Chrysler 2006 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

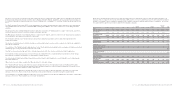

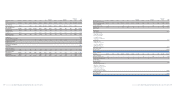

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 197

■Ameeting was held on February 19, 2007 at the Italian Prime Minister’s Office, with the participation of the Prime Minister, the

Ministers of Labour and Transport, and the Vice Minister for Economic Development, as well as national labour federation and

industry representatives. The Chief Executive Officer Sergio Marchionne illustrated the Group’s development plans for 2007-2010,

with special attention being devoted to the situation in Italy. The meeting concluded with the signing of a transcript in which the

Italian Government affirmed its willingness to support the Company’sdevelopment plans. In particular, this would involve close

assessment of initiatives taken in support of investments and research, and recognise the existence of conditions for granting the

Fiat Group a quota for “mobilità lunga”(long-term mobility benefit to bridge the period prior to retirement). This amount was

defined in the December 18, 2006 labour agreement, which envisages that a maximum of 2,000 Group employees will be laid off.

The meeting transcript also envisages setting up a roundtable with the participation of local institutions to examine the measures

necessary to overcome logistical and economic restraints at the Termini Imerese plant in Sicily, so that production of a model can

be allocated to it starting from 2009.

Turin, February 20, 2007

On behalf of the Board of Directors

Luca Cordero di Montezemolo

Chairman

41. Subsequent events

The principal events that have occurred after the balance sheet date are as follows:

■On January 26, 2007, Fitch Ratings upgraded Fiat’s rating from “BB-” to “BB”. The short-term rating was upheld at “B”. The

outlook remains positive. Standard & Poor’s Ratings services revised its outlook on Fiat’s rating upwards from stable to positive,

upholding the “BB” long-term and “B” short-term corporate credit ratings. On February 12, 2007, Moody’sInvestors Service

upgraded the (long-term ) rating of Fiat S.p.A. from Ba3 to Ba2, maintaining its positive outlook; the short-term rating remains

unchanged.

■On January 29, 2007, the Italian Stock Exchange removed from trading the 2007 Fiat Ordinary Share Warrants issued in 2002

and expiring in 2007. The owners of the 65,509,168 outstanding warrants at that date were given the option to subscribe in January

2007 to Fiat S.p.A. ordinary shares in the ratio of one Fiat ordinary share at a price of 29.364 euros for every four warrants held.

To date 4,676 warrants have been exercised with the issue of 1,169 shares. As a consequence, on February 1, 2007 the capital

stock of Fiat S.p.A. increased from 6,377,257,130 euros to 6,377,262,975 euros and additional paid-in capital increased by

28,481.52 euros.

■On February 1, 2007, Fiat Auto S.p.A. changed its name to “Fiat Group Automobiles S.p.A.” At the same time, four new

companies were formed, 100% owned by Fiat Group Automobiles S.p.A.: “Fiat Automobiles S.p.A.”, “Alfa Romeo Automobiles

S.p.A.”, “Lancia Automobiles S.p.A.”, and “Fiat Light Commercial Vehicles S.p.A.” These changes are consistent with the new

corporate culture at the Fiat Group. In particular, they reflect two strategic decisions as to how to approach the business. On the

one hand, the Group will exist as a unified whole, and on the other,each company will be distinguished by the specific nature of

the respective operating sectors and individual brands. Finally,the name “Fiat Group Automobiles S.p.A.” highlights the

international vocation of this large industrial organisation.

■On February 14, 2007, Fiat and Tata Motors signed an agreement under which calls for a Tata license to build a pick-up vehicle

bearing the Fiat nameplate at the Fiat Group Automobiles plant in Córdoba, Argentina. The first vehicles will be completed on the

Córdoba assembly lines during 2008. Annual production is expected to be around 20,000 units. Total planned investment in the

project is approximately 80 million US dollars. With the production of the pick-up model, the Fiat complex in Córdoba will retake

the integral activity of all its productive units, to a great extent reinitiated with the manufacture of Fiat engines and gearboxes and

the recent agreement to produce gearboxes for PSA Peugeot-Citroën. The vehicle is based on the new generation Tata pick-up

truck and will be sold in South and Central America and selected European markets through Fiat Automobiles’ import and

distribution network. This will permit the Fiat brand to make an aggressive entry into the medium pick-up sector, thanks to Tata

Motors’ specific know-how.

■On February 14, 2007, Iveco, and Tata Motors signed a Memorandum of Understanding (MoU) to investigate the feasibility

of cross-market cooperation in the area of Commercial Vehicles. The MoU encompasses a number of potential developments in

engineering, manufacturing, the sourcing and distribution of products, aggregates and components. Having signed the MoU, Iveco

and Tata Motors will now set up a joint Steering Committee to determine the feasibility of cooperation in these areas, both in the

short- and over the long-term. If a decision is reached that this is possible, the two companies will enter definitive agreements in

the course of the coming months.

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 196