Chrysler 2006 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

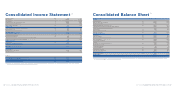

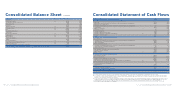

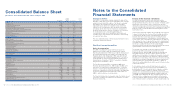

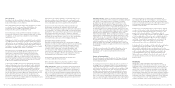

(in millions of euros) Note At December 31, 2006 At December 31, 2005

ASSETS

Intangible assets (13) 6,421 5,943

Property, plant and equipment (14) 10,540 11,006

Investment property (15) 19 26

Investments and other financial assets: (16) 2,280 2,333

-Investments accounted for using the equity method 1,719 1,762

-Other investments and financial assets 561 571

Leased assets (17) 247 1,254

Defined benefit plan assets (26) 11 –

Deferred tax assets (11) 1,860 2,104

Total Non-current assets 21,378 22,666

Inventories (18) 8,447 7,881

Trade receivables (19) 4,944 4,969

Receivables from financing activities (19) 11,743 15,973

Other receivables: (19) 2,839 3,084

-Current tax receivables 808 778

-Others 2,031 2,306

Accrued income and prepaid expenses (20) 247 272

Current financial assets: 637 1,041

-Current investments 31 31

-Current securities (21) 224 556

-Other financial assets (22) 382 454

Cash and cash equivalents (23) 7,736 6,417

Total Current assets 36,593 39,637

Assets held for sale (24) 332 151

TOTAL ASSETS 58,303 62,454

- Total assets adjusted for asset-backed financing transactions 49,959 51,725

(*) Pursuant to Consob Resolution No. 15519 of July 27, 2006, the effects of related party transactions on the Consolidated Balance Sheet are presented in the specific Balance Sheet schedule

provided in the following pages and are further described in Note 35.

Fiat Group Consolidated Financial Statements at December 31, 2006 87

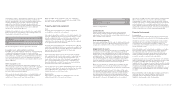

Consolidated Balance Sheet

(in millions of euros) Note 2006 2005

Net revenues (1) 51,832 46,544

Cost of sales (2) 43,888 39,624

Selling, general and administrative costs (3) 4,697 4,513

Research and development costs (4) 1,401 1,364

Other income (expenses) (5) 105 (43)

Trading profit 1,951 1,000

Gains (losses) on the disposal of investments (6) 607 905

Restructuring costs (7) 450 502

Other unusual income (expenses) (8) (47) 812

Operating result 2,061 2,215

Financial income (expenses) (9) (576) (843)

Unusual financial income (9) –858

Result from investments: (10) 156 34

-Net result of investees accounted for using the equity method 125 115

-Other income (expenses) from investments 31 (81)

Result before taxes 1,641 2,264

Income taxes (11) 490 844

Result from continuing operations 1,151 1,420

Result from discontinued operations ––

Net result 1,151 1,420

Attributable to:

Equity holders of the parent 1,065 1,331

Minority interests 86 89

(in euros)

Basic earnings per ordinary and preference share (12) 0.789 1.250

Basic earnings per savings share (12) 1.564 1.250

Diluted earnings per ordinary and preference share (12) 0.788 1.250

Diluted earnings per savings share (12) 1.563 1.250

(*) Pursuant to Consob Resolution No. 15519 of July 27, 2006, the effects of related party transactions on the Consolidated Income Statement are presented in the specific Income Statement

schedule provided in the following pages and are further described in Note 35.

Fiat Group Consolidated Financial Statements at December 31, 200686

Consolidated Income Statement (*) (*)