Chrysler 2006 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2006 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 141

■the fair value of interest rate swaps and forward rate agreements is determined by using the discounted cash flow method;

■the fair value of derivative financial instruments acquired to hedge interest rate risk and exchange rate risk is determined using

the exchange rates prevailing at the balance sheet date and the discounted cash flow method;

■the fair value of equity swaps is determined using market prices at the balance sheet date;

■the fair value of the equity option is determined using the Black-Scholes or binomial models, with market parameters

(in particular the price of the underlying, interest rates, expected future dividends and volatility) being measured at the balance

sheet date.

The overall decrease in Other financial assets from 454 million euros at December 31, 2005 to 382 million euros at December 31,

2006, and the decrease in Other financial liabilities from 189 million euros at December 31, 2005 to 105 million euros at

December 31, 2006, is due not only to the changes in exchange rates and interest rates over the period, but also to the expiry

of certain hedging operations relating principally to bonds that have been reimbursed.

As this item consists principally of hedging instruments, the change in their value is compensated by the change in the value

of the hedged item.

Derivates for trading consist principally of the following types:

■Currency derivatives acquired to hedge receivables and payables expressed in foreign currency that are not considered by fair

value hedges.

■Derivatives relating to Fiat shares (Equity Swap)which are described further below.

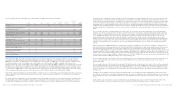

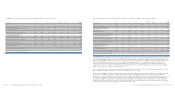

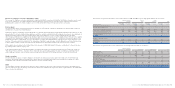

At December 31, 2006, the notional amount of outstanding derivative financial instruments is as follows:

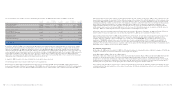

(in millions of euros) At December 31, 2006 At December 31, 2005

Exchange rate risk management 7,702 5,992

Interest rate risk management 8,249 10,544

Interest rate and exchange rate risk management –204

Other derivative financial instruments 2,154 1,805

Total notional amount 18,105 18,545

At December 31, 2006, the notional amount of Other derivative instruments consists of, amongst the others:

■For 220 million euros (70 million euros at December 31, 2005) the notional amount of the two equity swaps, expiring in 2007,

stipulated to hedge the risk of an increase in the Fiat share price above the exercise price of stock options granted in 2004

and 2006 to the Chief Executive Officer (see Note 25). At December 31, 2006, the Equity Swaps have a total positive fair value of 79

million euros (a positive value of 8 million euros at December 31, 2005). Although these equity swaps were entered into

for hedging purposes, they do not qualify for hedge accounting under IFRS and accordingly are defined as trading derivative

financial instruments.

■For 1,282 million euros (1,432 million euros at December 31, 2005), the notional amount of call options on General Motors

common stock purchased in 2004 in order to hedge the risk implicit in the Convertible Bond still outstanding at that time

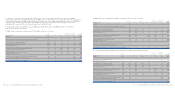

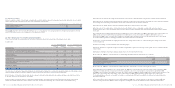

21. Current securities

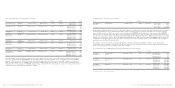

Current securities consist of short-term or marketable securities which represent temporary investments, but which do not satisfy

all the requirements for being classified as cash equivalents. In particular:

(in millions of euros) At December 31, 2006 At December 31, 2005

Current securities available-for-sale 90 317

Current securities for trading 134 239

Total Current securities 224 556

During 2006, this item decreased by 332 million euros as a consequence of a changed mix in the temporary investment of funds

and for 102 million euros as a consequence of the disposal of B.U.C.

22. Other financial assets and Other financial liabilities

These items include the measurement at fair value of derivative financial instruments at the balance sheet date.

In particular:

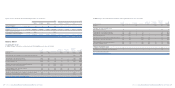

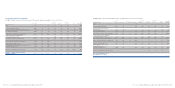

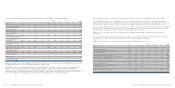

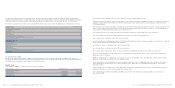

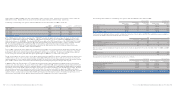

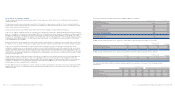

At December 31, 2006 At December 31, 2005

Positive fair Negative fair Positive fair Negative fair

(in millions of euros) value value value value

Fair value hedges:

-Exchange rate risk - Forward contracts and Currency swaps 1(1) 26 (16)

-Interest rate risk - Interest rate swaps and Forward rate agreement 129 (11) 307 (26)

- Interest rate and exchange rate risk - Combined interest rate and currency swaps ––9 (1)

-Other derivatives –(5) – –

Total Fair value hedges 130 (17) 342 (43)

Cash flow hedge:

- Exchange rate risks - Forward contracts, Currency swaps and Currency options 129 (61) 48 (95)

- Interest rate swaps and Forward rate agreement 15 (8) 2 (3)

Total Cash flow hedges 144 (69) 50 (98)

Derivatives for trading 108 (19) 62 (48)

Other financial assets/(liabilities) 382 (105) 454 (189)

The fair value of derivative financial instruments is determined by taking into consideration market parameters at the balance sheet

date and using valuation techniques widely accepted in the financial business environment. In particular:

■the fair value of forward contracts and currency swaps is determined by taking the prevailing exchange rate and interest rates

in the two currencies at the balance sheet date;

■the fair value of currency options is determined using valuation techniques based on the Black-Scholes model or binomial

models and market parameters at the balance sheet date (in particular exchange rates, interest rates and volatility rates);

Fiat Group Consolidated Financial Statements at December 31, 2006 -Notes 140