Chrysler 2006 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

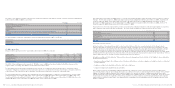

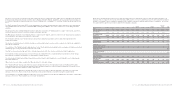

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 171

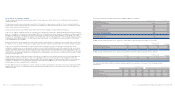

The following is reconciliation between Net financial position as presented in the above table and Net debt as presented in the

Report on Operations:

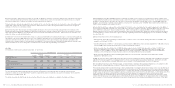

(in millions of euros) At December 31, 2006 At December 31, 2005

Consolidated net debt as presented in the Report on Operations (11,836) (18,523)

Less: Current financial receivables, excluding those due from jointly controlled financial

services companies amounting to 143 million euros at December 31, 2006 11,605 15,973

Net financial position (231) (2,550)

Reference should be made to Notes 19, 21, 22 and 23 and the information provided in Note 28 for a further analysis of the items in

the table.

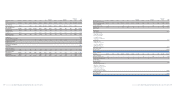

29. Trade payables

An analysis by due date of trade payables at December 31, 2006 is as follows:

At December 31, 2006 At December 31, 2005

due between due between

due within one and due beyond due within one and due beyond

(in millions of euros) one year five years five years Total one year five years five years Total

Trade payables 12,602 1 – 12,603 11,773 4 – 11,777

The carrying amount of Trade payables is considered in line with their fair value at the balance sheet date.

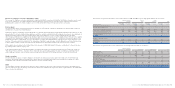

30. Other payables

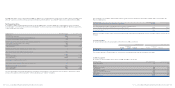

An analysis of Other payables at December 31, 2006 and 2005 is as follows:

(in millions of euros) At December 31, 2006 At December 31, 2005

Current tax payables 311 388

Others:

- Payables to personnel 496 483

-Tax payables 690 581

- Social security payables 341 354

- Advances on buy-back agreements 2,370 2,171

- Other minor 811 844

Total Others 4,708 4,433

Total Other payables 5,019 4,821

31, 2006 (872 million euros at December 31, 2005). In addition, it is recalled that the group’s assets include current receivables and

set-aside cash to be used for settling asset-backed financing of 8,344 million euros (10,729 million euros at December 31, 2005).

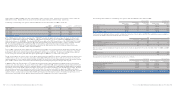

Net financial position

In compliance with Consob Regulation issued on July 28, 2006 and in conformity CESR’sRecommendations for the consistent

implementation of the European Commission’s Regulation on Prospectuses issued on February 10, 2005, the Net financial position

of the Fiat Group is as follows:

(in millions of euros) At December 31, 2006 At December 31, 2005

Liquidity (a): 7,965 6,973

- Cash and cash equivalents 7,736 6,417

- Cash and cash equivalents included as Assets held for sale 5–

- Securities held for trading (Current securities) 224 556

Current financial receivables (Receivables from financing activities) (b): 11,743 15,973

-from jointly controlled financial services entities 143 –

- from other related parties 48 73

- from third parties 11,552 15,900

Current financial receivables included as Assets held for sale (c) 5–

Other current financial assets (Other financial assets) (d) 382 454

Debt (e): 20,188 25,761

- due to related parties 734 365

- due to third parties 19,454 25,396

Debt included as Liabilities held for sale (f) 33 –

Other current financial liabilities (Other financial liabilities) (g) 105 189

Net financial position (h) = (a+b+c+d-e-f-g): (231) (2,550)

- due to related parties (543) (292)

-due to third parties 312 (2,258)

The item Receivables from financing activities includes the entire portfolio of the financial services entities, classified as current

assets as they will be realised during the normal operating cycle of these companies.

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 170