Chrysler 2006 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

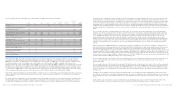

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 133

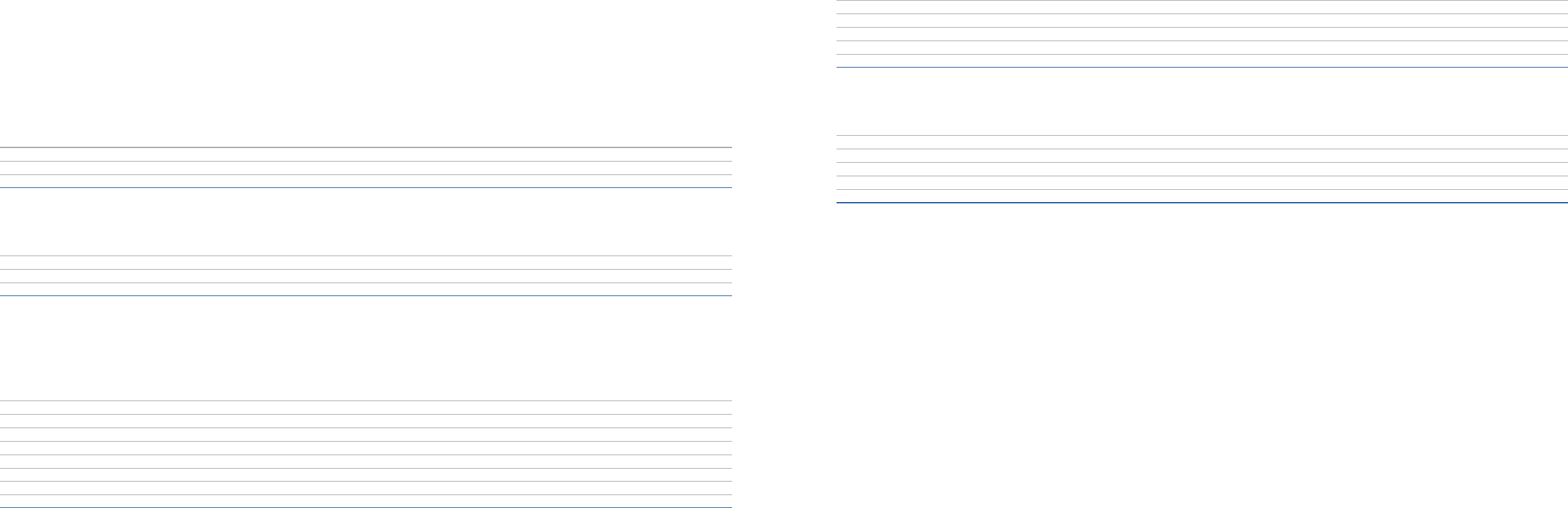

Investments

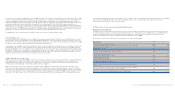

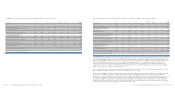

The changes in Investments in 2006 are set out below:

At Acquisitions, Change in the Disposals At

December Revaluations/ Capitalisations scope of Translation and other December

(in millions of euros) 31, 2005 (Write-downs) (Refunds) consolidation differences changes 31, 2006

Unconsolidated subsidiaries 46 (2) 10 – (3) (4) 47

Jointly controlled entities 705 45 113 – (74) 424 1,213

Associates 1,058 82 – 2 (23) (616) 503

Other companies 281 – 6 – – 28 315

Total Investments 2,090 125 129 2 (100) (168) 2,078

Changes in 2005 were as follows:

At Acquisitions, Change in the Disposals At

December Revaluations/ Capitalisations scope of Translation and other December

(in millions of euros) 31, 2004 (Write-downs) (Refunds) consolidation differences changes 31, 2005

Unconsolidated subsidiaries 32 (3) – (3) 2 18 46

Jointly controlled entities 1,790 39 9 (1,210) 95 (18) 705

Associates 1,740 46 12 137 24 (901) 1,058

Other companies 234 (7) 23 (7) – 38 281

Total Investments 3,796 75 44 (1,083) 121 (863) 2,090

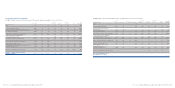

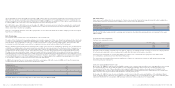

Revaluations and Write-downs consist of adjustments to the carrying value of investments accounted for using the equity method

for the Group’sshare of the result for the year of the investee company for an amount of 125 million euros in 2006 (115 million

euros in 2005). Write-downs also include, in 2006 and in 2005, any loss in value in investments accounted for under the cost method.

