Chrysler 2006 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

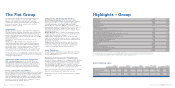

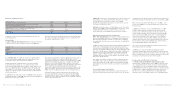

Revenues by Business Area

(in millions of euros) 2006 2005 % change

Automobiles (Fiat Auto, Maserati, Ferrari) 25,577 21,275 20.2

Agricultural and Construction Equipment (CNH-Case New Holland) 10,527 10,212 3.1

Trucks and Commercial Vehicles (Iveco) 9,136 8,483 7.7

Components and Production Systems (FPT, Magneti Marelli, Teksid, Comau) 12,366 10,727 n.s.

Other Businesses (Services, Publishing and Communications,

Holding companies and Other companies) 1,581 1,618 -2.3

Eliminations (7,355) (5,771) n.s.

Total for the Group 51,832 46,544 11.4

■Maserati had revenues of 519 million euros, down 2.6% from

the previous year, which had benefited from the sales of the

special MC12 street version, no longer sold in 2006.

Conversely, total volume grew due to an increase in sales of

the Coupé and Spyder models.

■Ferrari recorded revenues of 1,447 million euros. The 12.3%

increase from 2005 is largely attributable to the success of the

F430 and 599 GTB Fiorano models. Revenues were also

boosted by sales in the Middle East and Far East markets.

Agricultural and Construction Equipment

CNH – Case New Holland had revenues of 10,527 million euros,

up 3.1% from 2005 (+2.4% on a comparable currency basis).

Better pricing and higher volume of construction equipment

were partially offset by a decrease in deliveries of agricultural

equipment.

In 2006 the global market for agricultural equipment expanded

by 9%, with contrasting trends across the various regions;

volumes decreased slightly in Latin and North America, while

they were up slightly in Western Europe and significantly in the

Rest of the World markets. Against this backdrop, CNH tractor

shipments were down in North America and Rest of World

markets, stable in Western Europe, and up in Latin America.

Combine harvester volumes were down in all markets except

Rest of the World markets.

The global construction equipment market expanded by 11%

from 2005, with growth in all markets except North America

where the market was stable. Against this background, CNH

unit shipments increased (+3.4%) in all markets except North

America.

Trucks and Commercial Vehicles

As previously mentioned, for both fiscal years the figures of

the Trucks and Commercial Vehicles Sector (Iveco) are shown

Report on Operations Financial Review of the Group 27Report on Operations Financial Review of the Group26

■In 2006 Fiat Auto recorded net revenues of 23,702 million

euros, up 21.3% from 2005, due to the significant increase

in volumes and positive exchange rate impacts.

Trading performance throughout the year was positively

impacted by the growing success of new models, and in

particular: the Fiat Grande Punto and the Panda, with its new

Cross and 100 HP versions, the Alfa Romeo 159 (sedan and

Sportwagon) and the Brera, the Lancia Ypsilon and the New

Ypsilon, as well as the light commercial vehicles New Ducato

and the New Doblò.

In 2006 Fiat Auto delivered a total of 1,980,300 units, up 16.7%

from 2005. A total of 1,289,600 units were delivered in Western

Europe, for an increase of 17.2%.

The increase in deliveries reached significant levels in almost

all of the key European countries, with growth rates far

outpacing the market, as in Italy (+17.5% with respect to 2005

deliveries) and Germany (+21.3%), or realised in declining

markets, such as Great Britain where deliveries increased

by 42.8% and France (+10.9%). The only exception was Spain

where deliveries were impacted by weak demand and

decreased slightly (-1.0%). Fiat Auto had a 30.7% share of the

Italian car market, an increase of 2.7 percentage points from

2005, and 7.6% in Western Europe (+1.1 percentage points).

In Brazil, Fiat Auto exploited the positive performance of

the local market and increased its sales by 15% from 2005,

achieving a 25.3% share of the car market (+0.9 percentage

points). In Poland, where demand increased slightly,Fiat Auto

volume decreased by 2.3%.

excluding the powertrain activities, which were transferred to

the Fiat Powertrain Technologies Sector as of January 1, 2006.

Iveco revenues totalled 9,136 million euros in 2006, a 7.7%

increase from 2005, as a result of higher sales volumes and

better pricing.

In 2006 Iveco delivered a total of 181,500 vehicles, 17,600

of which with buy-back commitments, up 5.2% from the

previous year. In Western Europe, within the context of an

overall positive market (+2.3%), deliveries totalled 135,100

units, up 3.2% from 2005. The Sector recorded significant

increases in Germany (+21%) and Spain (+7.1%), against

decreased in Italy (-5.1%) and Great Britain (-9.9%) where

demand declined. Deliveries were particularly high in Eastern

Europe (+25%), Africa and the Middle East, while volumes

were substantially stable in Latin America.

Iveco sales also benefited from the market’sinterest in the

New Daily,launched in late May.

In 2006 Iveco’s share of the Western European market

remained substantially unchanged at 10.7%. In particular,the

light-range Daily confirmed its position as the top seller in the

3.5 ton segment while, in the medium segment, the Eurocargo

remained co-leader with over 25% of the market.

Components and Production Systems

The Components and Production Systems Business Area

had revenues of 12,366 million euros in 2006, an increase of 8%

on a comparable basis. Revenues increased at Fiat Powertrain

Technologies (+11% on a comparable scope of operations) and

at Magneti Marelli (+10.5%), against a decline recorded at Comau

(-18.6%) due to a sharp slowdown in demand for its services.

The decrease recorded at Teksid (-5.5%) is attributable to the

different scope of consolidation (+3.5% on a comparable basis).

Adetailed review of net revenues by Business Area/Sector

is provided below.

Automobiles

In 2006 the Automobiles Business Area recorded net revenues

of 25,577 million euros; the 20.2% increase from 2005 was

mainly driven by the significant growth recorded at Fiat Auto.

Revenues also improved at Ferrari (+12.3%), while Maserati

recorded a slight decline (-2.6%).

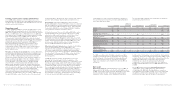

(in millions of euros) 2006 2005 % change

Fiat Auto 23,702 19,533 21.3

Maserati 519 533 -2.6

Ferrari 1,447 1,289 12.3

Eliminations (91) (80) n.s.

Total 25,577 21,275 20.2