Chrysler 2006 Annual Report Download - page 127

Download and view the complete annual report

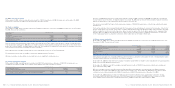

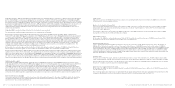

Please find page 127 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements 251Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements250

Use of estimates

The preparation of financial statements and related disclosures

that conform to IFRS requires management to make estimates

and assumptions that affect the reported amounts of assets

and liabilities and the disclosure of contingent assets and

liabilities at the date of the financial statements. Actual results

could differ from those estimates. Estimates are used in

accounting for depreciation and amortisation, impairment

losses and reversals of impairment losses on investments, the

margins earned on construction contracts, employee benefits,

taxes and provisions. Estimates and assumptions are reviewed

periodically and the effects of any changes are recognised in

the period in which the estimate is revised if the revision

affects only that period, or in the period of the revision and

future periods if the revision affects both current and future

periods.

New accounting principles

In August 2005, the IASB issued IFRS 7 – Financial Instruments:

Disclosures and a complementary amendment to IAS 1

Presentation of Financial Statements – Capital Disclosures.

IFRS 7 requires disclosures about the significance of financial

instruments for an entity’sfinancial position and performance.

These disclosures incorporate many of the requirements

previously included in IAS 32 – Financial Instruments:

Disclosure and Presentation.IFRS 7 also requires information

about the extent to which the entity is exposed to risks arising

from financial instruments, and a description of management’s

objectives, policies and processes for managing those risks.

The amendment to IAS 1 introduces requirements for

disclosures about an entity’s capital.

IFRS 7 and the amendment to IAS 1 are effective for annual

periods beginning on or after January 1, 2007. The Company

early adopted IFRS 7 for the annual period beginning January

1, 2006. Comparative data for the Notes envisaged in

paragraphs 31 and 42 of said standard are not provided, in

accordance with the transitional provisions of paragraph 44.

On November 2, 2006, the IFRIC issued an interpretation of

IFRS 2 (IFRIC Interpretation 11 – IFRS 2 – Group and Treasury

Share Transactions). This interpretation establishes that share-

based payment arrangements in which an entity receives

services as consideration for its own equity instruments must

be accounted for as equity-settled. IFRIC Interpretation 11 is

effective from January 1, 2008. The Company early adopted

this interpretation on January 1, 2006 and no significant effects

arose from this.

Risk management

The risks to which Fiat S.p.A. is exposed, either directly or

indirectly through its subsidiaries, are the same as those of the

companies of which it is the Parent. Reference should therefore

be made to the note on Risk Management included as part of

the Notes to the Consolidated Financial Statements of the Fiat

Group as well as to Note 29.

Provisions

The company recognises provisions when it has a legal or

constructive obligation to third parties, when it is probable

that the settlement of the obligation will require the outflow

of resources and when a reliable estimate can be made for

the amount of the obligation.

Changes in estimates are recognised in the Income Statement

for the period in which the change occurs.

Treasury stock

The cost of purchase of treasury stock is accounted for as a

reduction of equity. The effects of any subsequent transactions

with those shares are similarly recognised directly in equity.

Dividends received and receivable

Dividends received and receivable from investments are

recognised in the Income Statement when the right to receive

the payment of this income is established and only if declared

from post-acquisition net income.

If dividends are declared from pre-acquisition net income,

those dividends are deducted from the cost of the investment.

Revenue recognition

Revenue is recognised to the extent that it is probable that

economic benefits will flow to the company and when the

amount of revenue can be measured reliably.Revenue is

presented net of any adjusting items.

Revenue from services and revenue from construction

contracts is recognised by reference to the stage of completion

(the percentage of completion method). Revenues arising from

royalties are recognised on an accrual basis in accordance with

the terms of the relevant agreement.

Financial income and expenses

Financial income and expenses are recognised and measured

in the Income Statement on an accrual basis.

Taxes

The tax charge for the period is determined on the basis of

prevailing laws and regulations. Income taxes are recognised

in the Income Statement other than those relating to items

credited or charged directly to equity, in which case income

taxes are also recognised directly in equity.

Deferred tax assets and liabilities are determined on the basis

of all the temporary differences between the carrying amount

of an asset or liability in the Balance Sheet and its

corresponding tax basis. Deferred tax assets resulting from

unused tax losses and temporary differences are recognised

to the extent that it is probable that future taxable profit will

be available against which they can be utilised. Current and

deferred income taxes and liabilities are offset when there is

alegally enforceable right to offset. Deferred tax assets and

liabilities are measured by using the tax rates that are

expected to apply to the period when the asset is realised

or the liability is settled.

Fiat S.p.A. and almost all its Italian subsidiaries have elected to

take part in the national tax consolidation programme pursuant

to articles 117/129 of the Consolidated Income Tax Act

(T.U.I.R.); the election has been made for a three year period

beginning in 2004.

Fiat S.p.A. acts as the consolidating company in this programme

and calculates a single taxable base for the group of companies

taking part, thereby enabling benefits to be realised from

offsetting taxable income and tax losses in a single tax return.

Each company participating in the consolidation transfers its

taxable income or tax loss to the consolidating company and

Fiat S.p.A. recognises a receivable from that company for the

amount of IRES corporate income tax paid over on its behalf. In

the case of a company bringing a tax loss into the consolidation

Fiat S.p.A. recognises a payable to that company for the amount

of the loss actually set off at a group level.

Dividends

Dividends payable are recognised as a change in stockholders’

equity in the period in which their distribution is approved by

stockholders.