Chrysler 2006 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

or presumed violations of the code of conduct, financial and/or

accounting fraud against the company, oppressive behaviour

towards employees or third parties, and complaints regarding

bookkeeping, internal audits, and independent audits.

The Procedure for the Engagement of Auditing Firms regulates

the engagement of Group external auditors by Fiat S.p.A. and its

subsidiaries, as well as the commissioning of the companies and

professional firms that maintain an ongoing relationship with

those external auditors (so-called network) in order to ensure the

mandatory independence of the auditing firm.

Documents and financial information regarding the Company,

including those posted on the Group website, are disclosed

in compliance with the “Disclosure Controls & Procedures”

adopted in conformity with the Securities Exchange Act of

1934 and the Sarbanes Oxley Act of 2002.

Board of Statutory Auditors

The Board of Statutory Auditors is comprised of three

Statutory Auditors and three Alternates, all of whom,

as required by Article 17 of the By-laws, must be entered in

the Auditors’ Register and have at least three years’ experience

as chartered accountants. Furthermore, they may not hold

the position of statutory auditor in more than five other listed

companies, with the exception of the controlling companies

and subsidiaries of Fiat S.p.A.

Pursuant to the resolutions approved by the Stockholders

Meeting held May 3, 2006, the following individuals belong to the

Board of Statutory Auditors, which also performs the role of the

audit committee as envisaged by US-law, but within the limits

imposed by Italian law: Carlo Pasteris, Chairman, and Giuseppe

Camosci and Cesare Ferrero, Statutory Auditors. Their term

expires on the date of the stockholders meeting that approves

the 2008 financial statements. Carlo Pasteris holds the position of

Chairman of the Board of Statutory Auditors of Toro

Assicurazioni S.p.A. Cesare Ferrero, in addition to the positions

held as Chairman of the Board of Statutory Auditors of IFIL

Investments S.p.A. and Giovanni Agnelli & C. S.a.p.A., also holds

the position of statutory auditor at Toro Assicurazioni S.p.A. and

of director at Autostrada Torino Milano S.p.A. and Davide

Campari Milano S.p.A. Giuseppe Camosci does not hold other

positions in listed companies.

Thus far, the Board has approved Stock Option Plans offered to

about 900 managers of the Group’s Italian and foreign companies

who are qualified as “Direttore” or have been included in the

Management Development Program for high-potential managers.

Plan regulations share these common features:

■Options are granted to individual managers on the basis

of objective parameters that take into account the level

of responsibility assigned to each person and his or her

performance;

■If employment is terminated or an employee’s relationship

with the Group is otherwise severed, options that are not

exercisable become null and void. However,vested options

may be exercised within 30 days from the date of termination,

with certain exceptions;

■The options exercise price, which is determined on the basis

of the average stock market price for the month preceding the

option grant, can vary as a result of transactions affecting the

Company’scapital stock. It must be paid in cash upon

the purchase of the underlying shares;

■Consistently with tax regulations on the issue, the options

are normally exercisable starting three years after they are

granted and for the following six years. Nevertheless,

the totality of the options granted becomes exercisable only

four years after the grant date.

In consideration of the options that have been exercised and

of those that have expired upon termination of employment,

atotal of 5,433,900 option rights corresponding to the same

number of shares represent treasury stock to be assigned to

the holders of options pursuant to the conditions envisaged

in the specific Regulations.

Report on Operations Stock Options Plans 5352

In accordance with Article 17 of the Company’s By-laws

and as envisaged under the Consolidated Law on Financial

Intermediation, properly organised minority groups may

appoint one Statutory Auditor. The minimum equity interest

needed to submit a slate of candidates is equal to 1% of the

ordinary capital. Furthermore, in accordance with the By-laws,

the slates of candidates must be deposited at the registered

office of the company at least ten days before the scheduled

date of the Stockholders Meeting on its first call and be

accompanied by statements certifying satisfaction of the

requirements prescribed by law and the By-laws and that they

are not ineligible or incompatible, on penalty of rejection of

those slates. Slates representing minority stockholders were

presented for the first time ever at the May 3, 2006

Stockholders Meeting. This led to the appointment

of Professor Pasteris, who became the Chairman of the Board

of Statutory Auditors in accordance with the law.

Stock Option Plans

In 2004 the Board of Directors granted Mr. Sergio Marchionne,

as a portion of his variable compensation as Chief Executive

Officer, options for the purchase of 10,670,000 Fiat ordinary

shares at the price of 6.583 euros per share, exercisable from

June 1, 2008 to January 1, 2011. In each of the first three years

since the grant, he accrues the right to purchase, from June 1,

2008, a maximum of 2,370,000 per year and on June 1, 2008

he accrues the right to purchase, effective that date, the

residual portion amounting 3,560,000 shares. The right to

exercise the options related to this last portion of shares

is subject to certain predetermined profitability targets that

should be reached during the reference period.

Ferrari S.p.A. had granted its Chairman, Luca Cordero di

Montezemolo, options for the purchase of 184,000 Ferrari

shares, 80,000 of which exercisable upon placement of Ferrari

shares on the stock market, at a price of 175 euros per share

and exercisable until December 31, 2010. At the beginning of

2006, Mr.Montezemolo exercised the 104,000 options whose

exercise was not subject to the abovementioned condition

through the subscription of an equal number of newly-issued

Ferrari S.p.A. shares. Fiat S.p.A. purchased from Luca

Cordero di Montezemolo a total of 93,600 Ferrari shares at a

unit price of 285 euros per share (for a total investment of 26.6

million euros), equal to the price agreed upon by Mediobanca

S.p.A. and Mubadala Development Company PJSC on the

occasion of the sale of 5% of the capital stock of Ferrari S.p.A.

in August 2005.

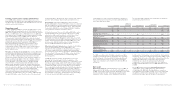

Options granted as part of Stock Option Plans on Fiat shares

and outstanding at December 31, 2006 are shown below.

Options granted to Board Members are instead shown in a

specific table in the Notes to the Financial Statements.

Report on Operations Corporate Governance

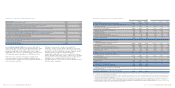

2006 2005

Number of Average Market Number of Average Market

shares exercise price (*) price shares exercise price (*) price

Options outstanding on 1/1 7,749,500 17.51 7.37 10,502,543 16.38 5.9

Options granted during the year – – – – – –

Options exercised during the year 558,250 10.4 13.74 – – –

Expired options 1,757,350 – – 2,753,043 – –

Options outstanding on 12/31 5,433,900 16.93 14.42 7,749,500 17.51 7.37

Options exercisable on 12/31 5,433,900 16.93 14.42 6,987,875 18.28 7.37

(*) Following the capital increases in January 2002 and July 2003 the exercise prices were adjusted by applying the factors calculated by Borsa Italiana, in the amount of 0.98543607 and

0.93167321. The capital increase of September 2005, factor equal to 1, did not give rise to adjustments.