Chrysler 2006 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

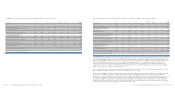

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 125

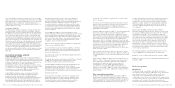

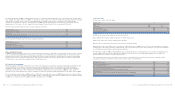

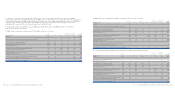

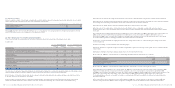

In 2005 Changes in accumulated amortisation and impairment losses were as follows:

At Changes in Translation At

December Impairment the scope of differences and December

(in millions of euros) 31, 2004 Amortisation losses Divestitures consolidation other changes 31, 2005

Goodwill 652 – 12 – – 77 741

Trademarks and other intangible assets with indefinite useful lives 58 – – (3) – 6 61

-Development costs externally acquired 341 230 100 – (7) 3 667

-Development costs internally generated 481 232 3 – – 68 784

Total Development costs 822 462 103 – (7) 71 1,451

-Patents, concessions and licenses externally acquired 504 158 – (113) (38) 19 530

Total Patents, concessions and licenses 504 158 – (113) (38) 19 530

-Other intangible assets externally acquired 375 69 5 (9) 14 5 459

Total Other intangible assets 375 69 5 (9) 14 5 459

-Advances and intangible assets in progress externally acquired 6 – – – – – 6

Total Advances and intangible assets in progress 6 – – – – – 6

Total accumulated amortisation and impairment of Intangible assets 2,417 689 120 (125) (31) 178 3,248

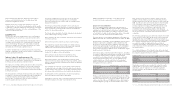

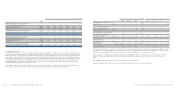

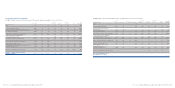

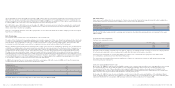

The net carrying amount of Intangible assets at December 31, 2005 can be analysed as follows:

Translation

At Change in differences At

December Impairment the scope of and other December

(in millions of euros) 31, 2004 Additions Amortisation losses Divestitures consolidation changes 31, 2005

Goodwill 2,157 – – (12) – 53 220 2,418

Trademarks and other intangible assets

with indefinite useful lives 202 1 – – (1) 2 18 222

-Development costs externally acquired 1,230 240 (230) (100) (7) – 22 1,155

-Development costs internally generated 1,259 416 (232) (3) (2) – 10 1,448

Total Development costs 2,489 656 (462) (103) (9) – 32 2,603

-Patents, concessions and licenses externally acquired 472 96 (158) – (1) (21) 81 469

Total Patents, concessions and licenses 472 96 (158) – (1) (21) 81 469

-Other intangible assets externally acquired 145 32 (69) (5) – 16 18 137

Total Other intangible assets 145 32 (69) (5) – 16 18 137

-Advances and intangible assets in progress externally acquired 113 51 – – – – (70) 94

Total Advances and intangible assets in progress 113 51 – – – – (70) 94

Total net carrying amount of Intangible assets 5,578 836 (689) (120) (11) 50 299 5,943

The decrease of 73 million euros regarding the Change in the scope of consolidation mainly reflects the deconsolidation

of the entities transferred to the FAFS joint venture. In 2005 the increase of 53 million euros included the effects of the acquisition

of control of Leasys S.p.A. and Mako Elektrik Sanayi Ve Ticaret A.S., net of the effects of the entry in the scope of consolidation

of the Powertrain activities previously part of the Fiat-GM Powertrain, the joint venture with General Motors, and of the

reclassification to assets held for sale of the intangible assets of Atlanet S.p.A.

Foreign exchange losses of 273 million euros in 2006 (gains of 402 millions euros in 2005) principally reflect changes

in the Euro/U.S. dollar exchange rate.

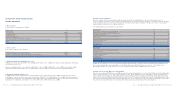

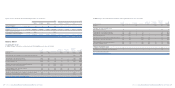

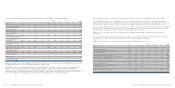

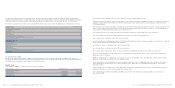

In 2005, changes in the gross carrying amount of Intangible assets were as follows:

At Changes in Translation At

December the scope of differences and December

(in millions of euros) 31, 2004 Additions Divestitures consolidation other changes 31, 2005

Goodwill 2,809 – – 53 297 3,159

Trademarks and other intangible assets with indefinite useful lives 260 1 (4) 2 24 283

-Development costs externally acquired 1,571 240 (7) (7) 25 1,822

-Development costs internally generated 1,740 416 (2) –78 2,232

Total Development costs 3,311 656 (9) (7) 103 4,054

-Patents, concessions and licenses externally acquired 976 96 (114) (59) 100 999

Total Patents, concessions and licenses 976 96 (114) (59) 100 999

-Other intangible assets externally acquired 520 32 (9) 30 23 596

Total Other intangible assets 520 32 (9) 30 23 596

-Advances and intangible assets in progress externally acquired 119 51 – – (70) 100

Total Advances and intangible assets in progress 119 51 – – (70) 100

Total gross carrying amount of Intangible assets 7,995 836 (136) 19 477 9,191

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 124