Chrysler 2006 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

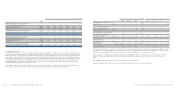

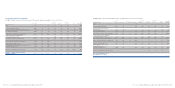

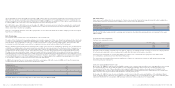

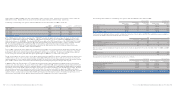

Receivables from financing activities

Receivables from financing activities include the following:

(in millions of euros) At December 31, 2006 At December 31, 2005

Retail financing 6,482 6,655

Finance leases 580 716

Dealer financing 4,084 6,804

Supplier financing 234 335

Receivables from banking activities –1,147

Current financial receivables from jointly controlled financial services entities 143 –

Financial receivables from companies under joint control, associates and unconsolidated subsidiaries 22 70

Other 198 246

Total Receivables from financing activities 11,743 15,973

The decrease of 4,230 million euros in Receivables from financing activities is principally due to the combined effect of the

following matters:

■adecrease of approximately 3,388 million euros arising from the deconsolidation of the subsidiaries whose activities were

transferred to the FAFS joint venture, this mainly affected Receivables from Dealer financing;

■the reduction to zero of Receivables from banking activities due to the disposal of B.U.C.;

■an increase of approximately 1 billion euros in retail financing and dealer financing receivables arising in the financial services

subsidiaries that continue to be consolidated (in particular, the financial services subsidiaries of CNH);

■adecrease of 871 million euros arising from exchange differences.

Receivables from jointly controlled financial services entities include financial receivables due to Fiat entities by the FAFS group.

Receivables from financing activities are shown net of an allowance for doubtful accounts determined on the basis of specific

insolvency risks. At December 31, 2006 the allowance amounts to 331 million euros (523 million euros at December 31, 2005).

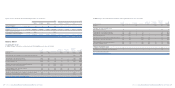

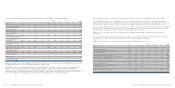

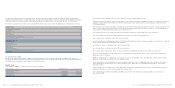

Movements in the allowance accounts during the year are as follows:

At Change in the At

December Use and other scope of December

(in millions of euros) 31, 2005 Provisions changes consolidation 31, 2006

Allowance for receivables regarding:

-Retail financing 197 66 (129) – 134

-Finance leases 98 10 (24) (6) 78

- Dealer financing 102 21 (21) (48) 54

- Supplier financing 28 – (17) – 11

-Receivables from banking activities 39 3(1) (41) –

-Financial receivables from companies under joint control,

associates and unconsolidated subsidiaries – – – – –

- Other 59 3 (8) – 54

Total allowance on Receivables from financing activities 523 103 (200) (95) 331

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 139Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 138

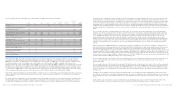

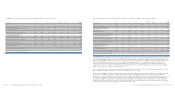

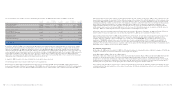

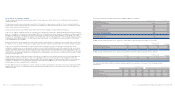

Finance lease receivables relate almost entirely to vehicles of Fiat Auto, Ferrari, Trucks and Commercial Vehicles and Agricultural

and Construction Equipment Sectors leased out under finance lease arrangements and may be analysed as follows stated gross of

an allowance of 78 million euros at December 31, 2006 (98 million euros at December 31, 2005):

At December 31, 2006 At December 31, 2005

due between due between

due within one and due beyond due within one and due beyond

(in millions of euros) one year five years five years Total one year five years five years Total

Receivables for future minimum lease payments 328 403 21 752 433 456 36 925

Less: unrealised interest income (42) (50) (2) (94) (51) (56) (4) (111)

Present value of future minimum lease payments 286 353 19 658 382 400 32 814

There are no contingent rents as finance lease recognised income during 2006 or 2005.

Unguaranteed residual values at December 31, 2006 and 2005 are not significant.

The interest rate implicit in the lease is determined at the commencement of the lease for the whole lease term. The average

interest rate implicit in total finance lease receivables vary depending on prevailing market interest rates.

Receivables for dealer financing are typically generated by sales of vehicles and are generally managed under dealer network

financing programs as a component of the portfolio of the financial services companies. These receivables are interest bearing,

with the exception of an initial limited, non-interest bearing period. The contractual terms governing the relationships with the

dealer networks vary from Sector to Sector and from country to country, although these receivables are collected in approximately

two to four months on average.

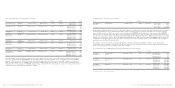

The fair value of receivables from financing activities at December 31, 2006 amounts approximately to 11,282 million euros (15,821

million euros at December 31, 2005) and has been calculated using a discounted cash flow method based on the following discount

rates, adjusted, where necessary,to take account of the specific risk of insolvency of the underlying financial instrument.

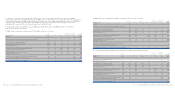

In % EUR USD GBP CAD AUD BRL PLN

Interest rate for six months 3.85 5.37 5.43 4.33 6.55 12.60 4.30

Interest rate for one year 4.03 5.33 5.58 4.31 6.52 12.37 4.55

Interest rate for five years 4.13 5.09 5.37 4.24 6.49 12.12 5.02

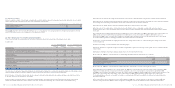

Other receivables

At December 31, 2006, Other receivables mainly consist of Current tax receivables of 808 million euros (778 million euros at

December 31, 2005), Other tax receivables for VAT and other indirect taxes of 971 million euros (1,125 million euros at December

31, 2005) and Receivables from employees of 62 million euros (41 million euros at December 31, 2005).

At the balance sheet date the carrying amount of Other receivables is considered to be in line with their fair value.

20. Accrued income and prepaid expenses

The item Accrued income and prepaid expenses consists mainly of prepaid insurance premiums and rent.