Acquisitions and capitalisations amounting to 129 million euros (44 million euros in 2005) include the subscription of 90 million

euros to the capital increase made by FAFS on the formation of the joint venture.

The formation of FAFS resulted in a reduction amounting to 431 million euros of Investments in associates as a consequence

of the purchase of the 51% interest in Fidis Retail Italia held by Synesis Finanziaria S.p.A. for 479 million euros. Additionally,the

simultaneous sale to Sofinco of 50% of its capital in FAFS gave rise to an increase amounting to 528 million euros of Investments

in jointly controlled entities. Such changes are included in the column Disposals and other changes. Also included in the column

Disposals and other changes are fair value gains of 28 million euros arising from the investment in Mediobanca S.p.A.; dividends

of 69 million euros distributed by companies accounted for using the equity method, disposal of associated companies 91 million

euros and other minor decreases of 36 million euros.

In 2005, Disposals and other changes negative for 863 million euros were made up as follows: a decrease of 856 million euros

arising from the sale of the investment in Italenergia Bis S.p.A., as described in Note 6; positive fair value adjustments of 59

million euros arising from the investment in Mediobanca S.p.A.; dividends of 47 million euros distributed by companies accounted

for using the equity method and other, minor decreases of 19 million euros.

Changes in the scope of consolidation of negative 1,083 million euros in 2005 mainly related to the consolidation on a line by line

basis of Fiat Powertrain B.V. (previously Fiat-GM Powertrain), consolidated using the equity method until December 31, 2004,

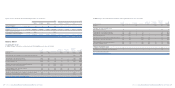

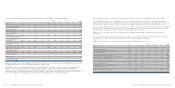

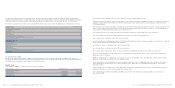

At December 31, 2006, land and industrial buildings of the Group pledged as security for debt amounted to 112 million euros

(195 million euros at December 31, 2005); plant and machinery pledged as security for debt and other commitments amounted

to 65 million euros (61 million euros at December 31, 2005) and other assets pledged totalled 4 million euros (nil at December

31, 2005).

At December 31, 2006, the Group had contractual commitments for the acquisition of property, plant and equipment amounting

to 493 million euros (418 million euros at December 31, 2005).

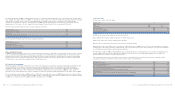

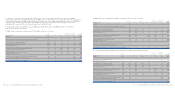

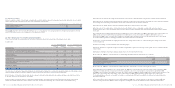

15. Investment property

The Group holds interests in certain property to earn rental income and this property is carried at cost. Changes in this item in

2006 were as follows:

At Divestitures At

December Translation and other December

(in millions of euros) 31, 2005 Additions Depreciation differences changes 31, 2006

Gross carrying amount 36 – – – (9) 27

Less: Depreciation and impairment (10) – (1) – 3 (8)

Net carrying amount of Investment property 26 – (1) – (6) 19

During 2005, changes in Investment properties were as follows:

At Divestitures At

December Translation and other December

(in millions of euros) 31, 2004 Additions Depreciation differences changes 31, 2005

Gross carrying amount 63 – – – (27) 36

Less: Depreciation and impairment (17) – (1) – 8 (10)

Net carrying amount of Investment property 46 – (1) – (19) 26

Rental income from investment property in 2006 amounted to 2 million euros, in line with the 2005 amount.

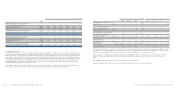

16. Investments and other financial assets

(in millions of euros) At December 31, 2006 At December 31, 2005

Investments:

Investments accounted for using the equity method 1,719 1,762

Investments at fair value with changes directly in equity 274 227

Investments at cost 85 101

Total Investments 2,078 2,090

Receivables 97 113

Other securities 105 130

Total Investments and other financial assets 2,280 2,333

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 132