Chrysler 2006 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

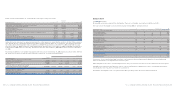

Fiat S.p.A. Financial Statements at December 31, 2006 241Fiat S.p.A. Financial Statements at December 31, 2006240

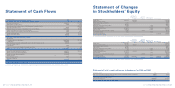

Statement of Changes

in Stockholders’ Equity

Capital increase

for conversion Fair value

of the Mandatory adjustments Valuation of stock

At Convertible recognised directly option plans and Net result for the At

(in thousands of euros) December 31, 2004 Facility in equity other changes period December 31, 2005

Capital stock 4,918,113 1,459,144 6,377,257

Additional paid-in capital – 681,856 681,856

Reserve under law no. 413/1991 22,591 22,591

Legal reserve 446,562 446,562

Reserve for treasury stock in portfolio 26,413 1,297 27,710

Extraordinary reserve 1,632 (1,297) 335

Retained earnings (losses) (813,435) 1,698 (811,737)

Treasury stock (26,413) (1,297) (27,710)

Gains (losses) recognised directly in equity 74,397 59,870 134,267

Stock option reserve 6,062 10,041 16,103

Net result for the period 1,117,325 1,117,325

Total Stockholders’ equity 4,655,922 2,141,000 59,870 10,442 1,117,325 7,984,559

(*) Treasury stock at December 31, 2005 consists of 4,331,708 ordinary shares for a total nominal value of 21,659 thousand euros.

Allocation Fair value

of the net result adjustments Valuation of stock

At for the prior recognised directly option plans and Net result for the At

December 31, 2005 period in equity other changes period December 31, 2006

Capital stock 6,377,257 6,377,257

Additional paid-in capital 681,856 859,000 1,540,856

Reserve under law no. 413/1991 22,591 22,591

Legal reserve 446,562 446,562

Reserve for treasury stock in portfolio 27,710 (3,571) 24,139

Extraordinary reserve 335 5,800 6,135

Retained earnings (losses) (811,737) 258,325 (553,412)

Treasury stock (27,710) 3,571 (24,139)

Gains (losses) recognised directly in equity 134,267 28,497 162,764

Stock option reserve 16,103 11,297 27,400

Net result for the period 1,117,325 (1,117,325) 2,343,375 2,343,375

Total Stockholders’ equity 7,984,559 – 28,497 17,097 2,343,375 10,373,528

(*) Treasury stock at December 31, 2006 consists of 3,773,458 ordinary shares for a total nominal value of 18,867 thousand euros.

(in thousands of euros) 2006 2005

A) Cash and cash equivalents at beginning of period 495 325

B) Cash flows from (used in) operating activities during the period:

Net result for the period 2,343,375 1,117,325

Amortisation and depreciation 2,882 2,918

Non-cash gain from extinguishment of the Mandatory Convertible Facility –(859,000)

Non-cash stock option costs 11,297 10,041

(Impairment losses) reversals of impairment losses of investments (2,099,350) 430,789

Capital losses/gains on the disposal of investments (329) (93)

Change in provisions for employee benefits and other provisions 7,990 2,100

Change in deferred taxes 3,438 277,000

Change in working capital 151,872 (76,028)

Total 421,175 905,052

C) Cash flows from (used in) investment activities:

Investments:

- Recapitalisations of subsidiaries (6,361,126) (165,193)

- Acquisitions (919,412) –

Other investments (tangible and intangible assets and other financial assets) (15,529) (1,808)

Proceeds from the sale of:

-Investments 2,357 –

- Other non-current assets (tangible, intangible and other) 313 261

Total (7,293,397) (166,740)

D) Cash flows from (used in) financing activities:

Change in current financial receivables 2,991,721 (753,091)

Change in non-current financial payables 2,804,767 –

Change in current financial payables 1,070,047 14,548

Capital increase (a) ––

Sale of treasury stock 5,800 401

Dividend distribution ––

Total 6,872,335 (738,142)

E) Total change in cash and cash equivalents 113 170

F) Cash and cash equivalents at end of period 608 495

(a) In 2005, the item “Capital increase” is shown net of the repayment of the Mandatory Convertible Facility (3 billion euros), as it did not give rise to cash flows.

Statement of Cash Flows

(*)

(*)

Statement of total recognised income and expenses for 2006 and 2005

(in thousands of euros) 2006 2005

Gains (losses) recognised directly in the fair value reserve (investments in other companies) 28,497 58,958

Gains (losses) recognised directly in equity 28,497 58,958

Transfer from cash flow hedge reserve –912

Net result for the period 2,343,375 1,117,325

Total of recognised income (expense) for the period 2,371,872 1,177,195