Chrysler 2006 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

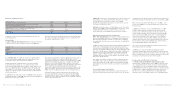

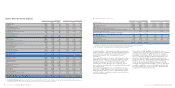

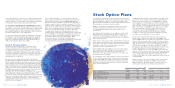

Statement of Cash Flows by Activity Segment

2006 2005

Industrial Financial Industrial Financial

(in millions of euros) Consolidated Activities Services Consolidated Activities Services

A) Cash and cash equivalents at beginning of period 6,417 5,517 900 5,767 4.893 873

B) Cash flows from (used in) operating activities during the period:

Net result for the year 1,151 1,151 287 1,420 1,419 249

Amortisation and depreciation (net of vehicles sold

under buy-back commitments) 2,969 2,639 330 2,590 2,392 198

(Gains)/losses and other non-cash items (a) (568) (921) 66 (1,561) (1,923) 114

Dividends received 69 180 1 47 132 3

Change in provisions 229 251 (22) 797 816 (18)

Change in deferred income taxes (26) 12 (38) 394 438 (43)

Change in items due to buy-back commitments (b) (18) 4(26) (85) (7) (74)

Change in working capital 812 679 136 114 92 13

Total 4,618 3,995 734 3,716 3,359 442

C) Cash flows from (used in) investment activities:

Investments in:

- Tangible and intangible assets (net of vehicles

sold under buy-back commitments) (3,789) (2,854) (935) (3,052) (2,636) (416)

-Investments (1,617) (1,633) (7) (67) (152) (33)

Proceeds from the sale of non-current assets 1,591 1,574 19 500 385 115

Net change in receivables from financing activities (876) 149 (1,025) (251) 409 (660)

Change in current securities 223 65 158 (159) (19) (140)

Other changes (c) 3,078 2,257 822 2.494 2,252 244

Total (1,390) (442) (968) (535) 239 (890)

D) Cash flows from (used in) financing activities:

Net change in financial payables and other financial

assets/liabilities (d) (1,730) (2,256) 526 (2,839) (3,159) 321

Increase in capital stock (d) 16 16 21 – – 119

Disposal of treasury stock 66– –––

Dividends paid (23) (23) (112) (29) (29) (88)

Total (1,731) (2,257) 435 (2,868) (3,188) (352)

Translation exchange differences (173) (102) (71) 337 214 123

E) Total change in cash and cash equivalents 1,324 1,194 130 650 624 27

F) Cash and cash equivalents at end of period 7,741 6,711 1,030 6,417 5,517 900

of which: cash and cash equivalents included among

Assets held for sale 55– –––

G) Cash and cash equivalents at end of period as reported

in the financial statements 7,736 6,706 1,030 6,417 5,517 900

(a) In 2005 this item included, among others, the unusual financial income of 858 million euros arising from the conversion of the Mandatory Convertible Facility and the gain of 878 million euros

realised on the sale of the investment in Italenergia Bis.

(b) The cash flows for the two periods generated by the sale of vehicles under buy-back commitments, net of the amount already included in the result, are included in operating activities for the

period in a single item which includes the change in working capital, capital expenditures, depreciation, gains and losses and proceeds from sales at the end of the contract term, relating to

assets included in “Property, plant and equipment”.

(c) The item Other changes includes, for approximately 3 billion euros, reimbursement of loans extended by the Group’s centralised cash management to the financial services companies of Fiat

Auto transferred to the FAFS joint venture. In 2005, the item included, for approximately 2 billion euros, the repayment of the loans granted by the Group’s centralised cash management to

the financial services companies sold by Iveco and, approximately 500 million euros, the effects of the unwinding of the joint ventures with General Motors.

(d) During 2005, the item Increase in capital stock was stated net of the repayment of the Mandatory Convertible Facility (3 billion euros) and of debt of approximately 1.8 billion euros connected

with the Italenergia Bis transaction, as neither of these gave rise to cash flows.

Report on Operations Financial Review of the Group 47

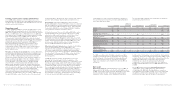

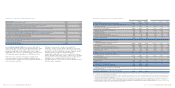

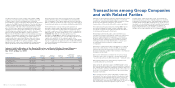

Statement of Changes in Net Industrial Debt

(in millions of euros) 2006 2005

Net industrial debt at beginning of period (3,219) (9,447)

- Net income 1,151 1,419

- Amortisation and depreciation (net of vehicles sold under buy-back commitments) 2,639 2,392

- Change in provisions for risks and charges and other changes (474) (544)

Cash flows from (used in) operating activities during the period, net of change in working capital 3,316 3,267

- Change in working capital 679 92

Cash flows from (used in) operating activities during the period 3,995 3,359

- Investments in tangible and intangible assets (net of vehicles sold under buy-back commitments) (2,854) (2,636)

Cash flows from (used in) operating activities during the period, net of capital expenditures 1,141 723

- Net change in receivables from financing activities 149 409

-Change in scope of consolidation and other changes 106 2,285

Net cash flows from (used in) industrial activities excluding capital contributions and dividends paid 1,396 3,417

- Capital increases, dividends, and purchase/disposal of treasury stock (1) 2,971

- Translation exchange differences 51 (160)

Change in net industrial debt 1,446 6,228

Net industrial debt at end of period (1,773) (3,219)

Report on Operations Financial Review of the Group46

During 2006 net industrial debt decreased by 1,446 million

euros, mainly due to the positive operating performance. Cash

flow generated by operating activities during the period was

positive by 3,995 million euros (679 million euros of which

attributable to the decrease in working capital), and more than

offset industrial capital expenditures of 2,854 million euros.

Furthermore, the collection of financial receivables from

associated companies and sold companies (Atlanet S.p.A.)

and of financial receivables from others generated 149 million

euros in positive cash flow.

During the fiscal year, the outlay connected with the

repurchase of 29% of Ferrari (total of 919 million euros) was

more than compensated by the proceeds (included in the item

Change in scope of consolidation and other changes), mainly

deriving from the transaction with Crédit Agricole

(approximately 360 million euros) the sale of B.U.C. – Banca

Unione di Credito (254 million euros), of Machen Iveco Holding

SA (which held a 51% shareholding in Ashok Leyland Ltd) for

88 million euros, of Atlanet S.p.A., Sestrieres S.p.A.,

Immobiliare Novoli S.p.A., IPI S.p.A. (total of 120 million euros)

and other minor companies.