Chrysler 2006 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 117

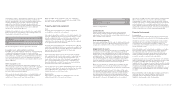

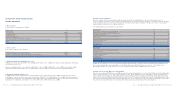

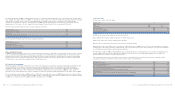

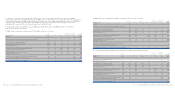

Deferred tax assets and deferred tax liabilities may be analysed by source as follows:

Translation

At Recognised Changes in differences At

December in income Charged the scope of and other December

(in millions of euros) 31, 2005 statement to equity consolidation changes 31, 2006

Deferred tax assets arising from:

- Taxed provisions 1,396 126 – (1) (32) 1,489

- Inventories 223 – – – (3) 220

-Taxed allowances for doubtful accounts 142 39 – (2) (7) 172

-Employee benefits 675 (15) – (2) (47) 611

- Write-downs of financial assets 1,073 (602) – (2) (3) 466

- Measurement of derivative financial instruments 22 124 (20) – (6) 120

- Other 1,099 (320) – (12) (21) 746

Total Deferred tax assets 4,630 (648) (20) (19) (119) 3,824

Deferred tax liabilities arising from:

- Accelerated depreciation (533) 8 – 20 17 (488)

- Deferred tax on gains (83) 71 – – (2) (14)

- Capital investment grants (27) 10 – – – (17)

- Employee benefits (24) (8) – 1 – (31)

-Capitalisation of development costs (822) (89) – – 5 (906)

- Other (1,011) (125) (15) 6 45 (1,100)

Total Deferred tax liabilities (2,500) (133) (15) 27 65 (2,556)

Theoretical tax benefit arising from tax loss carryforwards 5,011 804 – (72) (42) 5,701

Adjustments for assets whose recoverability is not probable (5,442) 38 –41 (9) (5,372)

Total Deferred tax assets, net of Deferred tax liabilities 1,699 61 (35) (23) (105) 1,597

The decision to recognise deferred tax assets is taken by each company in the Group by assessing critically whether the conditions

exist for the future recoverability of such assets on the basis of updated strategic plans, accompanied by the related tax plans. For

this reason, the total theoretical future tax benefits arising from deductible temporary differences (3,824 million euros at December

31, 2006 and 4,630 million euros at December 31, 2005) and tax loss carryforwards (5,701 million euros at December 31, 2006 and

5,011 million euros at December 31, 2005) have been reduced by 5,372 million euros at December 31, 2006 and 5,442 million euros

at December 31, 2005.

In particular, Deferred tax assets, net of Deferred tax liabilities, include 1,150 million euros at December 31, 2006 (965 million euros

at December 31, 2005) of tax benefits arising from tax loss carryforwards. At December 31, 2006, a further tax benefit of 4,551

million euros (4,046 million euros at December 31, 2005) arising from tax loss carryforwards has not been recognised.

Deferred taxes have not been provided on the undistributed earnings of subsidiaries since the Group is able to control the timing

of the distribution of these reserves and it is probable that they will not be distributed in the foreseeable future.

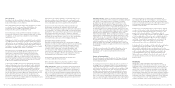

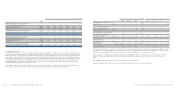

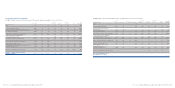

The totals of deductible and taxable temporary differences and accumulated tax losses at December 31, 2006, together with the

amounts for which deferred tax assets have not been recognised, analysed by year of expiry, are as follows:

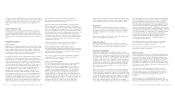

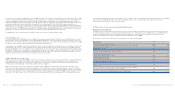

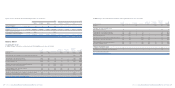

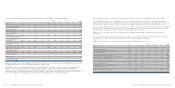

In order to render the reconciliation between income taxes recorded in the financial statements and theoretical income taxes more

meaningful, the IRAP tax is not taken into consideration. Since the IRAP tax has a taxable basis that is different from income before

taxes, it generates distortions between one year and another. Accordingly, theoretical income taxes are determined by applying

only the tax rate in effect in Italy (IRES equal to 33% in 2006 and in 2005) to income before taxes.

Permanent differences in the above reconciliation include the tax effect of non-taxable income of 206 million euros in 2006

(677 million euros in 2005) and of non-deductible costs of 204 million euros in 2006 (225 million euros in 2005). In particular, in

2005 the tax effect of permanent differences arose principally from the theoretical tax effect of 283 million euros on the unusual

financial income relating to the Mandatory Convertible Facility (gross 858 million euros) and that of 290 million euros arising from

the sale of Italenergia Bis S.p.A. (gross 878 million euros).

The reconciliation includes a positive effect of 189 million euros resulting from the recognition of net deferred tax assets not

recognised in prior years (the effect of this was negative in 2005 as the deferred tax assets originating during the year were not

recognised).

In 2006, Other differences included unrecoverable withholding tax for 20 million euros (21 million euros in 2005).

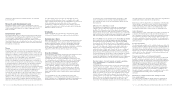

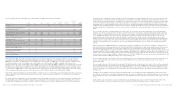

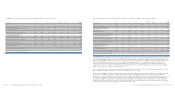

Net deferred tax assets at December 31, 2006 consist of deferred tax assets, net of deferred tax liabilities, which have been offset

where possible by the individual consolidated companies. The net balance of Deferred tax assets and Deferred tax liabilities may

be analysed as follows:

(in millions of euros) At December 31, 2006 At December 31, 2005 Change

Deferred tax assets 1,860 2,104 (244)

Deferred tax liabilities (263) (405) 142

Net deferred tax assets 1,597 1,699 (102)

The reduction in net deferred tax assets, as analysed in the following table, is mainly due to:

■negative exchange differences and other changes amounting to 105 million euros;

■the corresponding tax effect of items recorded directly in equity amounting to 35 million euros;

■changes in the scope of consolidation due to the sale of a subsidiary (B.U.C.) and to the deconsolidation of the Fiat Auto Sector

financial subsidiaries which were transferred to the FAFS joint venture for 23 million euros.

These components of the reduction were partly offset by the recognition of deferred tax assets, net of the realisation of deferred

tax assets recognised in prior years.

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 116