Chrysler 2006 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 147

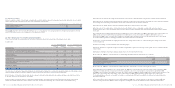

Fiat had nonetheless reserved the right to pay the warrant holders in cash, starting on January 2, 2007, in lieu of the shares to be

issued (shares in exchange for warrants), for the difference between the average of the official market price of Fiat ordinary shares

in December 2006 and the warrant exercise price, unless this difference were to exceed the maximum amount set and previously

communicated by Fiat, in which case the holder of the warrants could opt to subscribe to the shares in exchange for the warrants.

In the financial statements prepared in accordance with IFRS, these rights were recognised as an implicit component of the

additional paid-in capital reserve at their fair value of 18 million euros on issue. As described in Note 41 on subsequent events,

4,676 warrants were exercised in January 2007 which led to the issue of 1,169 ordinary shares at a total price of 34,327 euros on

February 1, 2007. The remaining warrants have expired and have accordingly been cancelled.

■Pursuant to the resolution approved by the Extraordinary Stockholders’ Meeting on September 12, 2002, the Board of Directors

has the right to increase the capital one or more times by September 11, 2007, up to a maximum of 8 billion euros.

■In a meeting held on November 3, 2006, the Board of Directors of Fiat S.p.A. exercised its delegated powers pursuant to article

2443 of the Italian Civil Code to increase capital stock to service the employee incentive plan reserved for employees of the

company and/or its subsidiaries up to a maximum of 1% of that stock, being 50,000,000 euros, by taking a decision to issue a

maximum of 10,000,000 ordinary shares each of nominal value 5 euros, corresponding to 0.78% of capital stock and 0.92% of

ordinary capital stock, at a price of 13.37 euros each, to service the new employee stock option plan described in the following

paragraph. The execution of this increase in capital is subject to the approval of the Annual General Meeting of Stockholders and is

dependant on the conditions of the increase being satisfied.

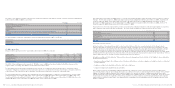

Stock-based compensation

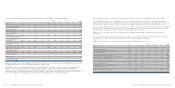

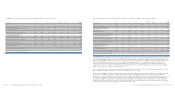

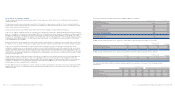

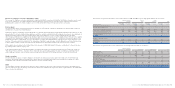

At December 31, 2006 and at December 31, 2005, the following stock-based compensation plans relating to managers of Fiat Group

companies or members of the Board of Directors of Fiat S.p.A. were in place.

Stock Option plans linked to Fiat S.p.A. ordinary shares

The Board of Directors of Fiat S.p.A. approved certain stock option plans between March 1999 and September 2002 which provide

managers of the Group with the title of Direttore and high management potential included in “management development

programmes” and members of the Board of Directors of Fiat S.p.A. with the right to purchase a determined number of Fiat S.p.A.

ordinary shares at a fixed price (strike price). These rights may be exercised over a fixed period of time from the vesting date to

the expiry date of the plan. These stock option plans do not depend on any specific market conditions.

These options may generally be exercised once a three year period has passed from the grant date and for the following six years,

consistent with tax law and regulations on the subject; nonetheless, the full amount granted as options is not exercisable until the

end of the fourth year.

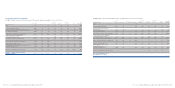

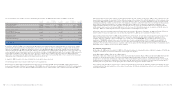

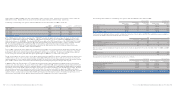

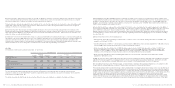

The reconciliation of the number of shares outstanding at December 31, 2004 and at December 31, 2006 is as follows:

At (Purchases)/ At (Purchases)/ At

December Capital Sales of December Capital Sales of December

(number of shares in thousand) 31, 2004 increase treasury stock 31, 2005 increase treasury stock 31, 2006

Ordinary shares issued 800,417 291,829 – 1,092,246 – – 1,092,246

Less: Treasury stock (4,384) – 52 (4,332) – 559 (3,773)

Ordinary shares outstanding 796,033 291,829 52 1,087,914 – 559 1,088,473

Preference shares issued 103,292 – – 103,292 – – 103,292

Less: Treasury stock – – – – – – –

Preference shares outstanding 103,292 – – 103,292 – – 103,292

Saving shares issued 79,913 – – 79,913 – – 79,913

Less: Treasury stock – – – – – – –

Saving shares outstanding 79,913 – – 79,913 – – 79,913

Total Shares issued by Fiat S.p.A. 983,622 291,829 – 1,275,451 – – 1,275,451

Less: Treasury stock (4,384) – 52 (4,332) – 559 (3,773)

Total Fiat S.p.A. outstanding shares 979,238 291,829 52 1,271,119 – 559 1,271,678

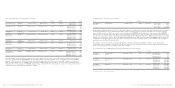

In regard to changes in 2005, it is recalled that the Mandatory Convertible Facility was extinguished by its conversion to capital

stock through subscription by the Lending Banks to an increase in capital stock for consideration, as approved by the Board of

Directors on September 15, 2005; the operation took place on September 20, 2005 (see Note 28). Capital stock increased in this

manner from 4,918,113,540 euros to 6,377,257,130 euros, through the issue of 291,828,718 ordinary shares, each of par value of 5

euros, having the same characteristics as those currently in circulation, including dividend rights from January 1, 2005, pursuant to

article 2441, paragraph 7 of the Italian Civil Code, at a price of 10.28 euros, of which 5.28 euros represents additional paid-in

capital. The operation increased capital stock by 1,459 million euros, other reserves by 682 million euros, and generated unusual

financial income of 858 million euros, net of related costs (see Note 9).

In regard to 2006, treasury stock was sold when the stock options were exercised.

The following matters have relevance with respect to the capital stock:

■Pursuant to resolutions approved by the Board of Directors on December 10, 2001 and June 26, 2003, capital could have been

increased through rights offerings for a maximum of 81,886,460 euros, with the issuance of a maximum of 16,377,292 ordinary shares

at a par value of 5 euros each on February 1, 2007, following the exercise of the residual “FIAT ordinary share warrants 2007”.

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 146