Chrysler 2006 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

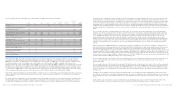

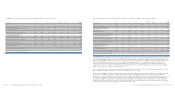

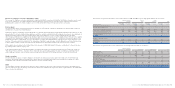

Fair value hedge

Gains and losses resulting from the measurement of interest rate derivative financial instruments using fair value hedging rules

and the gains and losses arising from the hedged item are shown in the following table:

(in millions of euros) 2006 2005

Interest rate risk

- Net gains (losses) on qualifying hedges (107) (105)

- Fair value changes in hedged items 106 105

Net gains (losses) (1) –

The effect of fair value hedges related to exchange rate risk and on other derivative instruments was not material for the years

2006 and 2005.

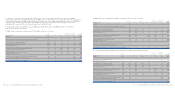

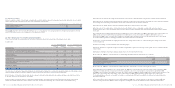

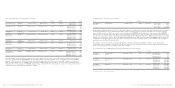

23. Cash and cash equivalents

Cash and cash equivalents include:

(in millions of euros) At December 31, 2006 At December 31, 2005

Cash at banks 6,104 4,529

Cash with a pre-determined use 627 706

Money market securities 1,005 1,182

Total Cash and cash equivalents 7,736 6,417

Amounts shown are readily convertible into cash and are subject to an insignificant risk of changes in value. The carrying amount

of cash and cash equivalent is to be considered in line with their fair value at the balance sheet date.

Cash with a pre-determined use consists principally of cash whose use is restricted to the repayment of the debt related

to securitisations classified in the item Asset-backed financing.

The credit risk associated with Cash and cash equivalents is limited, as contracts are entered into with primary national and

international financial institutions.

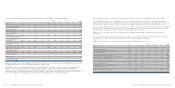

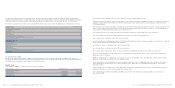

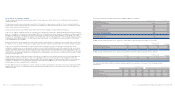

24. Assets and Liabilities held for sale

At December 31, 2006, the items Assets and Liabilities held for sale of respectively 332 million euros and 309 million euros include

the carrying amount of the assets and the liabilities of the subsidiaries Meridian Technologies Inc. and Ingest Facility S.p.A.;

the agreements for the sale of these subsidiaries were signed in 2006 and at the balance sheet date were still subject to the

necessary approvals. The items also include the assets and liabilities at carrying amount of the Indian business of Fiat Auto that

will be transferred to the joint venture with Tata Motors currently being set up.

At December 31, 2005, the items Assets and Liabilities held for sale included the assets and liabilities of the subsidiary Atlanet

S.p.A. at carrying values respectively of 119 million euros and 110 million euros: an agreement for the sale of this subsidiary was

signed with the British Telecom group in 2005 and approved by the antitrust authorities in February 2006.

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 143

(the residual debt of the Exchangeable bond linked to GM ordinary shares). Following the repayment of the majority of this bond

(Note 28), these options are classified as trading instruments, even though they were originally purchased for hedging purposes,

and are measured at their fair value which at December 31, 2006 and 2005 was essentially nil. These options expired unexercised

in January 2007, at the same time as the total extinguishment of the Exchangeable loan.

■For 385 million euros (303 million euros at December 31, 2005), the notional amount of derivatives embedded in certain bonds

with a return linked to stock market indices or inflation rates, as well as the notional amount of the related hedging derivatives,

which convert this to market rate variability.

There are no significant situations at the date of preparation of these financial statements for which hedging exceeds the hedged

future flows (overhedging).

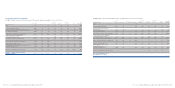

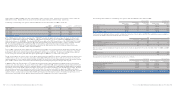

Cash flow hedges

The economic effects mainly refer to the management of the exchange risk.

The policy of the Fiat Group for managing exchange risk normally requires that future cash flows from trading activities which will

occur for accounting purposes within the following twelve months, and from orders acquired (or contracts in progress), whatever

their due dates, to be hedged. As a result, it is considered reasonable to suppose that the hedging effect arising from this and

recorded in the cash flow hedge reserve will be recognised in income, almost entirely during the following year.

Where a derivative financial instrument is designated as a hedge of the exposure to variability in cash flows of a recognised asset

or liability or a highly probable forecasted transaction and could affect income statement, the effective portion of any gain or loss

on the derivative financial instrument is recognised directly in equity.The cumulative gain or loss is removed from equity and

recognised in the profit and loss account at the same time as the economic effect arising from the hedged item affects income.

The gain or loss associated with a hedge or part of a hedge that has become ineffective is recognised in the income statement

immediately. When a hedging instrument or hedge relationship is terminated but the hedged transaction is still expected to occur,

the cumulative gain or loss realised to the point of termination remains in stockholders’ equity and is recognised at the same time

as the related transaction occurs. If the hedged transaction is no longer probable, the cumulative unrealised gain or loss held

in stockholders’ equity is recognised in the income statement immediately.

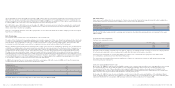

In 2006 the Group transferred to income gains of 6 million euros (gains of 44 million euros in 2005) net of tax effect previously

recognised directly in equity presented in the following line items:

(in millions of euros) 2006 2005

Exchange rate risk

- Increase in Net revenues 21 49

- Decrease/(Increase) in Cost of sales (33) 8

- Result from investments 6–

Interest rate risk

- Financial income (expenses) 1 (15)

Taxes income (expenses) 11 2

Total recognised in the income statement 644

The ineffectiveness of cash flow hedges was not material for the years 2006 and 2005.

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 142