Chrysler 2006 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements 275Fiat S.p.A. Financial Statements at December 31, 2006 - Notes to the Financial Statements274

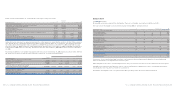

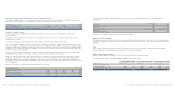

stock option plans. For the stock options plans of July 2004 and November 2006, the fair value calculated at the grant date used

to determine the compensation expense to be accrued, based on a binomial pricing model is based on the following assumptions:

Plan of July 2004 Plan of November 2006

Average unit fair value at grant date 2.440 3.99

Price of Fiat S.p.A. ordinary shares at grant date (euros) 6.466 14.425

Historical volatility of Fiat S.p.A. ordinary share (%) 29.37 28.33

In addition, it is recalled that the dividend payment rate used in the determination of the fair value at the plan grant date in July

2004 was assumed to be zero, based on the experience in the period from 2003 to 2005. In determining the fair value of the

November 2006 plan the recent statements made on future dividend prospects have been considered instead (25% of consolidated

income).

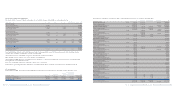

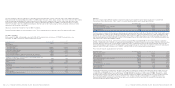

The following disclosures complete the information provided on equity items:

Availability for use of equity items

(in thousands of euros) At December 31, 2006 Possible use Available amount

Capital stock 6,377,257

Reserves:

- Additional paid-in capital 1,540,856 A, B, C (*) 1,540,856

-Reserve under Law no. 413/1991 22,591 A, B, C 22,591

- Legal reserve 446,562 B –

- Reserve for treasury stock in portfolio 24,139 – –

- Extraordinary reserve 6,135 A, B, C 6,135

- Gains (losses) recognised directly in equity 162,764 – –

- Stock option reserve 27,400 – –

Total 8,607,704

Key:

A: capital increase

B: coverage of losses

C: dividend

(*) Fully available to increase capital and cover losses. Any other use requires an increase of the legal reserve up to 20% of capital stock (this may also be carried out by making a transfer from

additional paid-in capital itself). The increase required for this at December 31, 2006 would be 828,889 thousand euros.

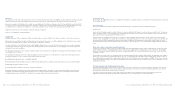

Asummary of outstanding stock option plans at December 31, 2006 is as follows:

Managers compensation Compensation as member of the Board

Average remaining Average remaining

No. of options No. of options contractual life No. of options No. of options contractual life

outstanding at outstanding at (in years) at outstanding at outstanding at (in years) at

Exercise price (euros) December 31, 2006 December 31, 2005 December 31, 2006 December 31, 2006 December 31, 2005 December 31, 2006

6.583 –––10,670,000 10,670,000 4.0

10.397 2,117,000 3,046,500 3.7 –––

12.699 –– – 1,000,000 1,000,000 3.0

13.37 (*) 10,000,000 – 7.8 10,000,000 – 7.8

16.526 1,943,500 2,299,000 2.8 –– –

23.708 –––1,000,000 1,000,000 1.8

24.853 80,000 300,000 2.2 –––

25.459 –– – 250,000 250,000 1.6

26.120 241,900 316,000 0.3 –– –

28.122 1,051,500 1,788,000 1.1 –– –

Total (*) 15,433,900 7,749,500 22,920,000 12,920,000

(*) The granting of 20,000,000 stock options (of which 10,000,000 granted to managers and 10,000,000 granted to the Chief Executive Officer), approved by the Board of Directors on November 3,

2006, is subject to approval by the Stockholders Meeting pursuant to law.

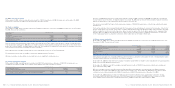

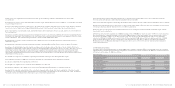

Changes during the year are as follows:

Managers compensation Compensation as member of the Board

Average Average

Number exercise price Number exercise price

of shares (euros) of shares (euros)

Outstanding at the beginning of the year 7,749,500 17.51 12,920,000 8.75

Granted (*) 10,000,000 13.37 10,000,000 13.37

Forfeited – – – –

Exercised (558,250) 10.397 – –

Expired (1,757,350) 21.54 – –

Outstanding at December 31, 2006 (*) 15,433,900 14.62 22,920,000 10.76

Exercisable at December 31, 2006 5,433,900 16.93 2,250,000 19.01

Exercisable at December 31, 2005 6,987,875 18.28 2,250,000 19.01

(*) The granting of 20,000,000 stock options (of which 10,000,000 granted to managers and 10,000,000 granted to the Chief Executive Officer), approved by the Board of Directors on November 3,

2006, is subject to approval by the Stockholders Meeting pursuant to law.

The majority of options that had been granted to managers were exercised during the fourth quarter of the year. The average price

of Fiat S.p.A. ordinary shares during this period was 14.14 euros.

As discussed under Significant accounting policies, in the case of share-based payments Fiat S.p.A. applies IFRS 2 to all stock

options granted after November 7, 2002, which had not yet vested at January 1, 2005, namely the July 2004 and November 2006