Chrysler 2006 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 115

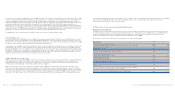

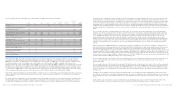

11. Income taxes

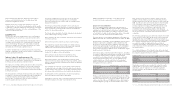

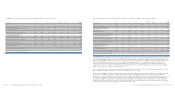

Income taxes consist of the following:

(in millions of euros) 2006 2005

Current taxes:

- IRAP 149 116

- Other taxes 346 184

Total Current taxes 495 300

Deferred taxes for the period (61) 425

Taxes relating to prior periods 56 119

Total Income taxes 490 844

In 2006, the decrease in the charge for income taxes reflects:

■the reduced effect arising from the realisation of deferred tax assets;

■adecrease in the level of taxes relating to prior periods;

■an increase in current taxes arising from the increase in operating results.

Deferred tax income of 61 million euros (net expense of 425 million euros in 2005) is the net effect of the recognition of deferred

tax during the year and the realisation of deferred tax assets recognised in prior years. Taxes relating to prior periods include the

cost of finalising certain disputes with foreign tax authorities.

The effective tax rate for 2006 (excluding IRAP) was 21% (which represents a considerable decrease over the corresponding rate

of 32% in 2005) and is the result of an increased utilisation of prior year tax losses and temporary differences for which no

deferred tax assets had been recognised in prior years.

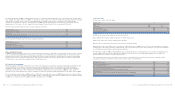

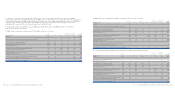

The reconciliation between the tax charges recorded in the consolidated financial statements and the theoretical tax charge,

calculated on the basis of the theoretical tax rate in effect in Italy,is the following:

(in millions of euros) 2006 2005

Theoretical income taxes 542 747

Tax effect of permanent differences (2) (452)

Taxes relating to prior years 56 119

Effect of difference between foreign tax rates and the theoretical Italian tax rate (29) (3)

Effect of unrecognised deferred tax assets (189) 504

Use of tax losses for which deferred tax assets had not been recognised (50) (83)

Other differences 13 (104)

Current and deferred income tax recognised in the financial statements, excluding IRAP 341 728

IRAP 149 116

Income taxes recorded in financial statements (current and deferred income taxes) 490 844

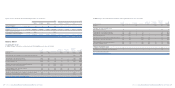

Net financial expenses in 2006 (excluding financial services companies) totalled 576 million euros, decreasing from the 843 million

euros in 2005. The improvement over 2005 is a consequence of the lower level of debt in the Group’s Industrial Activities (amongst

other things, as a result of the conversion of the Mandatory Convertible Facility and the completion of the Italenergia Bis

operation, both of which took place in the third quarter of 2005), and net financial income of 71 million euros arising from the

equity swaps on Fiat shares, set up to support stock option plans (further details of this are provided in Note 22).

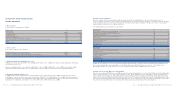

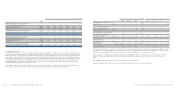

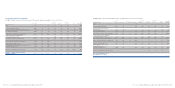

Interest earned and other financial income may be analysed as follows:

(in millions of euros) 2006 2005

Interest income from banks 106 41

Interest income from securities 17 25

Commissions 22

Other interest earned and financial income 170 190

Total Interest earned and other financial income 295 258

Interest and other financial expenses may be analysed as follows:

(in millions of euros) 2006 2005

Interest expenses on bonds 528 524

Bank interest expenses 307 397

Interest expenses on trade payables 10 11

Other interest and financial expenses 771 763

Total Interest and other financial expenses 1,616 1,695

Unusual financial income

In 2005 the item Unusual financial income consisted of income amounting to 858 million euros arising from the increase of capital

stock on September 20, 2005 and the simultaneous extinguishment of the Mandatory Convertible Facility (see Notes 25 and 28).

In particular, this income corresponded to the difference between the subscription price of 10.28 euros per share and the market

value of 7.337 euros per share at the subscription date, net of associated costs. This operation led to an increase in capital stock

of 1,459 million euros and in other equity reserves of 682 million euros.

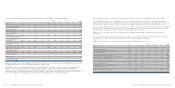

10. Result from investments

This item includes the Group’s interest in the net result of the companies accounted for using the equity method, the write-downs

connected with the loss in value of financial assets and any reinstatement of value, the write-downs of equity investments

classified as held for sale, accruals to provisions against equity investments, income and expense arising from the adjustment

to fair value of investments in other entities held for trading, and dividend income. In particular, in 2006 there was a profit of

125 million euros representing the net result of companies accounted for using the equity method (profit of 115 million euros in 2005).

The net result from investments in 2006 amounts to 156 million euros (34 million euros in 2005) and includes (amounts in millions

of euros): Fiat Auto Sector companies 38 (57 in 2005), entities of Agricultural and Construction Equipment Sector companies 46 (39

in 2005), Iveco companies 31 (-51 in 2005) and other companies 41 (-11 in 2005).

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 114