Chrysler 2006 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements 263Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements262

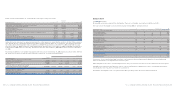

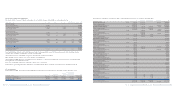

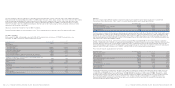

Investments in subsidiaries and changes that occurred during the year are set out in the following table:

At Acquisitions/ Disposals/ Capital (Imp. losses)/ At

(in thousands of euros) %interest December 31,2005 Capital increases reimbursements rev. of imp. losses December 31, 2006

Fiat Partecipazioni S.p.A. 100.00 580,792 6,000,000 1,388,000 7,968,792

-Gross carrying amount 5,983,792 6,000,000 11,983,792

-Accumulated impairment losses (5,403,000) 1,388,000 (4,015,000)

Fiat Netherlands Holding N.V. 60.56 2,725,683 121,126 (647,476) 95,536 2,294,869

-Gross carrying amount 3,767,033 121,126 (1,593,290) 2,294,869

-Accumulated impairment losses (1,041,350) 945,814 95,536 –

Iveco S.p.A. 60.56 647,476 945,814 1,593,290

-Gross carrying amount 1,593,290 1,593,290

-Accumulated impairment losses (945,814) 945,814 –

Ferrari S.p.A. 85.00 160,675 896,012 (1,484) 1,055,203

-Gross carrying amount 160,675 896,012 (1,484) 1,055,203

-Accumulated impairment losses – –

Magneti Marelli Holding S.p.A. 99.99 811,153 811,153

-Gross carrying amount 811,153 811,153

-Accumulated impairment losses – –

Teksid S.p.A. 84.79 75,851 75,851

-Gross carrying amount 128,837 128,837

-Accumulated impairment losses (52,986) (52,986)

Comau S.p.A. 100.00 140,613 240,000 (330,000) 50,613

- Gross carrying amount 182,413 240,000 422,413

-Accumulated impairment losses (41,800) (330,000) (371,800)

Business Solutions S.p.A. 100.00 36,304 36,304

-Gross carrying amount 88,360 88,360

-Accumulated impairment losses (52,056) (52,056)

Itedi - Italiana Edizioni S.p.A. 100.00 25,899 25,899

-Gross carrying amount 25,899 25,899

-Accumulated impairment losses – –

IHF - Internazionale Holding Fiat S.A. 100.00 33,445 33,445

-Gross carrying amount 33,445 33,445

-Accumulated impairment losses – –

Fiat Finance S.p.A. 100.00 222,263 222,263

-Gross carrying amount 222,263 222,263

-Accumulated impairment losses – –

Fiat Finance North America Inc. 39.47 15,557 15,557

-Gross carrying amount 17,118 17,118

-Accumulated impairment losses (1,561) (1,561)

Fiat U.S.A. Inc. 100.00 27,258 27,258

- Gross carrying amount 34,645 34,645

-Accumulated impairment losses (7,387) (7,387)

Other minor 1,047 144 (450) 741

-Gross carrying amount 1,935 144 (1,216) 863

-Accumulated impairment losses (888) 766 (122)

Total investments in subsidiaries 4,856,540 7,904,758 (649,410) 2,099,350 14,211,238

-Gross carrying amount 11,457,568 8,850,572 (1,595,990) – 18,712,150

- Accumulated impairment losses (6,601,028) (945,814) 946,580 2,099,350 (4,500,912)

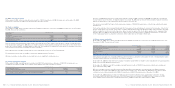

12. Property, plant and equipment

The main classes of property, plant and equipment and related changes during 2006 are summarised below:

At (Decreases) and At

(in thousands of euros) December 31, 2005 Additions Amortisation Other changes December 31, 2006

Land and buildings

- Gross carrying amount 45,946 – – – 45,946

- Accumulated depreciation (11,516) – (1,304) – (12,820)

- Net carrying amount 34,430 – (1,304) – 33,126

Plant and machinery

-Gross carrying amount 10,086 30––10,116

- Accumulated depreciation (8,161) – (989) – (9,150)

- Net carrying amount 1,925 30 (989) – 966

Other tangible assets

- Gross carrying amount 5,630 483 – (61) 6,052

- Accumulated depreciation (2,327) – (468) (96) (2,891)

- Net carrying amount 3,303 483 (468) (157) 3,161

Total property, plant and equipment

-Gross carrying amount 61,662 513 –(61) 62,114

-Accumulated depreciation (22,004) –(2,761) (96) (24,861)

-Net carrying amount 39,658 513 (2,761) (157) 37,253

Land and buildings include land for 610 thousand euros (unchanged with respect to the previous year) while buildings mainly

comprise the company’sheadquarters in Turin, Via Nizza 250.

Plant and machinery is principally made up of general plant used in the buildings.

Other tangible assets comprise cars, office furniture and equipment.

At December 31, 2006, there are no tangible assets in progress or contractual commitments to purchase items of property, plant

and equipment of a significant amount.

There are no buildings charged as collateral or whose use is restricted.

Depreciation of property, plant and equipment is recognised under Other operating costs in the Income Statement (Note 6).

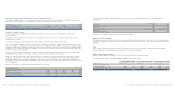

13. Investments

At December 31, 2006, investments total 14,499,595 thousand euros and underwent the following changes during the year:

(Impairment losses)

Disposals/ reversal of imp.

At Acquisitions/ Capital losses/ adjustments At

(in thousands of euros) December 31, 2005 Capital increases reimbursements to fair value December 31, 2006

Investments in subsidiaries 4,856,540 7,904,758 (649,410) 2,099,350 14,211,238

Investments in other companies 260,992 18,111 (19,243) 28,497 288,357

Total Investments 5,117,532 7,922,869 (668,653) 2,127,847 14,499,595