Chrysler 2006 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 175

Furthermore, in connection with significant asset divestitures carried out in 2006 and in prior years, the Group provided

indemnities to purchasers with the maximum amount of potential liability under these contracts generally capped at a percentage

of the purchase price. These liabilities primarily relate to potential liabilities arising from breach of representations and warranties

provided in the contracts and, in certain instances, environmental or tax matters, generally for a limited period of time. At

December 31, 2006, potential obligations with respect to these indemnities are approximately 860 million euros (approximately 833

million euros at December 31, 2005), against which provisions of 49 million euros (87 million euros December 31, 2005) have been

made, classified as Other provisions. The Group has provided certain other indemnifications that do not limit potential payment;

it is not possible to estimate a maximum amount of potential future payments that could result from claims made under these

indemnities.

In February 2006, Fiat has received a subpoena from the SEC Division of Enforcement regarding a formal investigation entitled

“In the Matter of Certain Participants in the Oil-for-Food Program”. Under this subpoena, the Group is required to provide the SEC

with documents relating to certain Fiat-related entities, including certain CNH subsidiaries and Iveco, regarding matters relating to

the United Nations Oil-for-Food Program. A substantial number of companies was mentioned in the “Report of the Independent

Inquiry Committee into the United Nations Oil-for-Food Program”, which alleged that these companies engaged in transactions

under this programme that involved inappropriate payments. Management is currently unable to predict what actions, if any, may

result from the SEC investigation.

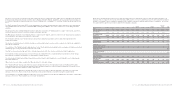

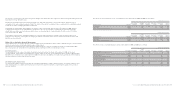

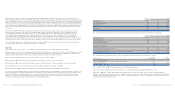

33. Segment reporting

Information by business and geographical area is disclosed in accordance with IAS 14 – Segment reporting,and is prepared in

conformity with the accounting policies adopted for preparing and presenting the Consolidated financial statements of the Group.

The primary reporting format is by business segment, while geographical segments represent the secondary reporting format.

This decision is based on the identification of the source and nature of the Group’srisks and returns, which determine how the

Group is organised and define its management structure and its internal financial reporting system.

Business segment information

The internal organisation and management structure of the Fiat Group throughout the world are based on the business segment to

which entities and divisions belong. In addition, the Group has investments in holding entities and service providers whose activity

is different from those of the industrial businesses. The following descriptions provide additional detail of this.

The Fiat Auto Sector operates internationally with the major brands Fiat, Lancia, Alfa Romeo and Fiat Light Commercial Vehicles,

and manufactures and markets automobiles and commercial vehicles. It also provides financial services through the Fiat Auto

Financial Services joint venture with the Crédit Agricole group.

The Maserati Sector produces and markets luxury sports cars with the brand Maserati.

The Ferrari Sector consists of the manufacturing and marketing of luxury sports cars with the brand Ferrari and the management

of the Formula One racing cars.

The Agricultural and Construction Equipment (CNH) Sector manufactures and sells tractors and Agricultural equipment under the

CaseIH and the New Holland brands and Construction equipment under the Case and New Holland brands. The Sector also

provides financial services to its end customers and dealers.

Fidis Retail Italia (FRI)

All the rights of and commitments to Synesis Finanziaria S.p.A. (the company that held 51% of Fidis Retail Italia S.p.A.) described

in Note 32 to the consolidated financial statements at December 31, 2005 terminated when Fiat exercised its call option on

December 28, 2006 on establishing the FAFS joint venture with Crédit Agricole.

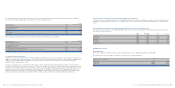

Sales of receivables

The Group has discounted receivables and bills without recourse having due dates after December 31, 2006 amounting to 5,697 million

euros (2,463 million euros at December 31, 2005, with due dates after that date), which refer to trade receivables and other receivables

for 4,489 million euros (2,007 million euros at December 31, 2005) and receivables from financing for 1,208 million euros (456 million

euros at December 31, 2005). These amounts include receivables, mainly from the sales network, sold to jointly-controlled financial

services companies (FAFS) for 3,400 million euros and associated financial service companies (Iveco Financial Services, controlled by

Barclays) for 661 million euros (710 million euros at December 31, 2005). The increase recorded during 2006 is due to the

deconsolidation of the financial services companies of Fiat Auto conveyed in the above mentioned joint venture with Crédit Agricole.

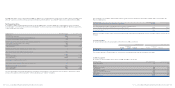

Operating lease contracts

The Group enters into operating lease contracts for the right to use industrial buildings and equipments with an average term of

10-20 years and 3-5 years, respectively,At December 31, 2006, the total future minimum lease payments under non-cancellable

lease contracts are as follows:

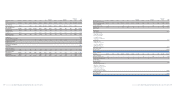

At December 31, 2006 At December 31, 2005

due between due between

due within one and due beyond due within one and due beyond

(in millions of euros) one year five years five years Total one year five years five years Total

Future minimum lease payments under

operating lease agreements 82 172 180 434 71 171 161 403

During 2006, the Group has recorded costs for lease payments for 71 million euros (69 million euros during 2005).

Contingent liabilities

As a global company with a diverse business portfolio, the Fiat Group is exposed to numerous legal risks, particularly in the areas

of product liability, competition and antitrust law, environmental risks and tax matters. The outcome of any current or future

proceedings cannot be predicted with certainty.It is therefore possible that legal judgments could give rise to expenses that are

not covered, or fully covered, by insurers’ compensation payments and could affect the Group financial position and results. At

December 31, 2006, contingent liabilities estimated by the Group amount to approximately 220 million euros (approximately 200

million euros at December 31, 2005), for which no provisions have been recognised since an outflow of resources is not considered

to be probable. Furthermore, contingent assets and expected reimbursement in connection with these contingent liabilities for

approximately 30 million euros have been estimated but not recognised.

Instead, when it is probable that an outflow of resources embodying economic benefits will be required to settle obligations and

this amount can be reliably estimated, the Group recognises specific provision for this purpose.

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 174