services

represent loans or advances to industrial companies, mainly

relating to the sale of receivables by industrial to financial

companies in transactions that do not comply with the

requirements set out in IAS 39 for the recognition of those

sales, as well as any temporary cash deposited with the central

cash management.

“Cash and cash equivalents” include 627 million euros at

December 31, 2006 (706 million euros at December 31, 2005),

mainly relating to financial services companies, allocated to

service the debt for securitisation structures and classified as

“Asset-backed financing”.

At December 31, 2006, net debt of the financial services

companies showed a decrease of 5,241 million euros compared

to net debt at December 31, 2005. The decrease is mainly

attributable to the positive effects of the sale of the financial

services companies of Fiat Auto within the framework of the

transaction with Crédit Agricole (approximately 4.8 billion

euros) and of B.U.C. – Banca Unione di Credito (approximately

0.8 billion euros), the operating performance (734 million

euros), and to the translation effects of changes in foreign

exchange rates (approximately 0.8 billion euros), in part offset

by capital expenditures carried out during the period (mainly

for vehicles that had been leased out under operating leases),

and growth in the investment portfolio.